Markets

Markets play a pivotal role in the global economic landscape, serving as dynamic platforms where financial instruments are bought and sold. For traders, investors, and financial enthusiasts, understanding the intricacies of markets is essential for making informed decisions and navigating the complexities of the financial world.

At the core of market activity are various asset classes, including stocks, bonds, commodities, and currencies, each representing distinct opportunities and risks. Stock markets, such as the New York Stock Exchange (NYSE) or NASDAQ, provide a venue for buying and selling shares of publicly traded companies. Bond markets facilitate the trading of debt securities issued by governments, corporations, and other entities, while commodities markets involve the exchange of physical goods like gold, oil, and agricultural products.

Currency markets, often referred to as the foreign exchange or Forex market, are where different currencies are traded against each other. The Forex market is the largest and most liquid financial market globally, influencing international trade and investment.

Market participants, ranging from individual traders to institutional investors, rely on various tools and analyses to make sense of market trends and price movements. Technical analysis involves studying historical price charts and patterns, while fundamental analysis delves into the financial health and performance of companies or economies.

Market information is disseminated through financial news, market reports, and real-time data feeds, empowering market participants to stay informed about economic indicators, corporate earnings, geopolitical events, and other factors influencing market movements. Platforms like Bloomberg, Reuters, and financial news websites provide a wealth of information for those seeking to stay abreast of market developments.

Market news, including breaking developments and corporate announcements, often sets the tone for investor sentiment, which is closely influenced by economic data and upcoming earnings reports. Understanding how economic indicators, such as inflation or employment data, intersect with market news and earnings expectations can help investors make more informed decisions about potential market movements.

In this dynamic landscape, staying adaptable is key. Traders and investors need to be aware of market volatility, regulatory changes, and emerging trends that can impact their portfolios. Moreover, the global interconnectedness of markets emphasizes the importance of understanding how events in one part of the world can reverberate throughout the entire financial system. Furthermore, U.S. presidents can significantly influence financial markets through their economic policies, trade decisions, tax reforms, and regulatory changes. While the broader market trends are driven by global and economic factors, presidential actions often create short-term volatility and shape long-term investment opportunities in specific sectors.

Whether one is an active day trader, a long-term investor, or someone simply interested in financial markets, acquiring knowledge about market dynamics, instruments, and trends is an ongoing and valuable pursuit. It equips individuals with the tools needed to make well-informed decisions and navigate the ever-evolving world of finance. For Premarket information see below or navigate to premarket overview.

Above the Green Line lists the most common Global Market Indices used by Traders, Investors and Financial Institutions. Each index represents different segments of the market and/or global exchanges. The indices are a hypothetical portfolio of the companies associated with the financial segment.

Shown below is a list of some of the most popular Global Indexes followed by some lesser known indexes.

List of Most Popular Stock Market Indexes (Indices)

- S&P 500 (SPX): measures 500 large-caps in U.S. stock market

- Dow Jones 30 (DJI): compares 30 large-cap U.S. stocks

- Nasdaq 100 (NDX): index made up of 103 largest non-financial companies

- Russell 2000 (RUT): small-cap index of 2000 stocks

- FTSE 100/Footsie (FTSE): 100 large-cap companies on London Stock Exchange

- Dax 30 (DAX): 30 (now 40) blue chip German stocks on Frankfurt Exchange

- Nikkei 225 (NKY): 225 stocks on the Tokyo Stock exchange

- Hang Seng Index (HSI): weighted index of Hong Kong’s largest companies

- Nifty 50 (NIFTY): weighted average of 50 of the largest Indian companies

Other Stock Indexes

Above the Green Line presents the current Market Overview along with top stories making the news – see below. For more market data for select stocks see our market watch.

-

Investors traded a record $6.6 trillion worth of stock in

the first half of 2025

Tariffs, market volatility and war in the Middle East couldn’t slow down the buying spree by individual investors, as they traded a record amount of stocks in the first half of the year.... Read more

-

I have $6.5 million in retirement savings and support my

working son. Should we move to a state with no income tax?

“I don’t want to leave my son with my taxable retirement accounts.”... Read more

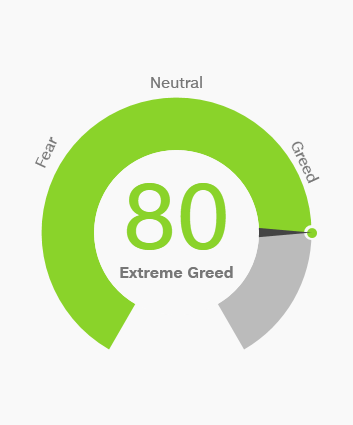

CNN Fear & Greed Index

What emotion is driving the market now?