By ATGL

Updated December 24, 2024

Stock signals, also known as trading signals, are indicators or alerts that suggest potential buying and/or selling opportunities in the stock market. Stock signals or trade alerts can be generated through various methods, including technical analysis, fundamental analysis or algorithmic trading strategies.

Why Are Stock Signals Key to Growing Your Wealth?

Stock signals are key to growing your wealth because they help you make informed decisions about when to buy and sell stocks. By analyzing technical indicators, such as moving averages, relative strength index, and stochastic oscillators, investors can identify potential investment opportunities in the stock market while gaining a comprehensive understanding of the market conditions.

Some key reasons why stock signals are considered key to growing wealth include:

- Informed Decision-Making – Stock signals provide investors with valuable information and insights into market trends, price movements, and potential opportunities. Receiving timely signals, investors can better and more informed decisions about buying and selling stocks.

- Risk Management – Risk management via stock signals can help investors with identifying resistance levels and possible exit points or stop-loss levels. Knowing when to cut losses or take profits is crucial for preserving capital and avoiding significant financial setbacks.

- Market Timing – Successful investing often involves good market timing. Stock signals can help investors identify favorable entry points, allowing them to buy stocks at lower prices and potentially benefit from future price appreciation.

- Access to Professional Insights – Some investors may not have the time, expertise, or resources to conduct in-depth market analysis. Stock signals provided by professional traders, analysts or trading platforms can offer access to expert insights, helping investors make more informed decisions.

- Diversification – Stock signals can be valuable for diversifying a portfolio. By receiving signals for different stocks or sectors, investors can spread their investments across various assets, reducing the risk associated with concentration in a single investment.

- Automation and Efficiency – Automated trading systems use stock signals to execute trades based on predefined criteria. This can be particularly useful for investors who want to implement a disciplined and systematic approach to their trading, reducing the impact of emotions on decision-making.

It’s important to note that while stock signals can be valuable tools, they are not foolproof, and investing always involves risks.

6 Trading Strategies That Use Stock Signals for Wealth Growth

Trading strategies that use stock signals for growing wealth are a popular approach for investors to identify potential investment opportunities in the stock market. Strategies frequently use technical indicators or trading algorithms in an objective manner to determine buy and sell indicators also commonly referred to as entry, exit points.

Itemized below are six trading strategies that use stock signals for growing wealth.

