By ATGL

Updated February 23, 2025

Investors and economists alike often rely on the yield curve as a vital indicator of economic health and future financial trends. Understanding this critical tool provides insight into market expectations and potential shifts in the economy.

The yield curve represents the relationship between interest rates on debt securities and their time to maturity, essentially mapping the costs of borrowing money over different timeframes. Its shape can vary, each configuration conveying important information about market sentiments, future inflation, and the overall strength of the economy.

In this article, we’ll delve into the nuances of what a yield curve is and how various shapes can predict economic changes. We’ll explore its implications for investors, its significance in signaling potential recessions, and its role in influencing business cycles. Join us as we unravel the layers of this essential financial concept and learn to navigate the stock market effectively.

What is the Yield Curve?

A yield curve is a graphic representation that shows the interest rates or yields of bonds with equal credit quality but varying maturities. It is a valuable tool for investors to gauge future interest rates and economic outlooks. There are three main shapes of yield curves:

- Normal Upward-Sloping: This indicates economic expansion and upward trending interest rates.

- Inverted Downward-Sloping: An indicator of possible recession.

- Flat: Suggests uncertainty in economic conditions.

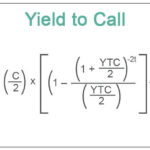

Yield to Call:

Yield to call is a calculation used by investors to determine the potential return on a callable bond if the issuer chooses to redeem it before its maturity date, which may impact the overall profitability of the bond investment.

Yield to Worst:

Yield to Worst is the lowest yield an investor can receive if the bond is called or matures early, helping assess the worst-case scenario for a bond investment.

Bond yield represents the return an investor earns from holding a bond, and it is closely tied to the yield curve, as the curve maps out the relationship between bond yields and their time to maturity. Bond yield vs interest rate highlights how bond yields are influenced by interest rates, with the shape of the yield curve reflecting expectations about future interest rate movements and overall economic conditions.

The U.S. Department of the Treasury updates these yield curve rates daily, reflecting current market conditions. Understanding the yield curve helps investors make informed decisions, especially regarding short-term vs. long-term bonds. This graph can signal shifts in financial markets and economic cycles, helping to forecast trends in long-term rates, bond yields, and short-term interest rates. By interpreting the shapes of the yield curve, investors gain insights into impending economic expansions or downturns, making it a critical component in assessing bond market dynamics. Here is a brief representation:

|

Shape |

Economic Implication |

|---|---|

|

Normal |

Economic Growth |

|

Inverted |

Potential Recession |

|

Flat |

Economic Uncertainty |

Different Shapes of Yield Curves

Yield curves come in various shapes, each signaling different economic conditions:

- Normal Yield Curve: An upward slope highlights economic growth. Longer-term bonds have higher yields than short-term bonds.

- Inverted Yield Curve: This downward slope suggests potential economic downturns. Short-term yields exceed long-term yields.

- Flat Yield Curve: Here, yields for short and long-term bonds are similar. This often happens in the transition between normal and inverted curves.

- Steep Yield Curve: Yields rise sharply with maturity. It generally indicates upcoming economic expansion.

- Humped Yield Curve: Rarely, medium-term yields surpass both short- and long-term yields, pointing to sluggish growth.

These shapes provide critical insights into economic cycles, helping bond investors make informed decisions. Recognizing these curves and their signals allows for better navigation of market conditions.

Yield Curve Summary Table

|

Yield Curve Type |

Indicative Economic Condition |

|---|---|

|

Normal |

Economic growth |

|

Inverted |

Potential economic downturn |

|

Flat |

Transition (normal to inverted) |

|

Steep |

Imminent economic expansion |

|

Humped |

Sluggish economic growth |

Economic Implications of Yield Curve Shapes

The yield curve is a crucial economic indicator that illustrates the relationship between bond yields and their time to maturity. It comes in several shapes, each carrying unique economic implications.

- Normal Yield Curve: This upward-sloping curve suggests a healthy economy where long-term bonds offer higher yields. It signals business growth and stable inflation.

- Inverted Yield Curve: Here, short-term yields surpass long-term ones, hinting at potential economic decline. It predicts recessions and low inflation, as investors seek long-term security.

- Flat Yield Curve: When short- and long-term yields are nearly equal, uncertainty looms. This shape marks a transition phase, signaling shifts between economic expansion and downturn.

The table below summarizes these points:

|

Yield Curve Shape |

Economic Implication |

|---|---|

|

Normal |

Economic growth; stable inflation |

|

Inverted |

Potential downturn; low inflation expectation |

|

Flat |

Economic uncertainty; transition phase |

The slope of the yield curve also reflects anticipated interest rate trends, with steeper slopes suggesting future rate hikes. Thus, understanding yield curve shapes helps investors and policymakers gauge market conditions and forecast economic cycles.

The Yield Curve as a Recession Indicator

The yield curve is a critical tool in forecasting economic conditions and is especially known for predicting recessions. An inverted yield curve occurs when long-term bond yields fall below short-term bond yields. This is viewed as a strong indicator of a forthcoming economic downturn.

Historically, every recession in the United States since 1970 has been preceded by an inverted yield curve. This highlights its effectiveness in signaling economic contractions. Research by Estrella and Mishkin supports this, showing that the slope of the yield curve can indicate recession probabilities. A negative slope usually reflects high chances of a recession due to decreased economic optimism.

