The Fibonacci Moving Average (FMA) offers a nuanced perspective on price movements and trend identification. This indicator has gained traction among professional traders, investment advisors, and institutional analysts for its ability to provide … [Read more...]

A Guide to Forecasting Using Moving Averages

Forecasting market trends is essential for optimizing your investment strategies. Whether you are an investor, day trader, financial advisor, or swing trader, leveraging technical analysis tools like moving averages can significantly enhance your … [Read more...]

Good Faith Violations: What Are Unsettled Funds?

Understanding good faith violations and the concept of unsettled funds is crucial, as these can impact an investor’s ability to trade and result in significant penalties. Unsettled funds refer to the money from a sale transaction that has not yet … [Read more...]

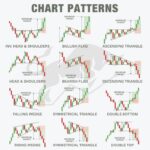

6 Day Trading Patterns You Should Know

Day trading involves buying and selling securities within a single trading day and can be a highly profitable trade strategy if executed with precision and foresight. Recognizing reliable day trading patterns is critical, as they are backed by … [Read more...]

Are Commodity ETFs a Good Investment?

Commodity exchange-traded funds (ETFs) are popular for diversifying portfolios beyond traditional stocks and bonds. These ETFs offer unique investment opportunities for physical goods such as gold, oil, and agricultural products without directly … [Read more...]

6 Commodity Trading Risk Management Strategies

In the volatile world of commodity trading, effective risk management is crucial for protecting investments and maximizing returns. Commodity trading risk management involves a set of strategic measures designed to mitigate the impacts of market … [Read more...]

How To Build an ICT Trading Strategy

In the fast-paced world of Forex trading, strategy is king. The ICT (Inner Circle Trader) methodology stands tall, whispered reverently across online trading forums and chat rooms. Understanding how to harness the principles of ICT could be your … [Read more...]

Is Algorithmic Trading Profitable?

Imagine computers conducting trades at a speed and frequency that is impossible for human traders. Algorithmic trading harnesses the power of complex algorithms to execute orders based on predefined criteria. In the ensuing discussion, we delve into … [Read more...]

Trading Instruments: Types and Asset Classes

As an investor navigating the markets, you have access to a wide variety of trading instruments across different types and asset classes. This guide is designed to help you understand these instruments so you can make informed decisions that align … [Read more...]

Day Trading vs Swing Trading: Which One Is More Worth It?

Investing strategies vary widely among traders. Day trading and swing trading are two of the most prominent methodologies. These strategies offer unique benefits and challenges, making it vital for investors to understand their differences before … [Read more...]

- 1

- 2

- 3

- 4

- Next Page »