Stock Ideas and Market Analysis

The Stock ideas and Market analysis presented below are generated by 3rd Party news feeds. Its a collection of articles, reports, and insights from industry-recognized third parties such as S&P Capital IQ, Dow Jones, and Credit Suisse. These resources provide a wealth of information on a broad range of stocks, ETFs, and investment strategies. You can access a variety of helpful tools and resources, like interactive charts, to help you validate new ideas. Our goal is to offer a centralized hub for individuals seeking timely and relevant information on key topics that can potentially impact markets and trading ideas. The ideas do NOT necessarily follow the Green Line Method for investing. If interested in learning more join Above the Green Line today.

-

#BTC.D (BTC-DOMINANCE) - Cheat sheet

#BTC-DOMINANCE The asset has many strong features to achieve its goal. This text does not contain recommendations on financial transactions or investments.... Read more

#BTC-DOMINANCE The asset has many strong features to achieve its goal. This text does not contain recommendations on financial transactions or investments.... Read more -

ETH: Buying in the Dip

CME: Micro Ether Futures ( CME:MET1! ), #microfutures On May 22nd, #Bitcoin reached a new all-time high of $111,814. The king of cryptos rallied as bullish sentiment built up behind the most pro-crypto U.S. administration. As of last Friday, bitcoin realized a one-year return of +90.8%. For comparison, holding S&P 500 only yields 11.8% for a year, even after the US stock index made its ATH last week. Meanwhile, #Ethereum, second only to Bitcoin in the cryptocurrency world, experienced a dramatic decline in 2025. ETH is currently trading around $2,500, down 40% since December. It is a far cry from its ATH of $4,815 on November 9, 2021. https://www.tradingview.com/x/k024bJkD/ Why Is Ethereum (ETH) Falling? The most significant challenge facing Ethereum is the proliferation of Layer 2 scaling solutions. Networks such as Arbitrum, Base, and Optimism were developed to address Ethereum's scalability issues, but they've created a revenue problem for the... Read more

CME: Micro Ether Futures ( CME:MET1! ), #microfutures On May 22nd, #Bitcoin reached a new all-time high of $111,814. The king of cryptos rallied as bullish sentiment built up behind the most pro-crypto U.S. administration. As of last Friday, bitcoin realized a one-year return of +90.8%. For comparison, holding S&P 500 only yields 11.8% for a year, even after the US stock index made its ATH last week. Meanwhile, #Ethereum, second only to Bitcoin in the cryptocurrency world, experienced a dramatic decline in 2025. ETH is currently trading around $2,500, down 40% since December. It is a far cry from its ATH of $4,815 on November 9, 2021. https://www.tradingview.com/x/k024bJkD/ Why Is Ethereum (ETH) Falling? The most significant challenge facing Ethereum is the proliferation of Layer 2 scaling solutions. Networks such as Arbitrum, Base, and Optimism were developed to address Ethereum's scalability issues, but they've created a revenue problem for the... Read more -

Technical Forecast for the upcoming week (July 8–12, 2025)

Hello Everyone 📉 Current Market Overview Price: $3,333.90 Trend: Uptrend with loss of bullish momentum, forming a distribution range after a strong rally since March. Structure: Currently ranging between $3,305 – $3,365. Volatility: Compressing, suggesting a possible breakout move soon. 🔍 Key Technical Zones Major Support: $3,300 –$3,305 Last strong rejection point, forming a floor Resistance: $3,360 – $3,370 Recent tops & strong rejections Trendline Support: Rising from March lows - Still respected Breakdown Risk: Below $3,300 Could trigger a drop to $3,250–$3,220 🧭 Expected Scenarios for Next Week ✅ Scenario 1: Bullish Breakout Trigger: Clean close above $3,370 on daily Target: $3,400 → $3,435 Stop Loss: Below $3,310 Reason: Break of resistance + continuation of higher lows ⚠️ Scenario 2: Bearish Breakdown Trigger: Break and daily close below $3,300 Target: $3,250 → $3,220 Reason: Structure failure, potential range breakdown https://www.tradingview.com/x/ACKjcYN3/ 🔄 Scenario 3: Continuation of Range Likely if price... Read more

