By ATGL

Updated April 21, 2024

In the volatile world of commodity trading, effective risk management is crucial for protecting investments and maximizing returns. Commodity trading risk management involves a set of strategic measures designed to mitigate the impacts of market uncertainty, price volatility, and other financial risks associated with trading raw and primary products.

By adopting sound risk management strategies, traders can ensure greater portfolio stability and enhance their decision-making processes. This guide outlines six key strategies to manage potential risks in commodity trading, providing a foundational approach for new and experienced traders.

What Are the Risk Factors of Commodities?

Trading commodities exposes investors to risk factors significantly influencing market prices and investment outcomes. One of the primary risk factors is market volatility. Commodities can experience wide price fluctuations due to changes in weather, geopolitical tensions, or shifts in supply and demand dynamics. For example, agricultural products depend heavily on weather conditions, and any unforeseen changes can alter crop yields, impacting prices globally.

Another significant risk in commodity trading is geopolitical risk. Many commodities, such as oil, gas, and minerals, are extracted from unstable or politically volatile regions. Changes in government policies, trade embargoes, or conflicts can disrupt supply chains and affect prices. Additionally, commodities are also subject to regulatory risks, where regulation changes can alter market dynamics, affecting both the cost and resource availability.

Top 6 Strategies To Manage Potential Risks in Commodity Trading

Effective management of risks in commodity trading is essential for safeguarding investments and securing financial stability. Here are six pivotal strategies traders can employ to navigate the complexities of commodity trading.

1. Derivatives Contracts and Hedging Strategies: Mitigate Price Risk

Derivatives contracts, such as futures, options, and swaps, are fundamental tools for managing price risks in commodity trading. By entering into a futures contract, a trader can lock in a price for a commodity at a future date, thus hedging against potential price volatility that could adversely affect profit margins.

Options provide the right, but not the obligation, to buy or sell a commodity at a predetermined price, offering another layer of protection against unfavorable price movements. Swaps allow traders to manage fluctuating commodity prices by exchanging cash flows with another party, which can be particularly useful in markets subject to significant price swings. These strategies help to stabilize financial outcomes despite the inherent unpredictability of commodity prices.

2. Diversification: Spread Risk Across Various Commodities

Diversification is a critical risk management technique that spreads investments across various commodities to reduce exposure to any single market’s volatility. By allocating capital to different commodity groups — such as energy, agricultural products, and precious metals — traders can mitigate the impact of a downturn in one sector on their overall portfolio.

This strategy limits potential losses and positions the portfolio to capitalize on opportunities across a broader spectrum of the market. Moreover, diversification is enhanced by incorporating non-commodity assets, such as equities or bonds, creating a more resilient investment profile against market uncertainties.

3. Supply Chain Risk Assessment: Identify Supply-Related Risks

Supply chain risk assessment is vital in recognizing and alleviating risks that could disrupt the availability and cost-efficiency of commodities. This strategy involves analyzing the entire supply chain — from raw material extraction to the final delivery — to pinpoint vulnerabilities, such as dependency on limited suppliers or logistics challenges.

For instance, a trader might assess the impact of potential strikes, natural disasters, or political instability in key supplier countries. Understanding these risks allows traders to develop contingency plans, such as securing alternative supply routes or holding safety stock. Effective supply chain management maintains steady commodity availability, reducing the likelihood of sudden price spikes due to supply shortages.

4. Market Trend Analysis: Anticipate Price Movements

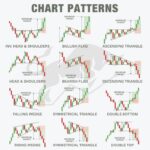

Market trend analysis is necessary for anticipating commodity price movements and making informed trading decisions. This involves examining historical price data and market behavior to identify patterns or trends that may indicate future price directions. Traders use analytical tools, including moving averages and stochastic indicators, to detect market momentum and potential reversals.

Additionally, understanding macroeconomic indicators, such as inflation rates, employment data, and GDP growth, can provide insights into broader market conditions that affect commodity prices.

5. Scenario Analysis: Stress Test Your Commodity Portfolio

Scenario analysis is a powerful technique for stress-testing a commodity portfolio against various hypothetical events to gauge potential impacts on investment performance. This approach involves creating diverse scenarios based on possible future events, such as significant economic downturns or extreme weather conditions, to understand how these could affect commodity prices and market dynamics.

By simulating different market conditions, traders can assess their portfolio strength, identify vulnerabilities, adjust strategies, enhance risk controls, and better prepare for adverse market scenarios. This proactive risk assessment contributes to a more resilient investment strategy capable of withstanding unexpected market shifts.

6. Financial Market Instruments: Protect Against Price Fluctuations

Utilizing financial market instruments, such as exchange-traded funds (ETFs), mutual funds, and commodity-linked bonds, can provide traders with additional protection against price fluctuations in the commodity markets. For example, ETFs offer a diverse array of commodities through a single transaction, which can dilute the price volatility risk in any single commodity.

Mutual funds that invest in commodity-related stocks, such as mining companies or agricultural businesses, allow traders to gain indirect exposure to commodity prices with potentially lower volatility. Commodity-linked bonds, with returns tied to the performance of a commodity index, offer another avenue to hedge against commodity price risk while potentially earning higher yields.

Make Informed Trading Decisions With Above the Green Line

Successful commodity trading requires access to expert analysis, robust tools, and comprehensive market insights. At Above the Green Line, we will equip you with the necessary resources to make informed decisions that align with your financial goals and risk management strategies.

Our proprietary methodologies and analytical tools are designed to guide you through the intricacies of commodity markets, helping you to optimize your trading strategies effectively. Visit our detailed resource page to deepen your understanding of commodity trading and enhance your trading acumen.

[…] financial tools help us lock in prices and protect against adverse market movements. They provide flexibility and […]