Top Stock Scanners and Screeners

Stock scanners and screeners are tools that help investors and traders find stocks that match their trading criteria. They are used to narrow down the large universe of stocks into a smaller and more manageable list, based on various factors such as price, volume, sector, industry, fundamentals, technical, and more.

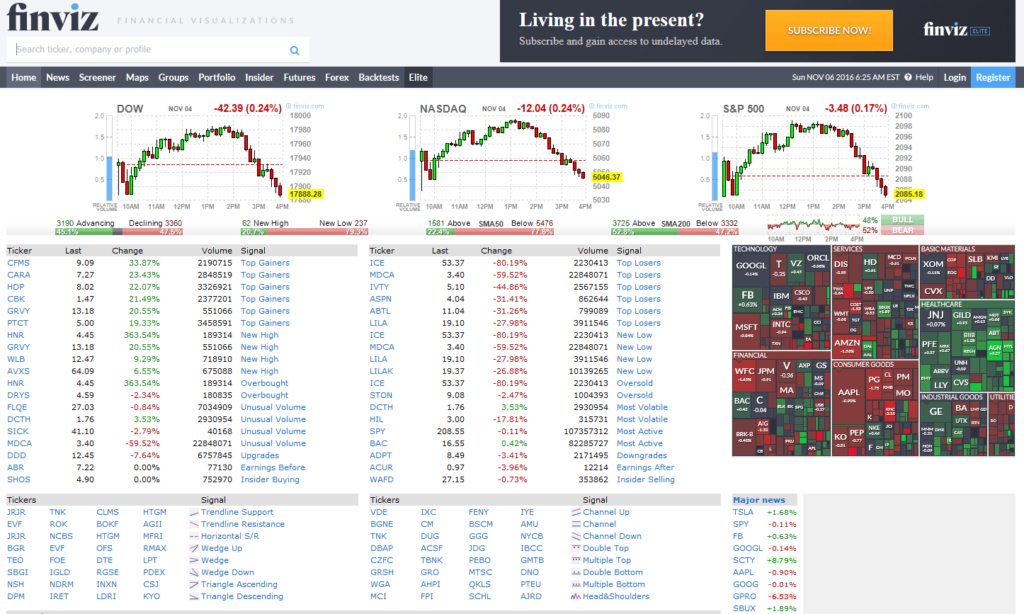

Stock scanners provide real-time data and alerts that help identify potential trading opportunities. They are useful for short-term traders who need to act quickly and catch market movements as they happen.

Stock screeners allow investors to filter a large pool of stocks based on specific criteria, such as sector, market capitalization, and dividend yield. They are useful for long-term investors who want to conduct deeper analysis and research on the stocks that meet their requirements.

Both tools are designed to help investors and traders make informed and efficient decisions in the stock market. However, they have different features, advantages, and disadvantages, depending on the user’s goals, preferences, and strategies.

Above the Green Line has performed extensive research to find the best stock scanners. Below is a list of the top companies that do just.

Are you looking for a list of the top stock scanners and tools to help you with your trading routine? Click any of the links below to read our full in depth reviews, or read this page for a highlight on each one. These tools are essential on both a daily and weekly basis. This list will encompass both good day trading scanners and swing trading scanners.