The shape of the yield curve—whether normal, flat, or inverted—often indicates shifts in economic landscapes. A normal yield curve suggests economic expansion, while a flat or inverted curve may warn of weak future performance and potential declines in interest rates. Therefore, tracking the yield curve is essential for investors and policymakers to anticipate changes and guide their strategies in financial markets.

How the Yield Curve Affects Business Cycles

The yield curve serves as a vital indicator of economic cycles. An inverted yield curve, where short-term yields surpass long-term yields, historically signals an upcoming recession. Since 1970, the U.S. has seen each recession preceded by this economic warning.

This curve impacts the business cycle through banks’ lending practices. When the yield curve is inverted, banks’ profits decrease, leading them to lend less. This reduction in lending tightens credit conditions, slowing economic growth.

Economists have argued that the risk of recession increases with an inverted yield curve. However, today’s lower interest rates and term premiums add complexity to this prediction.

Here’s how the yield curve influences business cycles:

- Inverted Yield Curve: Predicts economic downturns.

- Flat Yield Curve: Suggests uncertainty in economic conditions.

- Normal Yield Curve: Indicates stable economic expansion.

In conclusion, yield curves, particularly when flat or inverted, are key signals for potential shifts in the economic landscape. Understanding these curves helps predict changes in business cycles, benefiting investors and policymakers in their decision-making.

The Role of the Fed Funds Rate in Yield Curve Shape

The Fed funds rate is crucial in shaping the yield curve. This rate influences short-term interest rates on the left side of the yield curve. It’s directly impacted by the Federal Reserve’s monetary policy decisions. When the Fed raises the funds target rate, both short-term and long-term Treasury yields typically increase.

Here’s why:

- Short-term Bonds: Yields on these bonds reflect market expectations for the Fed’s next moves on interest rates.

- Long-term Bonds: These yields can rise with short-term rates due to expectations of future economic growth and inflation.

However, when the Fed cuts its key short-term rate, yields on shorter-term Treasuries generally decline. This often happens as the market anticipates further rate cuts.

The yield curve’s shape can indicate economic conditions. An inverted yield curve, where short-term yields exceed long-term yields, often signals a recession. This inversion relates to the Fed’s rate adjustments. This makes the Fed funds rate a vital tool for assessing economic cycles.

Practical Applications for Investors

The yield curve is an essential tool for bond investors. It helps compare different fixed income securities and assess relative risk. Investors often use the U.S. Treasury yield curve as a benchmark since it is considered risk-free.

Here’s how investors can apply the yield curve:

- Predicting Economic Conditions: A normal yield curve suggests steady economic growth. In contrast, an inverted yield curve might indicate a looming recession, prompting a shift to defensive assets.

- Adjusting Portfolios: If a steep yield curve indicates future inflation, investors may avoid long-term bonds, as their yields may not keep up with rising prices.

- Gauging Risk and Return: Monitoring yield spreads helps assess credit risk and economic conditions. Adjusting fixed-income portfolios accordingly can optimize returns and balance risk.

- Interest Rate Forecasting: Yield trend analysis offers insights into market sentiment. It can help forecast interest rate changes, helping investors fine-tune their investment strategies for optimal risk-return balance.

Using the yield curve effectively can guide investment decisions and portfolio adjustments, aligning them with economic forecasts and market conditions.

Yield Curve Chart

A yield curve chart is a graph that shows the relationship between the yields to maturity and the time to maturity of various bonds in the same asset class and credit quality. It typically slopes upwards, indicating that longer-term bonds offer higher yields than short-term bonds, due to the term structure of interest rates.

Here’s a quick guide to the elements of a yield curve chart:

- Vertical Axis: Represents bond yields or interest rates.

- Horizontal Axis: Represents time to maturity.

There are several types of yield curves:

- Normal Yield Curve: Upward sloping, showing higher long-term rates.

- Inverted Yield Curve: Downward sloping, where short-term rates are higher than long-term rates, often indicating a looming recession.

- Flat Yield Curve: Little difference between short-term and long-term yields, suggesting economic uncertainty.

Yield curves are essential for investors and policymakers. They help assess investment risks and set borrowing rates, including mortgages and loans. As leading economic indicators, yield curve shapes can reflect business cycles and economic conditions.

Understand The Yield Curve’s Significance to Succeed on the Stock Market

Understanding the yield curve is key to succeeding in the stock market. The yield curve is a visual representation of the yields for Treasuries of different maturities. Its shape and slope offer insight into investor sentiment about economic conditions.

- Normal Yield Curve: An upward-sloping curve indicates that long-term Treasury securities provide higher yields than short-term ones. This suggests positive economic expectations.

- Inverted Yield Curve: When short-term yields surpass long-term yields, it often predicts an economic downturn. This can lead to negative market sentiment.

- Steep Yield Curve: This shape indicates rapidly rising yields and suggests imminent economic expansion. Stronger market prospects are often on the horizon.

The yield curve serves as a crucial indicator of investor expectations regarding the economy and interest rates. By understanding these signals, investors can better assess market conditions and time their investment decisions. Join Above the Green Line and learn more about the yield curve and interest rates.