By ATGL

Updated June 23, 2024

Imagine a compass for financial strategists, guiding them through the complexities of corporate finance. The Weighted Average Cost of Capital, or WACC, serves as this crucial navigational tool, indicating the average rate a company expects to pay for financing its assets. It blends the cost of equity and debt, harmonizing investors’ expected returns with the reality of interest expenses.

Before we dive into the intricacies of WACC, it’s essential to grasp its foundation. WACC represents the combined costs of equity and debt to a firm, weighted according to their respective roles in the company’s capital structure. It’s a concept fundamental to both corporate valuation and financial decision-making.

By exploring how to calculate WACC, its formula, and its components, we’re set to make sense of this financial metric. This article will walk through the formula intricacies, illustrate its diverse applications, and acknowledge its limitations while aiming to decrypt how astute investors use WACC to spot outstanding investment opportunities.

What Is the Weighted Average Cost of Capital (WACC)?

The Weighted Average Cost of Capital, more succinctly known as WACC, is a substantial financial metric used by companies to compute the average cost of capital from all sources, including common shares, preferred stock, bonds, and any other long-term debt. It is an essential benchmark or hurdle rate that gauges the minimum return a company ought to realize on its investments to satisfy its investors or creditors.

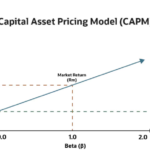

Fundamentally, WACC conveys two key elements: the cost of equity and the cost of debt. The cost of equity (Re) refers to the return that investors expect from the company for their capital contribution. Computation of Re often employs the Capital Asset Pricing model (CAPM), which takes into account the risk-free rate of return, the company’s equity beta, and the market risk premium. Conversely, the cost of debt (Rd) reflects the effective rate that a company pays on its borrowed funds. Since debts often have tax-deductible interest expenses, Rd is adjusted by the corporate tax rate (Tc) to account for the tax shield.

To calculate WACC, the formula is:

WACC = (E / V) x Re + (D / V) x Rd (1 – Tc)

where E represents the market value of equity, V is the firm’s total value (combined market value of debt (D) and equity), and (1 – Tc) reflects the benefit from the tax deductibility of interest expenses.

WACC is pivotal in corporate finance, especially for evaluating the feasibility and desirability of projects through discounted cash flow analysis, serving as the discount rate to calculate the net present value (NPV) of future cash flows. Therefore, understanding and calculating an accurate WACC enables finance professionals to make informed decisions about capital allocation, project funding, and assessing additional risk in finance operations.

How To Calculate WACC: Formula and Components

Calculating the Weighted Average Cost of Capital (WACC) is an intricate process that involves the integration of a company’s cost of equity and cost of debt, both of which are weighted according to the company’s capital structure. The WACC formula encapsulates the proportional costs of equity and debt, as well as their respective weights in the total capitalization of the company. Here’s the general representation of the formula:

WACC = (E / V) x Re + (D / V) x Rd x (1 – T)

In this equation:

- ( E ) is the market value of equity.

- ( D ) is the market value of debt.

- ( V ) is the sum of market values of both equity and debt (E + D).

- ( Re ) is the cost of equity.

- ( Rd ) is the cost of debt.

- ( Tc ) is the corporate tax rate.

WACC takes into account the market values of a company’s equity and debt in order to accurately gauge the company’s financing cost. An essential feature of calculating the WACC is that it includes a tax adjustment when incorporating the cost of debt, reflective of the tax savings due to deductible interest expenses. By blending the costs of equity and debt, factoring in their proportion within the company’s capital structure, finance professionals can determine WACC, which is indispensable for investing and financing decision-making.

Market Value of Equity (E)

The market value of equity, denoted as ( E ), is generally calculated by taking the company’s market capitalization, found by multiplying the current share price by the number of outstanding shares. For listed companies, this information is readily available and regularly updated based on current market conditions. In the case of private businesses, the valuation requires more nuanced methods such as comparable company analysis or discounted cash flow methods.

The market value of equity is not static; it fluctuates with market conditions and the company’s performance, representing the public’s valuation of the company’s worth. In the context of WACC, ( E ) serves as a gauge for the proportion of financing that comes from equity. It is essential for businesses to have an accurate market value of equity as it can significantly impact the weighted cost within the WACC formula.

Market Value of Debt (D)

The market value of debt, ( D ), is another core component in the calculation of WACC. It is defined as the total value the company would have to pay to retire all of its debts immediately. While this might seem straightforward, the market value of debt can be complex to ascertain since not all debt is traded publicly. For public bonds, the market value can be determined by the product of the number of bonds times the current market price.

To arrive at an approximate market value for non-public debt, businesses may use book values or estimate the values based on observed yields for similar debt instruments in the market. When calculating WACC, the amount of debt is taken relative to the total value of debt plus equity. Accurately appraising the market value of debt is imperative for businesses, as it influences the debt proportion in the WACC calculation.

Total Value of Capital (V)

The Total Value of Capital, ( V ), embodies the summation of market value of equity (E) and market value of debt (D). This metric is fundamental to the WACC computation as it determines the weights applied to the cost of equity and the cost of debt. For example, if our hypothetical company has $3 million in equity and $2 million in debt, then the combined capitalization, or total value of capital, is $5 million.

In other words:

[ V = E + D ] [ V = $3,000,000 + $2,000,000 ] [ V = $5,000,000 ]

The total value of capital represents the full market value of funding sources employed by the company. It is a linchpin in deciding what proportion each type of capital contributes to the firm’s operations and growth. An accurate valuation of ( V ) is therefore essential for assessing the company’s capital structure and leverage.