1. Trend Following Strategy

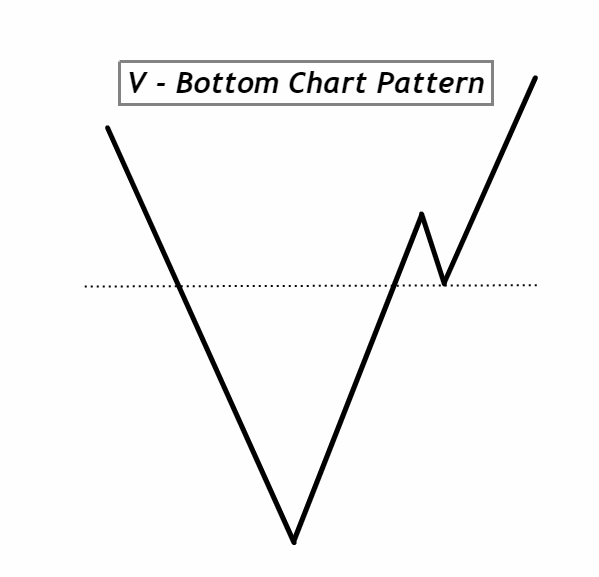

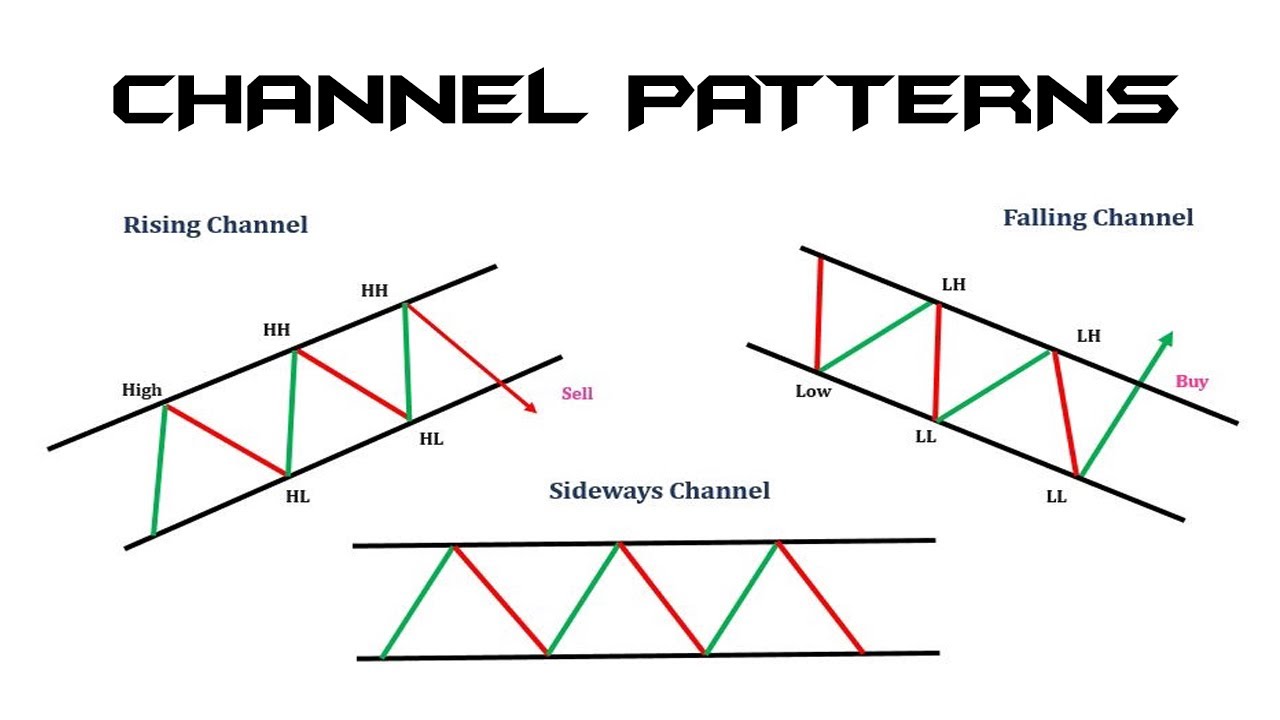

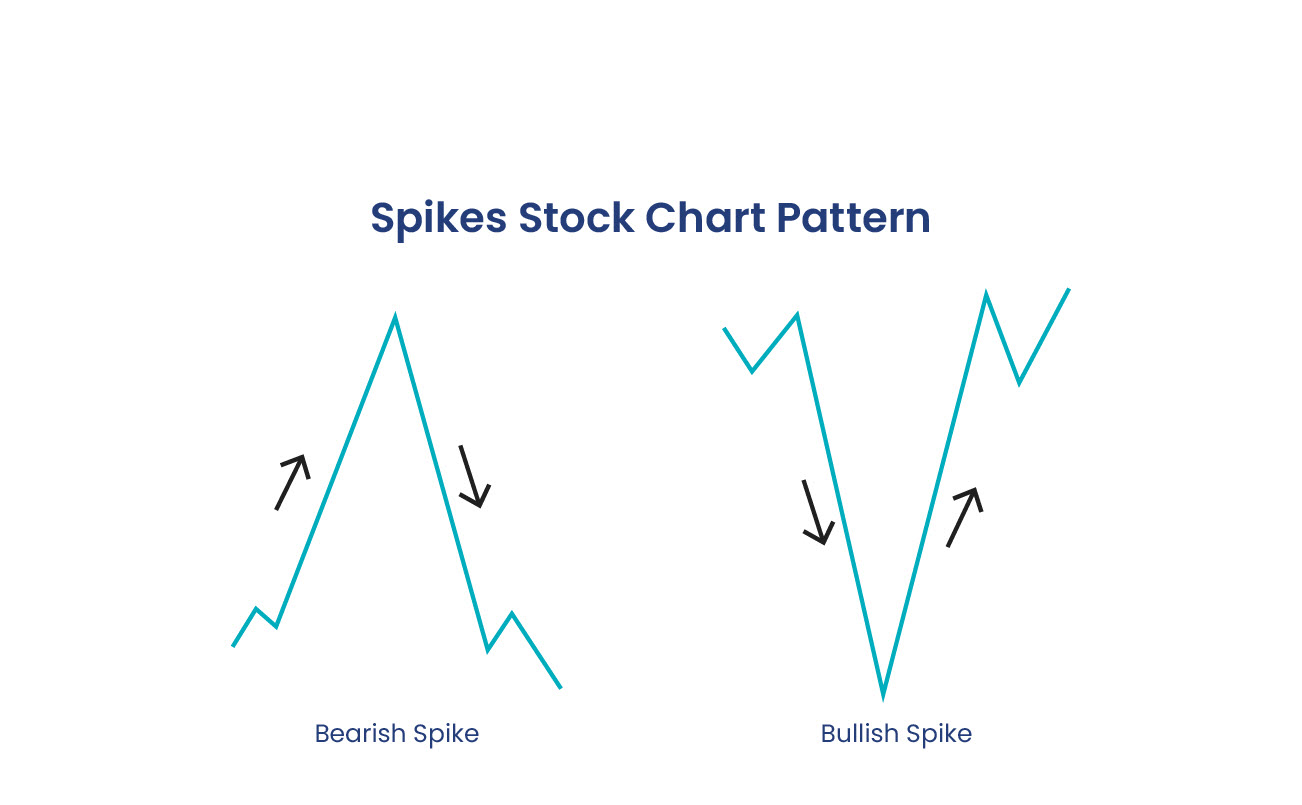

This strategy involves identifying and following the prevailing market trend. Traders that employ Trend-following strategies believe that stocks tend to move in trends, and by riding these trends, they can capitalize on potential price movements.

Technical indicators that are commonly used as signals in trend-following strategies include moving averages. For example, market