Swing Trading

What is Swing Trading?

Swing Trading is a strategy where a trader purchases a financial instrument and holds onto it anywhere from a few days to a few weeks. A swing trader will follow chart trends and patterns and hopes to sell at a defined target, and capture gains off of short term price movements. Traders who utilize this trading strategy primarily apply concepts of Technical Analysis. At Above the Green Line, we are Swing Trading Masters based on our system of Three Rules.

SWING TRADING (SHORT TERM)

Watchlist and Charts

Watch List Watch List Charts

Current Positions Current Charts

Closed Results Trading Dashboard

Swing Trading is one of the most popular trading styles employed by traders. Since the goal of Swing Trading is to capture a chunk of a price movement, the process of trading a financial instrument is quite active yet also very temporary. Once a Swing Trader has finished with a particular financial instrument, they quickly move on to the next. The type of position a Swing Trader may enter into depends on their strategy. Some Swing Traders may have a taste for risk, while others may enjoy a more steady purchase. Nevertheless, each Swing Trader involves themselves heavily in the process of identifying potential price movements, entering the trade, and hopefully profiting.

Assessing Trades

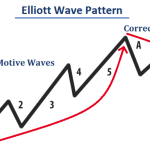

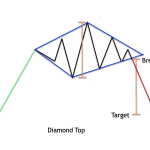

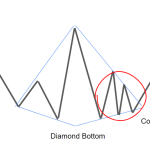

If Swing Trading sounds appealing, you will want to make sure you are familiar with Technical Analysis. As previously discussed, Swing Traders primarily employ Technical Analysis due to the short-term nature of the trades. In short, Technical Analysis aims to determine the future price of a stock by examining the market activity surrounding a financial instrument such as price history, trading volumes, etc.

In addition to having a grasp on Technical Analysis, an aspiring Swing Trader should assess their trades using a Risk/Reward Ratio. The Risk/Reward Ratio is a method used by traders to evaluate the potential profit in relation to each dollar they risk. An important component of the Risk/Reward Ratio is a Sell-Stop-Loss, which can be best described as a set price at which stock (or any financial instrument) will automatically sell.

To view a compilation of stocks previously featured on the ATGL watchlist, please visit ATGL Stock Review.

Picking The Right Financial Instruments and Taking Action In The Right Market

Many experts agree that the key to Swing Trading is choosing the right stocks to trade. According to Investopedia, the best candidate stocks for Swing Traders are large-cap stocks. Large-cap stocks are shares of a company with a total value of over $5 billion; clearly, these are well-known companies that the average person hears of often. In an active market, large-cap stocks will swing between broadly defined highs and lows and a Swing Trader can easily ride the wave. In addition to deciding the right stock, it is necessary that a Swing Trader take action in the right market. According to Investopedia, Swing Traders are best positioned when the market is going nowhere — when they repeat the same general pattern over and over again.

Choosing the Best Approach for Swing Trading

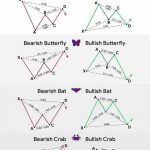

Various approaches exist within the realm of swing trading, including trend-following, momentum-based, and mean-reversion strategies. The importance of choosing the right approach lies in aligning the strategy with one’s risk tolerance, time horizon, and market conditions. Trend-following strategies, for instance, thrive in strong trending markets, while mean-reversion strategies may be more suitable in sideways or range-bound conditions. Additionally, selecting the right indicators, timeframes, and risk management techniques is crucial. A well-suited swing trading approach enhances the probability of success by allowing traders to adapt to different market scenarios and make informed decisions based on the specific characteristics of the assets being traded. Structured discipline Investing is key to executing these strategies effectively and minimizing emotional decision-making. At Above the Green Line we follow strict rules when swing trading while others like IBD Swing Trading may not. See a comparison of results between Above the Green Line and IBD for yourself.

For traders seeking a fresh alternative, the Top Pick of the Week (TPOW) strategy offers a streamlined and focused approach to swing trading. This strategy emphasizes selecting one standout stock each week based on stringent technical criteria, including a high SCTR rating, breakout potential, and volume spikes. By narrowing the focus to a single stock, TPOW allows traders to simplify decision-making while maintaining discipline and consistency. Designed for those looking to capitalize on high-probability setups, TPOW aligns well with both seasoned traders and those newer to swing trading who want a proven, rules-based methodology.

Takeaway

There are many pros to employing Swing Trading as a trading strategy. For one, it requires less time than Day Trading. Unlike Swing Trading, Day Trading involves closing out positions before the market closes and is limited to a single day, thus Day Traders will spend roughly 2 hours a day evaluating trends, charts, etc. In addition to saving time, Swing Traders essentially only need to utilize Technical Analysis which simplifies the process greatly.

While there are pros to Swing Trading, there are also cons. For instance, the market can be volatile, especially in the short term. If the market was to abruptly reverse, a Swing Trader may experience a substantial loss. Additionally, unlike Day Traders, Swing Traders are subjected to overnight and weekend market risks. Lastly, a common critique of Swing Trading is that traders often overlook long term trends due to the large focus on short term trends and thus can miss other investment opportunities.

When deciding if Swing Trading is the right method for you, all of the pros and cons should be weighed. However, it is of great importance to analyze yourself, your personality, and your goals; trading is not for everybody