A normal yield curve is a fundamental concept in fixed-income investing and economic analysis. It illustrates the relationship between bond yields and maturities, typically sloping upward. This upward trajectory indicates that long-term bonds offer … [Read more...]

Interest Rate Risk: Definition, Impact, and How To Mitigate It

Interest rate risk represents the potential for investment losses resulting from fluctuations in interest rates. This financial vulnerability affects various market participants, from individual investors to large financial institutions. … [Read more...]

What Is an Inverted Yield Curve and What Does It Tell Investors?

An inverted yield curve occurs when short-term interest rates exceed long-term rates, a rare phenomenon that has historically signaled economic downturns. Investors closely monitor yield curve inversions because they often precede recessions, … [Read more...]

What Does a Flat Yield Curve Mean? | Uses and Implications

The nuances of the yield curve can often reveal vital insights about economic trends. Understanding what a flat yield curve signifies is essential for investors and economists alike, as it reflects shifting perceptions of risk and return in the bond … [Read more...]

What Is a Yield Curve and How Do You Use It?

Investors and economists alike often rely on the yield curve as a vital indicator of economic health and future financial trends. Understanding this critical tool provides insight into market expectations and potential shifts in the economy. The … [Read more...]

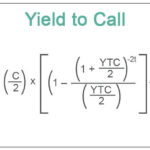

What Is Yield To Call? Formula + Calculations

When it comes to bond investing, understanding financial metrics can make a significant difference in your decisions. One essential concept is yield to call (YTC), a measure that helps investors evaluate the potential return on callable bonds if they … [Read more...]

Callable (or Redeemable) Bonds: Types and How They Work

Callable bonds, also known as redeemable bonds, represent fixed-income securities that grant issuers the right to repay the principal before the scheduled maturity date. These debt instruments play a significant role in corporate finance and … [Read more...]

Non-Callable Bond: Understanding What It Means and How It Work

Investors are always on the lookout for stable and predictable income sources, and non-callable bonds can provide just that. In a fluctuating financial market, understanding different investment options, especially bonds, is essential for making … [Read more...]

Yield to Worst (YTW): Definition, Formula, and Importance

Understanding the complexities of bond investments can often feel like navigating a labyrinth. Among the many metrics used by investors, Yield to Worst (YTW) stands out as a crucial gauge of a bond's potential performance. YTW signifies the lowest … [Read more...]

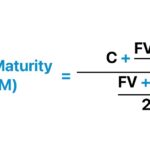

What Is Yield to Maturity (YTM) and How Does It Work?

Yield to maturity represents the total return anticipated on a bond if the investor holds it until its maturity date. This bond yield measurement calculates the present value of all future interest payments and the return of principal, expressed as … [Read more...]