Ever since I came to AGL I’ve been able to perform on both sides of the mkt. I was picking stocks BELOW the GL and not buying on strength, was a value guy. Learned to you use stop limit buys here, rather than hope for the best limit orders down below on weak names.

Jim Habash

IT Consultant

ATGL is a pretty unique service; it is completely transparent about its approach, anyone can replicate it with a bit of effort. Of course in reality things are always a little harder than they seem, even if its a rules based approach you need to be able to find the opportunities and navigate them profitably, ATGL is an excellent guide and mentor, and your portfolio will benefit regardless of ‘the weather’. No narratives, just rules and profits.

Tony P

Investor

AGL is awesome at picking swing trade stocks! Love your service, thank you for your hard work!

Katie H

Business Professional

Why People Join Above the Green Line?

| Features | MONTHLY | ANNUAL | LIFETIME |

|---|---|---|---|

| TRADING ROOMS |

|

||

| LIVE STREAMING | |||

| DISCORD | |||

| WATCHLISTS | |||

| SCANNER AND TOOLS | |||

| REAL TIME TEACHING | |||

| BUY & SALE TRADE ALERTS | |||

| TECHNICAL CHARTS | |||

| PERSONALIZED ZOOM SESSIONS | |||

| Signup | Signup | Signup |

Swing Trading

Swing Trading is a strategy where a trader purchases a financial instrument and holds onto it anywhere from a few days to a couple of months. Over this period of time, a swing trader will carefully observe chart trends and patterns to sell at a moment they believe is the most profitable, thus capturing gains off of short term price movements.

Dogs of Dow

Dogs of the Dow is a stock picking strategy that tries to beat the Dow Jones Industrial Average (DJIA) each year by selecting the highest dividend DOW stocks. The strategy produces a portfolio resulting in an equal amount of money being invested in the 10 highest dividend-yielding, blue-chip stocks among the 30 components of the DJIA. At the beginning of each year the portfolio is re-balanced.

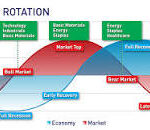

ETF Sector Rotation

Many investors are interested in investing and diversifying their portfolio in various global and local sectors, but are often unsure of where to start. Sector rotation with ETF’s is a strategy used by investors whereby they hold an overweight position in strong sectors and underweight positions in weaker sectors.

Day Trading

Day traders buy and sell stocks or other assets during the trading day in order to profit from the rapid fluctuations in prices. Day trading employs a wide variety of techniques and strategies to capitalize on these perceived market inefficiencies.

Dividend Growth

The Dividend Growth Investment Strategy is a relatively simple way to increase one’s overall income. Here at Above the Green Line, we follow multiple sources including the DVK system for owning dividend stocks and Dividend Growth Metrics and Definitions for long term investing.