Hello Everyone 📉 Current Market Overview Price: $3,333.90 Trend: Uptrend with loss of bullish momentum, forming a distribution range after a strong rally since March. Structure: Currently ranging between $3,305 – $3,365. Volatility: Compressing, suggesting a possible breakout move soon. 🔍 Key Technical Zones Major Support: $3,300 –$3,305 Last strong rejection point, forming a floor Resistance: $3,360 – $3,370 Recent tops & strong rejections Trendline Support: Rising from March lows - Still respected Breakdown Risk: Below $3,300 Could trigger a drop to $3,250–$3,220 🧭 Expected Scenarios for Next Week ✅ Scenario 1: Bullish Breakout Trigger: Clean close above $3,370 on daily Target: $3,400 → $3,435 Stop Loss: Below $3,310 Reason: Break of resistance + continuation of higher lows ⚠️ Scenario 2: Bearish Breakdown Trigger: Break and daily close below $3,300 Target: $3,250 → $3,220 Reason: Structure failure, potential range breakdown https://www.tradingview.com/x/ACKjcYN3/ 🔄 Scenario 3: Continuation of Range Likely if price... Read more -

BTC - Bulls Getting Ready!!

Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst. 📈BTC has been bullish trading within the flat rising wedge marked in blue and it is currently retesting the lower bound of the wedge. Moreover, the orange zone is a strong demand. 🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of demand and lower blue trendline acting as a non-horizontal support. 📚 As per my trading style: As #BTC approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...) 📚 Always follow your trading plan regarding entry, risk management, and trade management. Good luck! All Strategies Are Good; If Managed Properly! ~Rich... Read more

Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst. 📈BTC has been bullish trading within the flat rising wedge marked in blue and it is currently retesting the lower bound of the wedge. Moreover, the orange zone is a strong demand. 🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of demand and lower blue trendline acting as a non-horizontal support. 📚 As per my trading style: As #BTC approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...) 📚 Always follow your trading plan regarding entry, risk management, and trade management. Good luck! All Strategies Are Good; If Managed Properly! ~Rich... Read more -

We can expect such a move if the event I mentioned in the captio

Hello friends.. In the analysis we had previously told you about the dollar index on this page, it started a downward trend right from the specified area (you can visit the page) Now, after a long time has passed since that analysis, we are now in a suitable range in the dollar index. See, on the weekly time frame, the index number has hit a strong support area, but we should not make a trading decision by seeing this support unit. As you can see in the image, if the index number suffers in this range, we can expect a turn in the index. You can change the trading decisions you have had so far in the event of a turn in the index. This is just a view from our team, do not attach it to your trades. . . Follow our page to see more analyses.... Read more

Hello friends.. In the analysis we had previously told you about the dollar index on this page, it started a downward trend right from the specified area (you can visit the page) Now, after a long time has passed since that analysis, we are now in a suitable range in the dollar index. See, on the weekly time frame, the index number has hit a strong support area, but we should not make a trading decision by seeing this support unit. As you can see in the image, if the index number suffers in this range, we can expect a turn in the index. You can change the trading decisions you have had so far in the event of a turn in the index. This is just a view from our team, do not attach it to your trades. . . Follow our page to see more analyses.... Read more -

Break-Out Bros vs. Range Followers – will BTC rip?

Bitcoin just kissed the channel roof at 109–110 k. Same line has stuffed every rally since April, so 112 k on a daily close is the whole story: print it and we leave the dungeon. Under the hood the bulls finally have ammo – price back above the 50-day, bands squeezed, volume upticking, RSI mid-50s. Enough spark to torch shorts if resistance snaps. Range Followers aren’t sweating. Their cash machine is simple: dump 110 k, scoop 100 k. Holiday liquidity = fake-out heaven. Slip under 105 k and gravity drags us straight to that comfy demand couch. So it’s binary: close over 112 k, momentum fires toward 118 k; fail, and we ping-pong in the box again. Pick a side, slap on a stop, and remember: Bitcoin’s favourite sport is humiliating whichever crowd screams loudest.... Read more

