Dividend Growth Investment Strategy

A dividend growth strategy is an investment approach focused on selecting stocks of companies that consistently increase their dividend payouts over time. This strategy aims to provide investors with a growing stream of income while benefiting from potential capital appreciation. The underlying principle is that companies with a track record of raising dividends are generally financially stable, exhibit strong earnings growth, and have a commitment to returning value to shareholders. A dividend growth strategy leverages fundamental analysis to identify financially robust companies with a consistent history of increasing dividend payouts, ensuring sustainable income and growth potential.

The core benefit of a dividend growth strategy is the creation of a reliable and increasing income stream. By investing in companies that regularly boost their dividends, investors can enjoy a rising income over time, which can help offset inflation and enhance overall returns. For instance, a company that raises its dividend annually demonstrates confidence in its financial health and its ability to generate sustainable profits, making it an attractive option for income-focused investors.

Moreover, dividend growth stocks can offer a hedge against market volatility. During periods of market downturns or economic uncertainty, the consistent dividend payments can provide a steady income source, reducing the impact of falling stock prices. This makes dividend growth stocks particularly appealing to retirees or those seeking a stable income during fluctuating market conditions.

This strategy is best employed by long-term investors who prioritize income stability and gradual growth over short-term gains. It requires patience and a focus on the long-term performance of dividend-paying companies. Investors should also conduct thorough research to identify firms with a history of reliable and increasing dividends, as well as evaluate the sustainability of their dividend policies.

In summary, a dividend growth strategy is an investment approach centered on stocks with a history of increasing dividend payouts, offering growing income and stability. It is suitable for investors seeking reliable income and long-term growth, while also providing a cushion against market volatility. The Dividend Growth Investment Strategy is a relatively simple way to increase your overall income. Here at Above the Green Line, we have the following resources surrounding this approach:

- ATGL Dividend Portfolio Strategy

- Dividend Growth Portfolio

- DVK system for owning dividend stocks

- Dividend Growth Metrics and Definitions for long term investing

- Drip Investing for long term accumulation

- Dividend Growth Model used to estimate the intrinsic value of a stock based on the present value of its future dividends

What is a Dividend?

Dividends are regular payments made by a company to its shareholders. The amount of these payments is based on a multitude of factors such as the profit and the amount invested. Dividends are a consistent way for companies to distribute revenue back to its investors. In the United States, dividends are normally given quarterly, though some companies may pay monthly or semi-annually. It is important to keep in mind that not all stocks pay dividends, so if you are looking to employ the Dividend Growth Investment Strategy, you will want to choose stocks that pay regular dividends.

Significant Components of a Dividend

If you are looking to invest in stocks that pay out dividends, you must be aware of the concept of an ex-dividend date. In order to receive dividends from a company, an investor must own the stock by the ex-dividend date. If purchased after this date, the investor will not receive the dividends from that quarter.

In addition to the ex-dividend date, an investor should be familiar with dividend yields. According to NerdWallet, dividend yields even the playing field for investors. Let’s say you purchased a $10 stock that paid $0.10 quarterly ($0.40 per share annually). This example would have the same yield as a $100 stock that paid $1.00 quarterly ($4.00 annually). Both scenarios represent a 4% yield. There are two ways for a stock’s dividend yield to increase. The first is if the company raises the dividend, the second is if the stock price goes down while the dividend remains unchanged. This is because the price of a stock and its dividend yield are inversely related. For dividend yields, a general rule of thumb is to be wary of a dividend yield above 4%. Anything higher than this can hint that the dividend payout is unsustainable. However, there are some exceptions to this. A quick way to measure a stock’s dividend safety is to check its payout ratio. Generally, investors should look for payout ratios of 80% or lower.

Types of Dividends

The most well-known type of dividend is paid on a company’s common stock. Common stock is a security that represents ownership, but common stockholders tend to be at the bottom of the priority list when it comes to the ownership structure. Another type of dividend that is infrequent in its nature is called a special dividend. A special dividend is a payout on all shares of a company, but it does not occur regularly. Rather, a company will issue special dividends when there are profits of which they do not have a need for. Similar to special dividends, preferred dividends are a less common form of dividends. Preferred dividends are issued to an owner’s preferred stock. When it comes to dividends, preferred stockholders have higher priority than commons stockholders. These dividends normally yield more than common stocks, but they are generally fixed quarterly or monthly payments.

