Seeking Alpha Review

Review of Seeking Alpha: A Comprehensive Look.

Seeking Alpha has become one of the most popular destinations for investors looking to gain insights, share ideas, and stay ahead in the dynamic world of investing. With its mix of user-generated content, professional analysis, and innovative tools, the platform appeals to both retail and institutional investors. Let’s take a closer look at what Seeking Alpha offers and how it stacks up for those looking to sharpen their investment edge.

What Is Seeking Alpha?

Seeking Alpha is an online community-driven platform for investment research and financial market analysis. Since its launch in 2004, the site has grown into a leading resource for actionable insights, with contributors ranging from professional analysts to everyday investors sharing their strategies and market outlooks.

The platform stands out by combining crowd-sourced analysis with in-depth data tools, making it valuable for investors seeking diverse perspectives and comprehensive market intelligence.

Key Features

- User-Generated Content

- Thousands of articles are published monthly, covering stocks, ETFs, mutual funds, and more.

- Contributors range from amateurs to seasoned analysts, offering a wide variety of viewpoints.

- Articles often include detailed fundamental and technical analysis, giving readers actionable ideas.

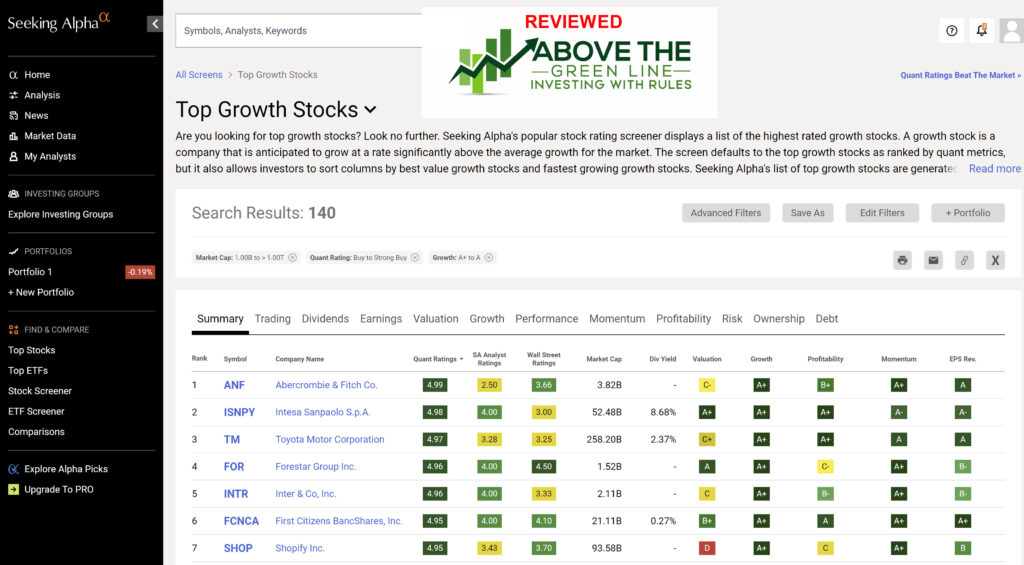

- Stock Ratings and Data

- Each stock features ratings for Value, Growth, Profitability, Momentum, and EPS Revisions.

- Quantitative ratings (based on algorithms) complement qualitative insights provided by contributors.

- Earnings and Dividends Coverage

- In-depth earnings call transcripts, dividend scores, and payout projections help investors monitor company performance.

- Alerts for upcoming earnings reports and dividend announcements keep users informed.

- Premium Subscription (Seeking Alpha Premium)

- Ad-free experience with exclusive access to deeper analysis and proprietary tools like “Quant Ratings” and stock screener filters.

- Premium subscribers can access thousands of stock ideas and build watchlists with advanced data insights.

- Community Engagement

- The comment sections on articles encourage debate and discussions, creating a dynamic learning environment.

- Investors can ask questions, challenge ideas, and share their own knowledge.

Strengths of Seeking Alpha

- Diverse Perspectives: The variety of contributors ensures that readers get a mix of bullish, bearish, and neutral takes on any given asset.

- Actionable Insights: Articles often provide specific buy, hold, or sell recommendations supported by data and analysis.

- Comprehensive Tools: From earnings call transcripts to dividend calculators, Seeking Alpha goes beyond articles to offer actionable tools.

- Community Interaction: The engaged user base fosters a collaborative learning experience.

Areas for Improvement

- Quality Variability: Since the platform relies on user-generated content, the quality and accuracy of analysis can vary widely. Premium content often provides more consistent insights.

- Bias: Some contributors may present overly optimistic or pessimistic views, so cross-referencing information is essential.

- Learning Curve: New users may find the abundance of data and articles overwhelming without clear guidance on how to navigate.

Who Is Seeking Alpha Best For?

- Retail Investors: Ideal for those looking to expand their knowledge, discover new investment ideas, and stay updated on market trends.

- Dividend Enthusiasts: The platform’s focus on dividend data and analysis makes it great for income-focused investors.

- DIY Investors: If you prefer managing your own portfolio, Seeking Alpha offers plenty of tools to support your research.

- Active Traders: With real-time updates and data-driven insights, the platform is also useful for short-term traders.

Final Thoughts: Seeking Alpha Review

Seeking Alpha offers a wealth of information and tools to investors of all levels, but it’s most valuable to those who are willing to spend time discerning high-quality insights from the platform’s vast library of content. Its Premium subscription provides added value for serious investors, though the free version remains robust enough for many users.

Whether you’re a novice looking to learn or a seasoned trader seeking new ideas, Seeking Alpha is worth exploring as part of your investment toolkit. However, as with any resource, it’s best used in conjunction with your own research and due diligence. Summarizing, Seeking Alpha provides the ability to:

- FIND INVESTING IDEAS

- Notable calls

- Screen for stocks or REITs with the best ratings and factor grades

- Lists of top stocks

- RESEARCH STOCKS

- MANAGE YOUR PORTFOLIO