Bitcoin just kissed the channel roof at 109–110 k. Same line has stuffed every rally since April, so 112 k on a daily close is the whole story: print it and we leave the dungeon. Under the hood the bulls finally have ammo – price back above the 50-day, bands squeezed, volume upticking, RSI mid-50s. Enough spark to torch shorts if resistance snaps. Range Followers aren’t sweating. Their cash machine is simple: dump 110 k, scoop 100 k. Holiday liquidity = fake-out heaven. Slip under 105 k and gravity drags us straight to that comfy demand couch. So it’s binary: close over 112 k, momentum fires toward 118 k; fail, and we ping-pong in the box again. Pick a side, slap on a stop, and remember: Bitcoin’s favourite sport is humiliating whichever crowd screams loudest.... Read more -

NASDAQ Key Levels July 7 2025

If NY fails to reclaim 22,755–780 early in the week, expect a grind back toward 22,644 → 22,600, with 22,520 in play only if volume confirms. Reclaiming and holding above 22,800+ would invalidate this bearish setup. Watch for trap volume, delta reversals, and volume imbalances at all key zones before entering. 22,880 – 🔻 Weekly wick top ➤ Major rejection zone with a stop cluster sitting above. 22,800–820 – Possible NY trap zone ➤ Trap absorption detected here on footprint — watch New York for rejection or breakout. 22,755–22,780 – Retest zone ➤ Multiple trap wicks with low delta on 1H/15M. Likely to bait breakout traders before fading. 22,700 – Structural demand / pivot point ➤ A clean break + hold below = bearish market shift. 22,644 – ✅ Session low / Take Profit 1 ➤ If 22,700 breaks, this is the first clean downside target. 22,600 – Daily value... Read more

If NY fails to reclaim 22,755–780 early in the week, expect a grind back toward 22,644 → 22,600, with 22,520 in play only if volume confirms. Reclaiming and holding above 22,800+ would invalidate this bearish setup. Watch for trap volume, delta reversals, and volume imbalances at all key zones before entering. 22,880 – 🔻 Weekly wick top ➤ Major rejection zone with a stop cluster sitting above. 22,800–820 – Possible NY trap zone ➤ Trap absorption detected here on footprint — watch New York for rejection or breakout. 22,755–22,780 – Retest zone ➤ Multiple trap wicks with low delta on 1H/15M. Likely to bait breakout traders before fading. 22,700 – Structural demand / pivot point ➤ A clean break + hold below = bearish market shift. 22,644 – ✅ Session low / Take Profit 1 ➤ If 22,700 breaks, this is the first clean downside target. 22,600 – Daily value... Read more -

EOS -> Vaulta : (0.5013 support is the key)

Hello, traders. If you "Follow", you can always get new information quickly. Have a nice day today. ------------------------------------- EOS switched from banking to blockchain during the network reorganization. (AUSDT 1D chart) https://www.tradingview.com/x/nOyESmOz/ The key is whether it can rise to around 0.5013 and receive support. If not, it is likely to show a step-down trend. - (4h chart) https://www.tradingview.com/x/O2nLqwG7/ In terms of day trading, Support range: 0.4942-0.4822 Resistance range: 0.5959-0.6394 We need to see whether it can receive support and rise in the above range. However, since the M-Signal indicator of the 1D chart is passing around 0.5013, it is important to see how the volume profile formed around this area and 0.5389 will rise. - Thank you for reading to the end. I hope you have a successful trade. -------------------------------------------------- - Here is an explanation of the big picture. (3-year bull market, 1-year bear market pattern) https://www.tradingview.com/chart/BTCUSD/tXPVglDp-3-year-bull-market-1-year-bear-market-pattern/ I will... Read more

Hello, traders. If you "Follow", you can always get new information quickly. Have a nice day today. ------------------------------------- EOS switched from banking to blockchain during the network reorganization. (AUSDT 1D chart) https://www.tradingview.com/x/nOyESmOz/ The key is whether it can rise to around 0.5013 and receive support. If not, it is likely to show a step-down trend. - (4h chart) https://www.tradingview.com/x/O2nLqwG7/ In terms of day trading, Support range: 0.4942-0.4822 Resistance range: 0.5959-0.6394 We need to see whether it can receive support and rise in the above range. However, since the M-Signal indicator of the 1D chart is passing around 0.5013, it is important to see how the volume profile formed around this area and 0.5389 will rise. - Thank you for reading to the end. I hope you have a successful trade. -------------------------------------------------- - Here is an explanation of the big picture. (3-year bull market, 1-year bear market pattern) https://www.tradingview.com/chart/BTCUSD/tXPVglDp-3-year-bull-market-1-year-bear-market-pattern/ I will... Read more -

ETHEREUM TRADE PLAN!!!

