The Weekly Stock Pick strategy is designed to Buy a high-potential stock on Monday and Sell on Friday, based on specific criteria like technical analysis, market conditions, and performance indicators. The criteria could involve factors such as strong fundamentals, a high Relative Strength (SCTR rating above 90), and evidence that the stock is breaking out of a lower “green zone” with increased volume. The stock is selected for a Buy on the Open on Monday, and then holding it until Friday’s market Close, unless a maximum target gain of 8%—is reached before that.

Join Above the Green Line today and start using our proven Top Stock of the Week (TPOW) strategy to capitalize on high-probability trades and achieve consistent gains in just one week with a disciplined, straightforward approach. Visit our TPOW Strategy Guide to learn how to maximize your weekly returns with actionable insights and proven investment principles.

Below are the results for the Weekly Stock Pick Performance.

| Open Date | Stock | Beginning Balance | Open Price | Shares | Close Date | Sell Price | Gain / Loss | Percent% | End Balance |

|---|---|---|---|---|---|---|---|---|---|

| 2025-06-30 | GDX | 13,603.86 | 50.73 | 268 | N/A | N/A | N/A | N/A | N/A |

| 2025-06-23 | EFA | 13,052.64 | 85.74 | 152 | 2025-06-27 | $89.34 | $3.60 | 4.20% | $13,579.68 |

| 2025-06-16 | CHWY | 13,077.00 | 41.99 | 311 | 2025-06-20 | $41.91 | ($0.08) | -0.19% | $13,034.01 |

| 2025-06-09 | KC | 13,624.00 | 12.95 | 1052 | 2025-06-13 | $12.43 | ($0.52) | -4.02% | $13,076.36 |

| 2025-05-27 | ACHR | 13,112.00 | 11.00 | 1192 | 2025-06-09 | $11.43 | $0.43 | 3.91% | $13,624.56 |

| 2025-05-19 | IAU | 12,601.09 | 60.91 | 207 | 2025-05-23 | $63.38 | $2.47 | 4.06% | $13,119.66 |

| 2025-05-12 | VRNA | 11,650.10 | 61.62 | 189 | 2025-05-12 | $66.55 | $4.93 | 8.00% | $12,577.95 |

| 2025-04-28 | IAG | 11,616.00 | 7.00 | 1652 | 2025-05-09 | $7.03 | $0.03 | 0.43% | $11,613.56 |

| 2025-04-21 | DOCS | 10,829.00 | 52.81 | 205 | 2025-04-25 | $56.65 | $3.84 | 7.27% | $11,613.25 |

| 2025-04-13 | GILD | 10,770.41 | 103.97 | 104 | 2025-04-17 | $104.54 | $0.57 | 0.55% | $10,872.16 |

| 2025-03-24 | HIMS | 14,278.81 | 36.10 | 396 | 2025-04-11 | $27.23 | ($8.87) | -24.57% | $10,783.08 |

| 2025-03-17 | HOOD | 12,663.00 | 39.35 | 322 | 2025-03-21 | $44.37 | $5.02 | 12.76% | $14,287.14 |

| 2025-03-10 | MAGS | 12,663.00 | 47.67 | 266 | 2025-03-14 | $47.67 | $0.00 | 0.00% | $12,680.22 |

| 2025-02-24 | ARKK | 14,549.29 | 60.15 | 242 | 2025-03-07 | $52.44 | ($7.71) | -12.82% | $12,690.48 |

| 2025-02-10 | TSLA | 15,342.22 | 356.21 | 43 | 2025-02-21 | $337.80 | ($18.41) | -5.17% | $14,525.40 |

| 2025-02-03 | SOFI | 15,414.25 | 14.98 | 1029 | 2025-02-07 | $14.91 | ($0.07) | -0.47% | $15,342.39 |

| 2025-01-26 | AAL | 15,304.93 | 16.80 | 911 | 2025-01-31 | $16.92 | $0.12 | 0.71% | $15,414.12 |

| 2025-01-21 | LUMN | 14,942.65 | 5.78 | 2581 | 2025-01-24 | $5.92 | $0.14 | 2.42% | $15,279.52 |

| 2025-01-13 | AUR | 14,898.00 | 6.78 | 2197 | 2025-01-17 | $6.80 | $0.02 | 0.29% | $14,939.60 |

| 2025-01-06 | DOCU | 15,009.00 | 91.16 | 165 | 2025-01-10 | $90.49 | ($0.67) | -0.73% | $14,930.85 |

| 2024-12-30 | GBTC | 14,175.82 | 73.67 | 192 | 2025-01-03 | $78.00 | $4.33 | 5.88% | $14,976.00 |

| 2024-12-23 | Z | 14,335.00 | 77.00 | 186 | 2024-12-27 | $76.18 | ($0.82) | -1.06% | $14,169.48 |

| 2024-12-16 | IWM | 15,037.00 | 232.91 | 65 | 2024-12-20 | $222.04 | ($10.87) | -4.67% | $14,432.60 |