Choosing the Right Stock

Investing in stocks that pay dividends can provide a stable source of extra income. When it comes to employing a Dividend Growth Investment Strategy, an investor should seek out companies that increase their dividend payout yearly and thus beat inflation. Additionally, dividends are more likely to be paid out by companies that no longer need to invest a large sum of money into their business. Thus, investors utilizing the Dividend Growth approach should invest in well-established companies. Once deciding upon a dividend yield, these established companies are expected to maintain their dividend payout, even through hardships.

S&P 500 Dividend Aristocrats Index

The S&P 500 Dividend Aristocrats Index is a compiled list of companies in the S&P 500 with a history of increasing their dividends for at least the past 25 years. Typically possessing 40 to 50 companies, the S&P 500 Dividend Aristocrats Index includes stocks with a total dollar market value of over $3 billion and an average trading volume of at least $5 billion. Its primary objective is to analyze the performance of well-known companies and rebalance them each January. If a company fails to increase its dividends that year, it is removed from the list.

The company stocks within the S&P 500 Dividend Aristocrats Index have historically outperformed the S&P 500 by 1% each year. The ultimate strength of this index lies not only in the consistent increase of dividends paid out by the companies but also in the performance of the companies, which is why investing in these stocks can be a powerful way to employ the Dividend Growth approach. A common way to obtain exposure to the list of dividend aristocrats is through Exchange-Traded Funds (ETFs). An ETF involves a collection of securities that regularly follow an underlying index.

One criticism that the S&P 500 Dividend Aristocrats Index faces is that the companies occasionally may use share buybacks in order to increase their dividends. A share buyback occurs when a company purchases its own outstanding shares. The dilemma lies in the possibility that a company is overpaying for its shares while still increasing dividends, meaning it might not be acting in the interest of the shareholder.

Why Dividend Growth?

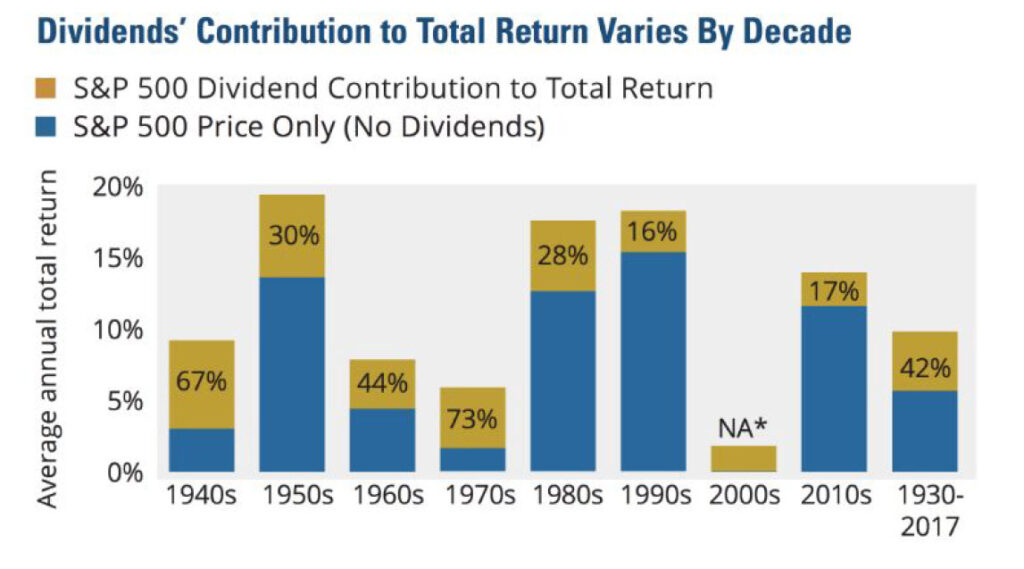

As previously stated, dividends are significant in a portfolio’s overall return. From 1930 to 2017, dividends accounted for roughly 42% of the S&P 500 Index’s total return. As presented in the chart below, there have been decades where dividends accounted for over half of the market’s returns. If an investor were to instead purchase a growth stock (or a stock that does not pay dividends), the only way they could earn a return is through share price appreciation.