Ethereum still remains bullish, especially on the daily timeframe there's a +OB/BISI supporting the price. My focus is on the "4-Hour TF" I want to see price revisit (BISI) level as a more favorable entry point for continuation. This level aligns with a key bullish order block, which I anticipate will draw price down before resuming the uptrend.... Read more

Ethereum still remains bullish, especially on the daily timeframe there's a +OB/BISI supporting the price. My focus is on the "4-Hour TF" I want to see price revisit (BISI) level as a more favorable entry point for continuation. This level aligns with a key bullish order block, which I anticipate will draw price down before resuming the uptrend.... Read more -

TradeCityPro | 1INCH Tests Supply Zone After Strong Bounce

👋 Welcome to TradeCity Pro! In this analysis, I want to review the 1INCH coin for you. It’s one of the DeFi coins, with a market cap of $256 million, ranked 162 on CoinMarketCap. ⏳ 4-Hour Timeframe As you can see in the 4-hour timeframe, this coin is sitting on a support floor at the 0.1668 zone and has formed a range box at this bottom. 🔔 There’s a key supply zone at the top of this range box, which I’ve marked as a range for you, and currently, the price is inside this zone. 📊 Given the significant buying volume that has entered this coin, the price has penetrated into this range and is testing it for the several-th time. ✨ If this range is broken, we can confirm the bullish reversal of this coin and open a long position. Volume has already given us confirmation, and if RSI... Read more

👋 Welcome to TradeCity Pro! In this analysis, I want to review the 1INCH coin for you. It’s one of the DeFi coins, with a market cap of $256 million, ranked 162 on CoinMarketCap. ⏳ 4-Hour Timeframe As you can see in the 4-hour timeframe, this coin is sitting on a support floor at the 0.1668 zone and has formed a range box at this bottom. 🔔 There’s a key supply zone at the top of this range box, which I’ve marked as a range for you, and currently, the price is inside this zone. 📊 Given the significant buying volume that has entered this coin, the price has penetrated into this range and is testing it for the several-th time. ✨ If this range is broken, we can confirm the bullish reversal of this coin and open a long position. Volume has already given us confirmation, and if RSI... Read more -

DXY LONG TERM ANALYSIS

I anticipate dollar to trade down towards 80. After which we shall look for longs towards 144. This is a long term outlook. 1. first we trade down towards sellside liquidity at 87. 2. Next key level is the 3 month fair value gap at 84 3. Eventually hitting the 25 DRT of the current dealing range at 80. 4. Then we can look to go long targeting 75 DRT of the parent Dealing Range. 5. We shall be coming here weekly to review and correct course as the market unfolds. THANK YOU.... Read more

I anticipate dollar to trade down towards 80. After which we shall look for longs towards 144. This is a long term outlook. 1. first we trade down towards sellside liquidity at 87. 2. Next key level is the 3 month fair value gap at 84 3. Eventually hitting the 25 DRT of the current dealing range at 80. 4. Then we can look to go long targeting 75 DRT of the parent Dealing Range. 5. We shall be coming here weekly to review and correct course as the market unfolds. THANK YOU.... Read more -

SPX500 Bearish Breakout!

https://www.tradingview.com/x/D8Rub9zL/ HI,Traders ! #SPX500 was trading along The rising support line but Now we are seeing a bearish Breakout so we are bearish Biased and we will be expecting A further bearish move down ! Comment and subscribe to help us grow !... Read more

https://www.tradingview.com/x/D8Rub9zL/ HI,Traders ! #SPX500 was trading along The rising support line but Now we are seeing a bearish Breakout so we are bearish Biased and we will be expecting A further bearish move down ! Comment and subscribe to help us grow !... Read more -

Interesting swing buy opportunity in EURGBP! Don’t miss out!