signals might be generated when a short-term moving average crosses a long-term moving average, indicating a potential uptrend. A Golden Cross (short-term crossing above long-term) indicate a bullish trend while a Death Cross (short-term crossing below a long-term) indicates a bearish trend.

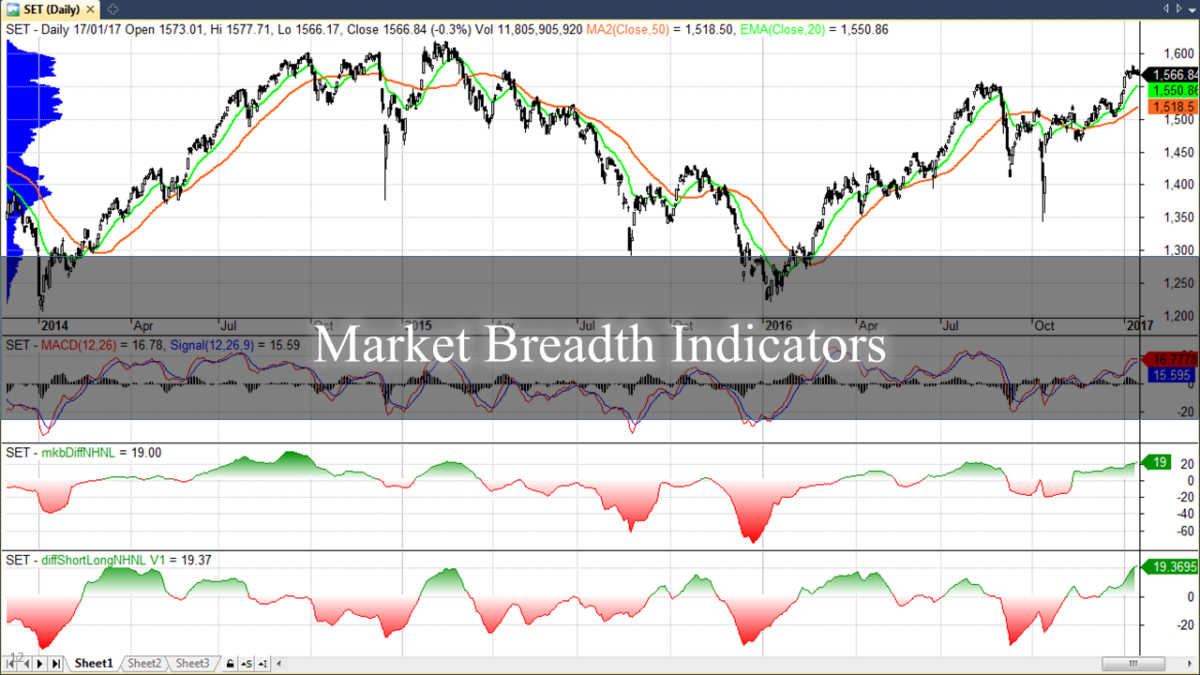

Traders use technical indicators like the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI) to confirm the strength of the trend and make better informed buy and sell decisions.