While growth stocks have their merits, the market is volatile and this appreciation is not always guaranteed. A Dividend Growth stock is beneficial as it will provide investors with a steadily growing income that can be reinvested if they so desired.

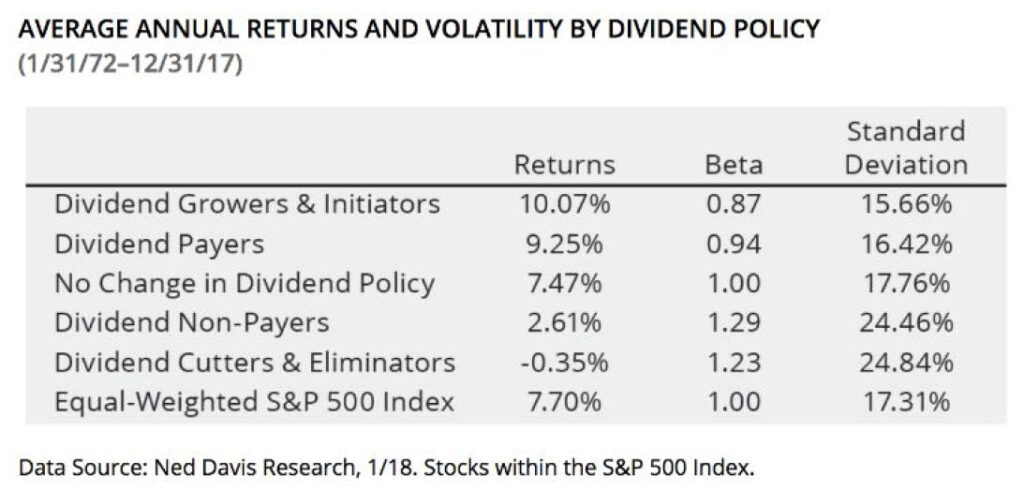

In addition to attaining a consistent source of income, Dividend Stocks have generally outperformed the market. As seen in the chart below, companies that regularly pay and grow their dividends have surpassed non-dividend stocks. This is because companies that pay out dividends are long-term focused and tend to have a more conservative management style. Since they are paying out dividends, there is little room for acting irresponsibly and tossing

money around. If the dividend is at risk, the share price could easily plummet.

Maybe one of the greatest appeals of Dividend Growth stocks is their relation to retirement. A study done by Jack Garner in 2008 concluded that if an investor were to only invest in the 100 highest-yielding dividend stocks, the outperformance of this portfolio would allow for a withdrawal of 5% annually. This is an increase of 1% from a common retirement strategy developed by William Bengen that advocated for a 60% stock, 40% bond portfolio that allowed for a 4% annual withdrawal. Garner’s study was so powerful that it was later endorsed by Bengen.

Conclusion

Overall, Dividend Stocks can be wonderful investments as they aid in avoiding market volatility and the plight of human nature. These small yet consistent increases in wealth can give their investor’s a sense of financial independence and consistency that is difficult to come by in the investing/trading world. If you think that the Dividend Growth Investment Strategy is for you, the key is to get started as quickly as you can, to thoroughly inspect your chosen stocks, and to stay disciplined.

At Above the Green Line, we apply a mixture of rules to help us determine which stocks are best long term for building a Dividend Growth Portfolio. Click here to see our current Dividend Growth Portfolio. If interested in learning more, please see our Dividend Growth and Value Investing Topics of interest.

Related Articles

What Is CAPM in Finance? A Practical Look at Risk vs. Return

Least Squares Method Explained: How It Works in Trading and Finance

Reinvestment Risk: Definition, Examples, and How To Manage It

Interest Rates vs Bond Yields

Understanding Value at Risk and How To Calculate VaR

Please send some profits to help animals (ASPCA).