A potential swing low is spotted around the price level of 0.85275 Technically, I am looking forward to seeing price fallback to a swing low so as to buy low. Potential take profit level is at recent swing high. Overall trend of the market remains bullish both on monthly & weekly.... Read more

A potential swing low is spotted around the price level of 0.85275 Technically, I am looking forward to seeing price fallback to a swing low so as to buy low. Potential take profit level is at recent swing high. Overall trend of the market remains bullish both on monthly & weekly.... Read more -

The potential of gold!

Looking at gold. Its still in a bit of limbo after the NFP reaction on Friday. However it is looking like the draw on liquidity is higher. Therefore my bias on gold for the start of the week is bullish so will be looking to get the most optimal entry to take some buys to the upside. If we can manage to find a decent enough move price really could rally upwards.... Read more

Looking at gold. Its still in a bit of limbo after the NFP reaction on Friday. However it is looking like the draw on liquidity is higher. Therefore my bias on gold for the start of the week is bullish so will be looking to get the most optimal entry to take some buys to the upside. If we can manage to find a decent enough move price really could rally upwards.... Read more -

BTCUSDT

Do you think Bitcoin is long or short? I think we are shorting it to the 104,500 range and I am in a short position myself🎯🎯... Read more

Do you think Bitcoin is long or short? I think we are shorting it to the 104,500 range and I am in a short position myself🎯🎯... Read more

Market Analysis

-

Week Ahead: NIFTY Set To Stay In A Defined Range Unless These Levels Are Taken Out; Drags Support Higher

After a strong move in the week before this one, the Nifty spent the last five sessions largely consolidating in a very defined range. The markets traded with a weak underlying bias and lost ground gradually over the past few days; however, the drawdown remained quite measured and within the expected range. As the markets consolidated, the trading range got narrower. The Nifty moved in a 337-point range during the week. While the Index formed a near-similar high, it marked a much higher low. The volatility also retraced; the India VIX came off by 0.59% to 12.31. While showing no intention...... Read more

After a strong move in the week before this one, the Nifty spent the last five sessions largely consolidating in a very defined range. The markets traded with a weak underlying bias and lost ground gradually over the past few days; however, the drawdown remained quite measured and within the expected range. As the markets consolidated, the trading range got narrower. The Nifty moved in a 337-point range during the week. While the Index formed a near-similar high, it marked a much higher low. The volatility also retraced; the India VIX came off by 0.59% to 12.31. While showing no intention...... Read more -

From Oversold to Opportunity: Small Caps on the Move

This holiday-shortened week was anything but short on action! The S&P 500 and Nasdaq Composite closed at record highs, but what is really driving the market? In this essential recap, expert Mary Ellen McGonagle dives into the sectors and stocks making big moves. She'll reveal why energy and financial stocks are heating up, discuss the surge in biotech and regional banks, and provide key insights into software and renewable energy trends. Discover the technical signals behind these moves and learn how you can spot early-stage reversals across different...... Read more

This holiday-shortened week was anything but short on action! The S&P 500 and Nasdaq Composite closed at record highs, but what is really driving the market? In this essential recap, expert Mary Ellen McGonagle dives into the sectors and stocks making big moves. She'll reveal why energy and financial stocks are heating up, discuss the surge in biotech and regional banks, and provide key insights into software and renewable energy trends. Discover the technical signals behind these moves and learn how you can spot early-stage reversals across different...... Read more -

Money's Not Leaving the Market — It's Rotating!

