Money Wave

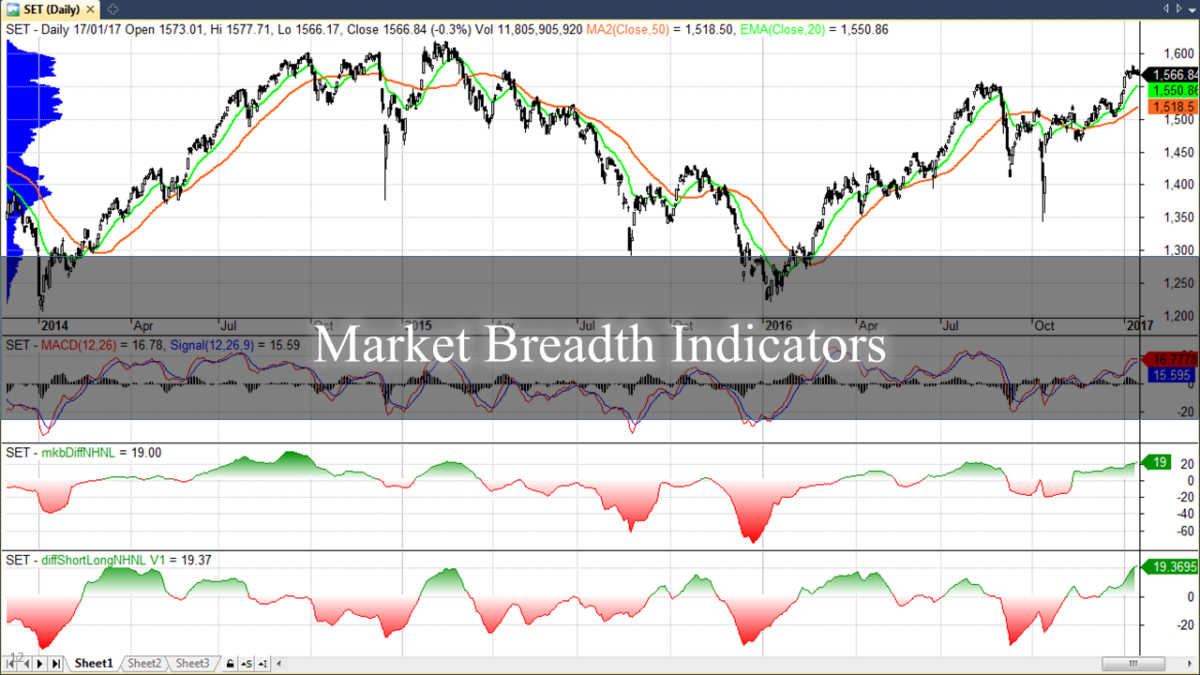

The Money Wave is a technical indicator used by traders and investors to identify profitable buying and selling opportunities in the stock market. It combines elements of momentum and price action, helping traders gauge the strength of a trend and spot ideal points to enter or exit a trade. The Money Wave is often represented by oscillators or indicators that fluctuate between overbought and oversold conditions, such as the Relative Strength Index (RSI) or Stochastic Oscillator. These tools help traders understand when a security is either undervalued or overvalued based on its recent price movements, offering insight into potential market reversals.