| 2024-12-09 | TOST | 15,403.00 | 39.07 | 394 | 2024-12-13 | $38.16 | ($0.91) | -2.33% | $15,035.04 |

| 2024-12-01 | RBLX | 13,394.00 | 50.99 | 263 | 2024-12-05 | $58.64 | $7.65 | 15.00% | $15,422.32 |

| 2024-11-24 | DOCS | 12,394.79 | 49.21 | 252 | 2024-11-29 | $53.18 | $3.97 | 8.07% | $13,401.36 |

| 2024-11-18 | CAVA | 11,498.00 | 134.35 | 86 | 2024-11-22 | $144.82 | $10.47 | 7.79% | $12,454.52 |

| 2024-11-11 | UAA | 11,394.00 | 9.86 | 1155 | 2024-11-15 | $9.95 | $0.09 | 0.91% | $11,492.25 |

| 2024-11-03 | OWL | 10,643.00 | 21.38 | 498 | 2024-11-08 | $22.89 | $1.51 | 7.06% | $11,399.22 |

| 2024-10-27 | UBER | 11,360.00 | 78.18 | 145 | 2024-11-01 | $73.25 | ($4.93) | -6.31% | $10,621.25 |

| 2024-10-21 | ONON | 10,812.00 | 48.21 | 224 | 2024-10-25 | $50.65 | $2.44 | 5.06% | $11,345.60 |

| 2024-10-14 | ITB | 10,363.00 | 124.03 | 84 | 2024-10-18 | $129.40 | $5.37 | 4.33% | $10,869.60 |

| 2024-10-07 | SMMT | 10,000.00 | 19.25 | 519.48 | 2024-10-11 | $19.95 | $0.70 | 3.64% | $10,363.63 |

| TPOW | 35.80% |

| SPY | 7.63% |

| #Trades | 32 |

| Wins | 20 |

| Losses | 11 |

| Max Win Streak | 6 |

| Max Loss Streak | 3 |

| Current Streak | 1 |

| Avg G/L % | 1.21% |

| Max Gain % | 15.00% |

| Max Loss % | -24.57% |

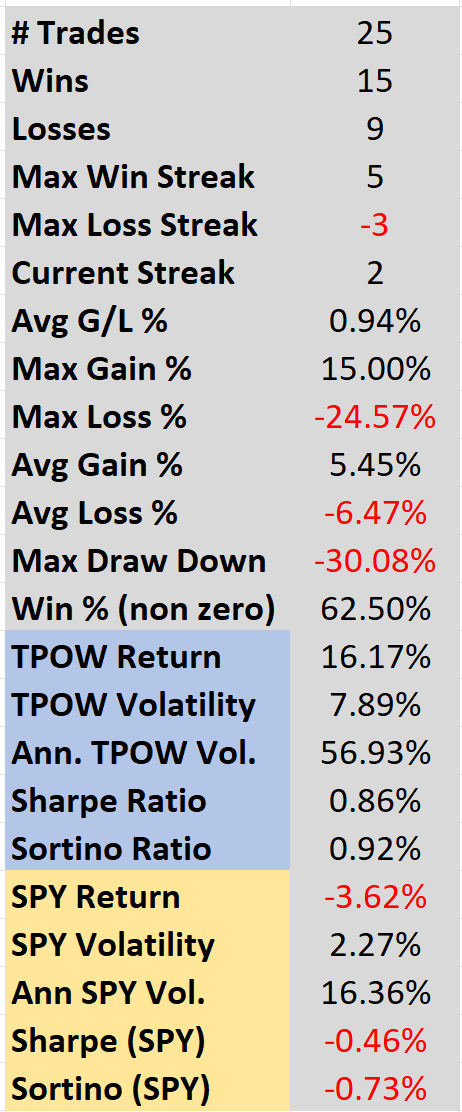

The TPOW strategy continues to stand out, delivering a powerful 16.17% return across 25 trades, while the SPY stumbled with a -3.62% loss. With a 62.5% win rate and an average gain of 5.45% per trade, TPOW captured consistent upside even in a volatile market. Risk was managed effectively, with a Sharpe Ratio of 0.86 and a Sortino Ratio of 0.92 — far outperforming the SPY’s negative risk metrics. Despite natural market swings, volatility remained under control at just 7.89% weekly. TPOW’s disciplined approach limited downside while maximizing breakout opportunities, highlighted by a maximum single trade gain of 15.00%. In today’s challenging environment, TPOW’s resilience, performance, and smart risk management are setting a new standard for active trading success.

The table below summarizes the key performance metrics for the TPOW strategy, including return, volatility, win rate, and risk-adjusted measures compared to the SPY benchmark. View the full results and detailed metrics each week on our TPOW Performance Dashboard.

During the week you can see the current Weekly Stock Pick Chart and Stock Pick.

Performance tracking for these weekly stock picks is essential to both the platform’s reputation and the investor’s decision-making process. Evaluating each pick’s historical returns, comparing it to market benchmarks, and understanding the risks are critical for long-term success. Stock performance depends on market sentiment, sector trends, and overall economic conditions, and the weekly report usually includes real-time charts that users refresh for updates, technical analysis, and potential trade alerts.

For investors, the Weekly Stock Pick offers a focused, short-term opportunity to capitalize on well-researched trades without the need to sift through the entire market themselves. This strategy allows for flexibility, enabling investors to exit their positions if the target gain is hit early in the week, which minimizes holding risk over longer periods of market volatility. A disciplined approach, combined with the right technical tools, can help traders maximize their weekly gains while managing their exposure to risk.