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn't fleeing the market; it's simply moving around, creating fresh opportunities. In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom shows clear signals of broad market participation, digging into the performance of key areas like transports, tech stocks, regional banks, small caps, and mid caps. He also touches on bonds, major indexes, and individual stocks with intriguing patterns. An interesting insight brought up...... Read more

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn't fleeing the market; it's simply moving around, creating fresh opportunities. In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom shows clear signals of broad market participation, digging into the performance of key areas like transports, tech stocks, regional banks, small caps, and mid caps. He also touches on bonds, major indexes, and individual stocks with intriguing patterns. An interesting insight brought up...... Read more -

Missed Disney's Rally? Grab This Defined-Risk Put Spread for a Second Chance

Stocks keep notching record highs. If you're like most investors, you're probably wondering, "Should I really chase these prices or sit tight and wait for a pullback?"Instead of overthinking and ending up in Analysis-Paralysis land, however, it may be worth exploring other avenues — and maybe even something you've never thought of.Enter bearish counter-trend options strategies. Yup, it sounds crazy, especially when the S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) closed at fresh highs. But here's the reality: a well-planned put strategy has the potential to generate some revenue while...... Read more

-

Should You Buy Roblox Stock Now? Key Levels to Watch

Roblox Corporation (RBLX), the company behind the immersive online gaming universe, has been on a strong run since April. This isn't the first time the stock demonstrated sustained technical strength: RBLX has maintained a StockCharts Technical Rank (SCTR) above 90, aside from a few dips, since last November.Currently, RBLX is showing up on a few scans that may signal an opportunity for those who are bullish on the stock. It currently ranks among the SCTR Report Top 10, but also appeared on a few cautionary scans, including the Parabolic SAR Sell Signals and Overbought with a Declining RSI...... Read more

Roblox Corporation (RBLX), the company behind the immersive online gaming universe, has been on a strong run since April. This isn't the first time the stock demonstrated sustained technical strength: RBLX has maintained a StockCharts Technical Rank (SCTR) above 90, aside from a few dips, since last November.Currently, RBLX is showing up on a few scans that may signal an opportunity for those who are bullish on the stock. It currently ranks among the SCTR Report Top 10, but also appeared on a few cautionary scans, including the Parabolic SAR Sell Signals and Overbought with a Declining RSI...... Read more -

MACD Crossovers: Why Most Traders Get It Wrong

Joe presents a deep dive into MACD crossovers, demonstrating how to use them effectively across multiple timeframes, establish directional bias, and improve trade timing. He explains why price action should confirm indicator signals, sharing how to identify "pinch plays" and zero-line reversals for higher-quality setups. Joe then analyzes a wide range of stocks and ETFs, from QQQ and IWM to Nvidia, Tesla, Palantir, and Reddit; he highlights the importance of momentum, relative strength, and ADX in spotting potential reversals or breakouts. This video is a must-see for traders looking to...... Read more

Joe presents a deep dive into MACD crossovers, demonstrating how to use them effectively across multiple timeframes, establish directional bias, and improve trade timing. He explains why price action should confirm indicator signals, sharing how to identify "pinch plays" and zero-line reversals for higher-quality setups. Joe then analyzes a wide range of stocks and ETFs, from QQQ and IWM to Nvidia, Tesla, Palantir, and Reddit; he highlights the importance of momentum, relative strength, and ADX in spotting potential reversals or breakouts. This video is a must-see for traders looking to...... Read more -

Market Signals Align – Is a Bigger Move Ahead?

This week, Frank analyzes recent technical signals from the S&P 500, including overbought RSI levels, key price target completions, and the breakout potential of long-term bullish patterns. He examines past market breakouts and trend shifts, showing how overbought conditions historically play out. Frank also walks through a compelling mean-reversion trade idea in Apple, emphasizing its lagging performance and potential rebound based on past patterns.This video originally premiered on July 2, 2025.You can view previously recorded videos from Frank and other industry experts at this link.... Read more

This week, Frank analyzes recent technical signals from the S&P 500, including overbought RSI levels, key price target completions, and the breakout potential of long-term bullish patterns. He examines past market breakouts and trend shifts, showing how overbought conditions historically play out. Frank also walks through a compelling mean-reversion trade idea in Apple, emphasizing its lagging performance and potential rebound based on past patterns.This video originally premiered on July 2, 2025.You can view previously recorded videos from Frank and other industry experts at this link.... Read more -

Top 10 July 2025 Stock Picks You Shouldn't Miss

Join Grayson for a solo show as he reveals his top 10 stock charts to watch this month. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. As a viewer, you'll also gain insight into key market trends and chart patterns that could directly impact your trading strategy. Whether you're a short-term trader or a long-term investor, this breakdown will help you stay one step ahead.This video originally premiered on July 1, 2025. Click on the above image to watch on our dedicated...... Read more