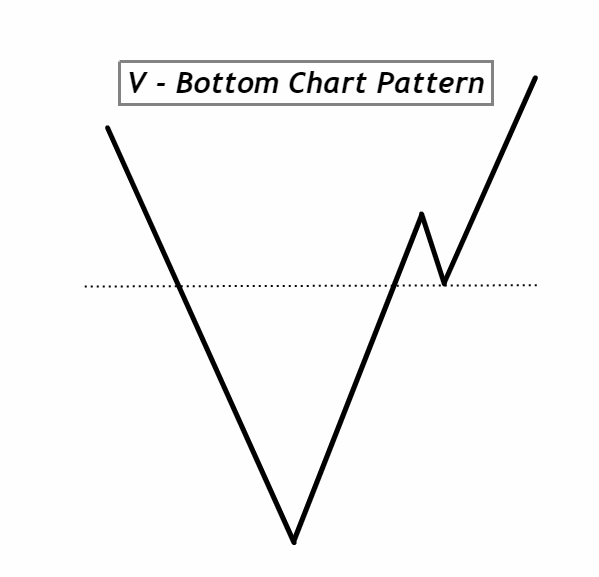

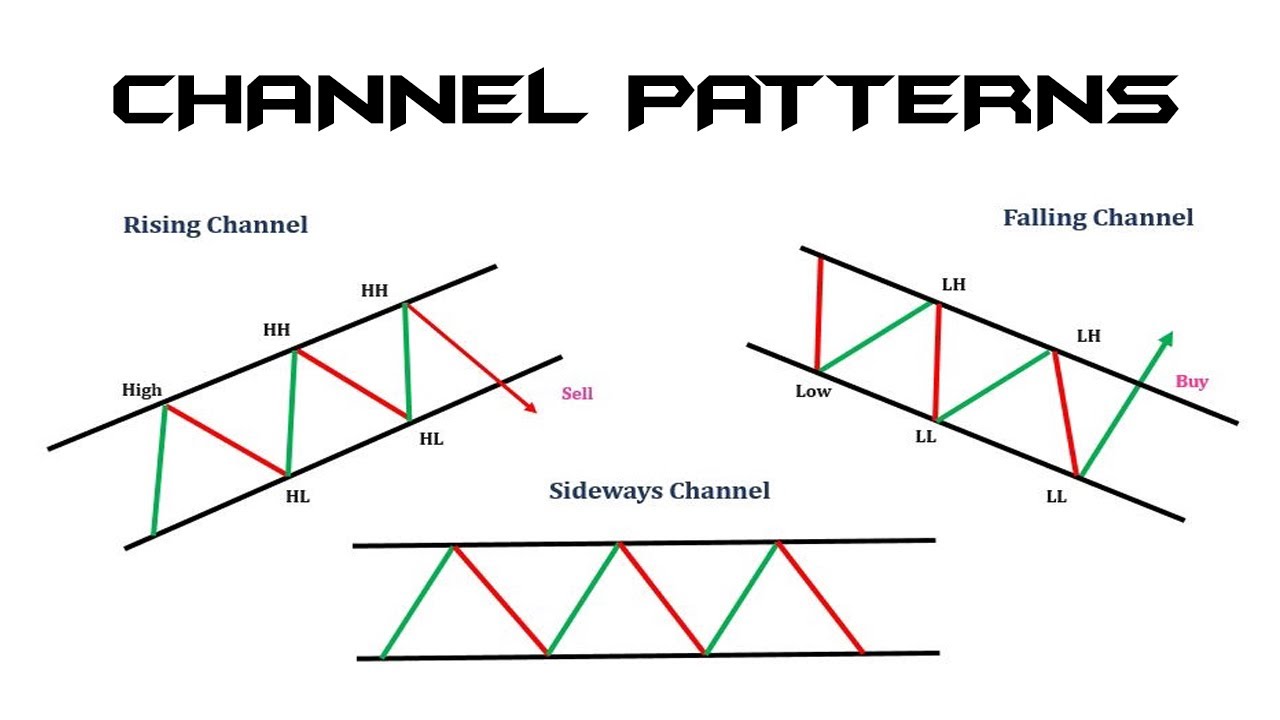

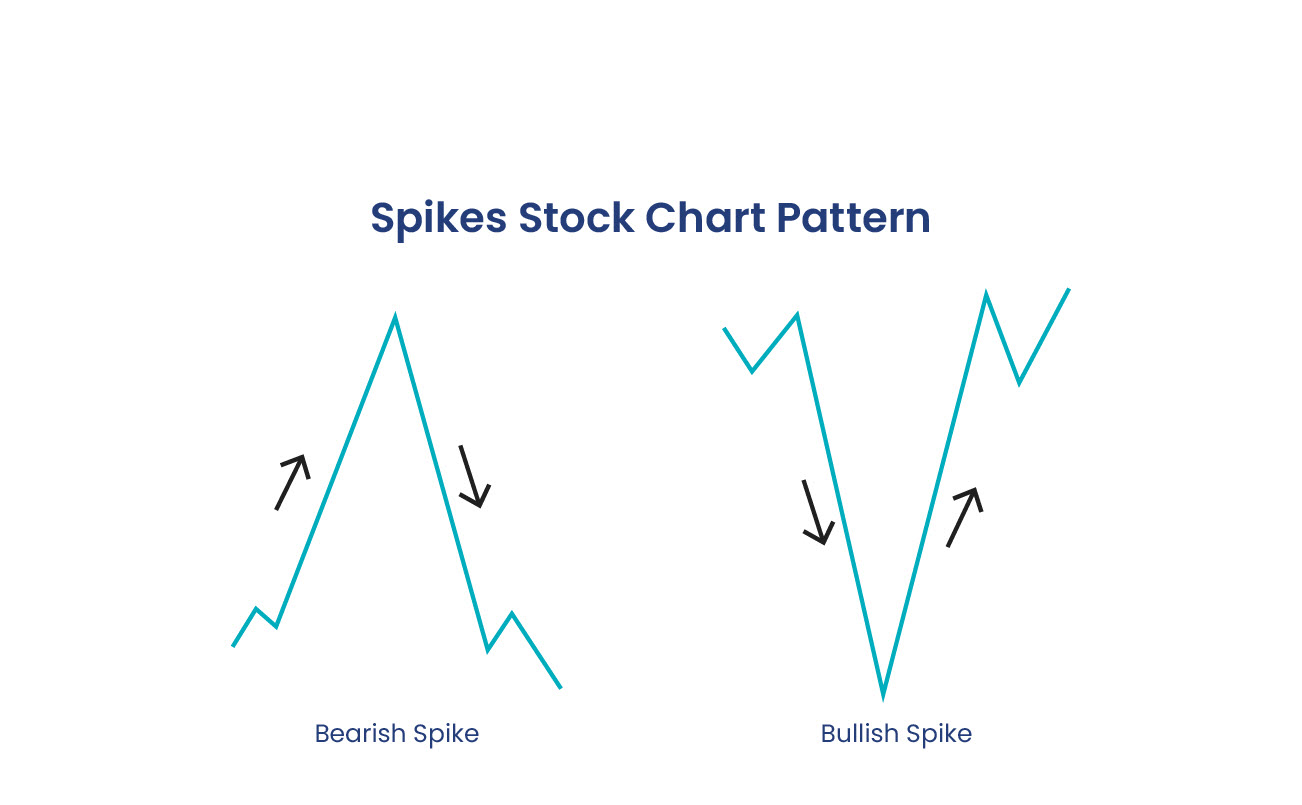

In investing, the Money Wave can be used to time entries and exits by focusing on the market’s natural cycles of highs and lows. When a stock or asset is in the “oversold” zone, it indicates that selling pressure has peaked, and the price is likely to rebound, creating a buying opportunity. Conversely, when a stock reaches the “overbought” zone, it suggests that buying momentum has reached its limit, and the asset may soon correct or decline, signaling a selling opportunity. The key to using the Money Wave effectively is to combine it with other technical indicators and trend analysis tools to confirm the signals.

To use the Money Wave in investing, traders often set thresholds on oscillators like the RSI or Stochastic Oscillator, typically using levels like 70-80 (overbought) and 20-30 (oversold). When these indicators show the price entering the overbought zone, traders might look to sell or take profits. When the price enters the oversold zone, they could prepare to buy. However, it’s essential not to rely on the Money Wave in isolation. It’s best used in conjunction with other forms of analysis, such as trendlines, volume data, or support and resistance levels, to confirm whether the signal aligns with broader market conditions.

The Stochastic Oscillator mentioned above is a popular technical indicator used to identify potential overbought or oversold conditions in the market. It compares a security’s closing price to its price range over a certain period, helping traders assess momentum. There are two main types of stochastic oscillators: Fast Stochastic and Slow Stochastic. They differ in terms of their sensitivity to price movements, and traders use them for different types of strategies, depending on their time horizon and market conditions.

In addition to using the Money Wave to determine if overbought and oversold, traders also use the Money Wave to avoid “false signals,” where an asset temporarily shows overbought or oversold conditions but doesn’t immediately reverse. By pairing the Money Wave with a strong understanding of market trends and combining it with fundamental analysis or other technical tools, investors can better predict market movements and increase the accuracy of their trades. The Money Wave strategy is popular among short-term traders, but it can also be adapted for longer-term investing by adjusting the timeframes on the technical indicators.