2. Value and Momentum Investing: Find Stocks with Potential

Value and Momentum investing are two distinct but complementary investment strategies. Combining these approaches can offer a well-rounded approach to finding stocks with potential for long-term growth. Below is a guide on how to use both investing principles.

Momentum Investing:

Momentum traders believe that stocks that have been performing well in the recent past are more likely to continue performing well in the immediate future. Momentum trading strategy aims to capitalize on existing market trends and momentum.

Momentum signals can be generated by examining price trends, trading volumes, or a combination of both. For instance, a stock that has experienced a significant stock price increase on high trading volume may generate a momentum buy signal.

Traders that use Momentum trading strategy may use technical indicators like Relative Strength Index (RSI) and/or the Moving Average Convergence Divergence (MACD) to confirm momentum to make entry or exit decisions.

Value Investing:

Value investing is an investment strategy that involves identifying undervalued stocks and investing in them with the expectation that their intrinsic value will be recognized by the market over time. Identifying undervalued stocks is a fundamental aspect of value investing.

Its important to note that while stock signals can complement value investing, they should not replace a thorough fundamental analysis. The integration of stock signals is most effective when combined with a solid understanding of a company’s financials.

Combining Momentum and Value Investing:

By combining value and momentum investing strategies, one can create a well-balanced strategy that takes advantage of both the inherit stability of value stocks and the potential for strong returns offered by momentum stocks.

3. Contrariant Trading Strategy

Contrarian investors take a counterintuitive approach to trading by going against the prevailing market sentiment. Contrarians believe the market often overreacts to news or events, leading to mispriced securities that can be exploited for profit.

Contrarian signals can be triggered by extreme movements in sentiment indicators, such as high levels of pessimism or optimism among investors. For example, a high level of pessimism might be a contrarian buy signal.

Traders that employ contrarian trading strategies will use sentiment indicators, such as the Put/Call ratio or the Volatility Index (VIX) to gauge market sentiment. They will enter trades when sentiment reaches an extreme, betting on a potential reversal.

4. Financial Leverage: Generate Returns on Risk Capital

Financial leverage is an investment strategy that involves using borrowed money to increase the potential return of an investments. By using leverage, investors can multiply their buying power in the market and potentially increase their returns.

Margin is one form of leverage that allows investors to increase their buying power and therefore potentially increase their returns. Margin accounts also allow investors to sell securities short.

However, it’s important to note that leverage can also amplify the potential downside risk in case the investment does not pan out. Misuse of leverage can have serious consequences, as was illustrated in 2008 Global Financial crisis.

5. Options Trading: Make Informed Trading Decisions

Option trading is another popular way to leverage stock signals for growing wealth. Option trading, also referred to as stock options, are financial instruments that give investors the right, but not the obligation, to buy or sell a specific amount of a stock at a predetermined stock price, known as the strike price, within a specified time frame.

While options offer leverage, they can also lead to rapid losses if the market moves against the investor. Implement risk management strategies, such as setting stop-loss orders or using protective options strategies.

6. Swing Trading

Swing Trading strategy involves holding a stock for a short period of time, typically a few days to a few weeks, and aims to profit from an anticipated price movement. Swing traders use technical analysis to identify stocks with short-term price momentum and then enter and exit positions based on signals generated by technical indicators.

Find Investment Opportunities by Tracking Technical Indicators

Tracking technical indicators is a common approach for identifying potential investment opportunities in the stock market because it helps investors to analyze the past and anticipate future price trends and patterns.

Technical indicators are mathematically based tools that traders and investors use to analyze the past and anticipate future price trends and patterns. Indicators, such as moving averages and Bollinger Bands, are used to help interpret price moves. The goal when using technical indicators is to identify trading opportunities or price actions for a specific period of time.

Strategies frequently use technical indicators in an objective manner to determine entry, exit, and/or trade management rules. A strategy specifies the exact conditions under which traders are established—called setups—as well as when positions are adjusted and closed. Strategies typically include the detailed use of indicators (often multiple indicators) to establish instances where the trading activity will occur.

For those interested in learning more about technical indicators and how to leverage stock signals for financial growth, we invite you to explore Above The Greenline’s guide on Investment strategy. This comprehensive resource provides a detailed overview of investment strategies, including how they work, the benefits of leverage, stock selection criteria, and more. Join Above the Green Line and learn more.