Join Grayson for a solo show as he reveals his top 10 stock charts to watch this month. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. As a viewer, you'll also gain insight into key market trends and chart patterns that could directly impact your trading strategy. Whether you're a short-term trader or a long-term investor, this breakdown will help you stay one step ahead.This video originally premiered on July 1, 2025. Click on the above image to watch on our dedicated...... Read more -

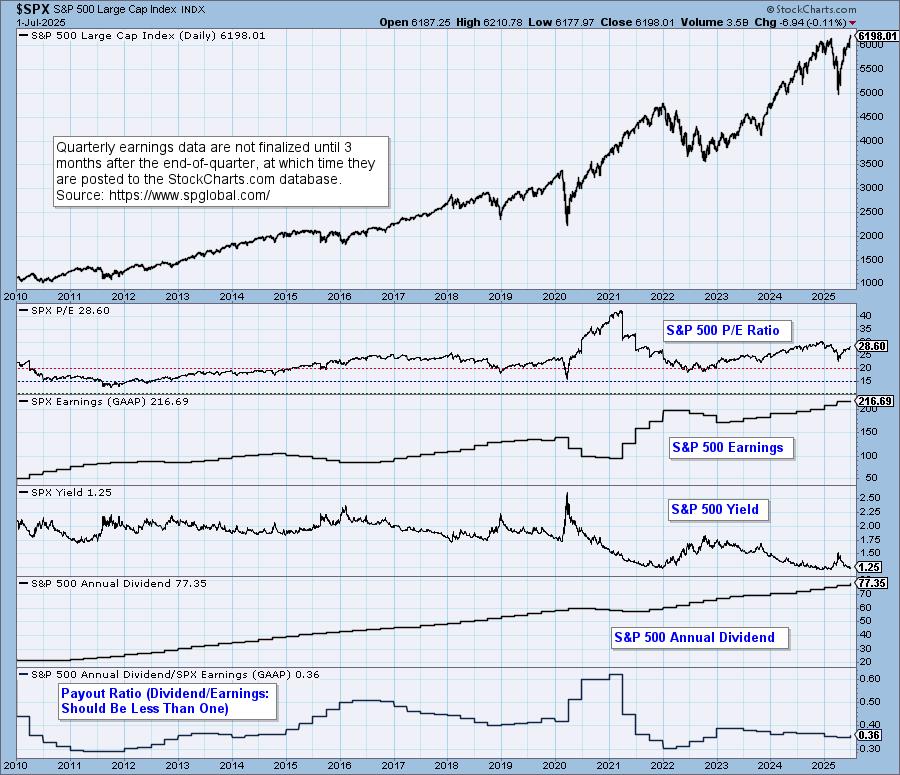

S&P 500 Earnings for 2025 Q1 -- Still Overvalued

S&P 500 earnings are in for 2025 Q1, and here is our valuation analysis.The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an undervalued P/E of 10 (green line). Annotations on the right side of the chart show where the range is projected to be, based upon earnings estimates through 2026 Q1.Historically, price has usually remained below the top of the normal value range (red line); however, since about 1998, it...... Read more

S&P 500 earnings are in for 2025 Q1, and here is our valuation analysis.The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an undervalued P/E of 10 (green line). Annotations on the right side of the chart show where the range is projected to be, based upon earnings estimates through 2026 Q1.Historically, price has usually remained below the top of the normal value range (red line); however, since about 1998, it...... Read more -

The Future of Tech Stocks: Will They Soar or Sink?

The last day of trading for the first half of 2025 ended with a bang. The S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) closed at record highs — an impressive finish, given the year has seen significant swings.We saw signs of investors rotating into technology stocks last week when the Nasdaq 100 ($NDX) hit a record high. Looking at the one-week timeframe in the US Indexes tab in the Equities panel in the StockCharts Market Summary page, the $NDX has seen the largest percentage gain (+3.76%) and is trading 9.94% above its 200-day simple moving average (SMA). The Nasdaq Composite is a...... Read more