Cost of Equity (Re)

To fulfill the expectations of shareholders for their investment risk, a company must pay its equity investors a certain return, known as the Cost of Equity, otherwise symbolized as ( Re ). It is the anticipated rate of return that investors demand for owning shares in the company, effectively serving as an opportunity cost. The common way to calculate this is by using the Capital Asset Pricing Model (CAPM), which factors in the risk-free rate of return, the equity beta (a measure of the risk or volatility of the company’s shares relative to the market), and the expected market return.

The formula for calculating the cost of equity using CAPM can be expressed as:

Re = (Risk-Free Rate) + Beta x (Market Return – Risk-Free Rate)

Here, ( Re ) encompasses common and preferred shares along with retained earnings, making it an integral factor in determining the weighted cost of capital for the equity part in WACC.

Cost of Debt (Rd)

The Cost of Debt, or ( Rd ), represents the effective interest rate that the company pays on its borrowed funds. For public companies, it can be straightforwardly computed by averaging the yields to maturity on outstanding debt. For private companies, estimations are performed based on similar companies’ debt or by adding a risk premium to the risk-free rate based on the company’s credit standing.

When factoring this into the WACC, the cost of debt is adjusted for the tax shield provided by the deductibility of interest payments, which effectively reduces the after-tax cost of debt. Hence, the formula:

Rd = Average Yield to Maturity x (1 – Tc)

This cost reflects the minimum rate of return required to satisfy debt holders and is a vital part of the WACC calculation as it directly affects the company’s ability to finance new projects at a reasonable cost.

Tax Rate (T)

The corporate tax rate, ( Tc ), must be considered in the calculation of WACC because interest expenses on debt are tax-deductible. This deduction reduces the company’s taxable income and, consequently, its tax payment, leading to the tax shield effect. When the cost of debt is factored into the WACC calculation, it is adjusted by the factor ( (1 – Tc) ) to account for this tax advantage:

Adjusted Cost of Debt = Rd x (1 – Tc)

For businesses, the effective tax rate can vary based on geographic location and the applicable tax laws in those jurisdictions. A change in tax rate can affect the cost of debt and thus impact the company’s WACC. Staying informed of tax rate changes is critical for companies to evaluate the impact on their capital costs and investment strategies.

By considering each of these components, business leaders and finance professionals can accurately calculate the WACC to evaluate investment opportunities, assess the cost of new capital, and make informed decisions that align with their financial goals and strategies.

What Are the Uses of WACC?

The Weighted Average Cost of Capital (WACC) is a fundamental tool in corporate finance, serving multiple purposes across industries. Primarily, WACC is indispensable for assessing corporate valuation. It acts as an important benchmark in discounted cash flow (DCF) valuations, often used by finance professionals for appraising investment opportunities and determining enterprise value.

In the realm of borrowing, WACC guides companies looking for cost-effective sources of financing. By revealing a company’s average cost to secure capital—whether equity or debt—it informs loan application strategies and can influence terms negotiation. Smart use of WACC can lead to more favorable financing rates, directly impacting a firm’s profitability.

Moreover, by quantifying the minimum return necessary to satisfy investors and lenders, WACC helps in making strategic investment decisions about which projects meet financial viability thresholds. A higher WACC signals increased operational risk, prompting the need for investments to offer proportionately more substantial returns. This assessment is vital for managing and scaling business operations effectively.

Deeply embedded in the daily work of investment bankers and equity researchers, WACC calculations are cornerstone to the evaluation of projects and companies alike, influencing crucial decisions in the dynamic landscapes of industry sectors.

Core Uses of WACC:

- Corporate valuation and DCF analysis

- Loan application assessment

- Operational risk evaluation

- Project investment analysis

- Strategic decision-making in finance

Understanding the Limitations of WACC

Understanding the limitations of WACC involves recognizing that this financial metric, while informative, isn’t static. Key factors — including shifts in capital structure, such as incurring additional debt or the issuance and repurchase of shares, as well as alterations in corporate tax rates — can all cause the WACC to fluctuate. Large companies in particular face complexity when calculating their WACC due to having diverse sources of debt and equity, each with its own cost and not uniform tax implications.

The WACC estimation becomes less consistent in the light of inevitable business activities such as refinancing, equity transactions, or legislative amendments affecting taxation. Additionally, global operations complicate tax rate determinations across different jurisdictions. Due to these intricacies, WACC may not provide a precise measure of a company’s cost of capital at any given time, leading some individual investors to prefer simpler valuation methods, like the P/E ratio, to assess investment potential.

In essence, while WACC serves as an important gauge for the average cost of capital, it remains an estimate with a degree of uncertainty, influenced by an array of business and regulatory factors.

Unlock the Best Investment Opportunities With Above the Green Line

When diving into investment opportunities, savvy investors often leverage the Weighted Average Cost of Capital (WACC) as their compass. WACC represents the discount rate that is used to calculate the present value of a business and is pivotal in recognizing worthwhile ventures. By using WACC as a hurdle rate, investors can gauge the viability of potential mergers, acquisitions, or internal projects. A clear understanding of WACC is imperative when making decisions as it embodies the company’s cost of capital.

Here’s why WACC deserves your attention:

- Differentiates cost implications for nominal vs. real cash flows.

- Serves as a critical factor in the valuation using the Unlevered Free Cash Flow method.

- Elevates investment insights by highlighting minimum return thresholds.

As an invaluable tool in corporate finance, WACC provides clarity on the risks and rewards, ensuring you place your bets on the right opportunities that promise returns “Above the Green Line” – where investment prospects not only meet but exceed the calculated WACC, signifying performance above the average cost of capital. Understanding the nuances of WACC empowers investors to identify and unlock the best paths to profitable investments, join Above the Green Line today.