What Is Equity Risk Premium (ERP) and How Do You Calculate It?

Equity Risk Premium (ERP) plays a crucial role in investment decision-making and financial analysis. This article explains the concept of ...

Ex-Dividend Dates Explained: What Every Investor Should Know

If you’re looking for passive income through dividends, you should first understand the role of dividend dates in determining when ...

What Is Market Risk Premium? | Formula and Uses in Investing

Investing in the stock market comes with its share of risks, and the market risk premium helps quantify the extra ...

How Do Bond ETFs Work: A Beginner’s Guide

Imagine a financial instrument that combines the stability of bonds with the flexibility of stocks. Bond ETFs offer just that ...

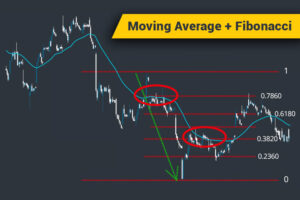

Fibonacci Moving Averages: Indicator and Strategies

The Fibonacci Moving Average (FMA) offers a nuanced perspective on price movements and trend identification. This indicator has gained traction ...

A Guide to Forecasting Using Moving Averages

Forecasting market trends is essential for optimizing your investment strategies. Whether you are an investor, day trader, financial advisor, or ...

What Are the Types of Forex Traders?

The foreign exchange (forex) market is a diverse ecosystem, attracting traders with various strategies, goals, and time horizons. Understanding the ...

Trading Correlations in Forex: How To Do It Right

For forex traders seeking to elevate their game, currency correlations unlock a wealth of strategic possibilities and risk management techniques ...

The Ultimate List of Technical Indicators for Trading

As an investor or trader, having a toolkit of technical indicators can significantly improve your market analysis and decision-making process ...

A Guide on How To Trade the Bear Pennant Pattern

The bear pennant pattern is a valuable tool in technical analysis, offering insights into potential downward price movements in financial ...

SML vs CML: Understanding the Differences

Investors often grapple with complex concepts that can make or break their portfolios. Two fundamental concepts in portfolio management and ...

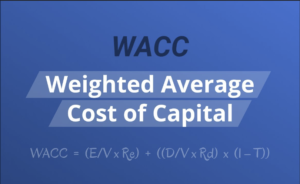

Weighted Average Cost of Capital (WACC): Formula and Uses

Imagine a compass for financial strategists, guiding them through the complexities of corporate finance. The Weighted Average Cost of Capital, ...