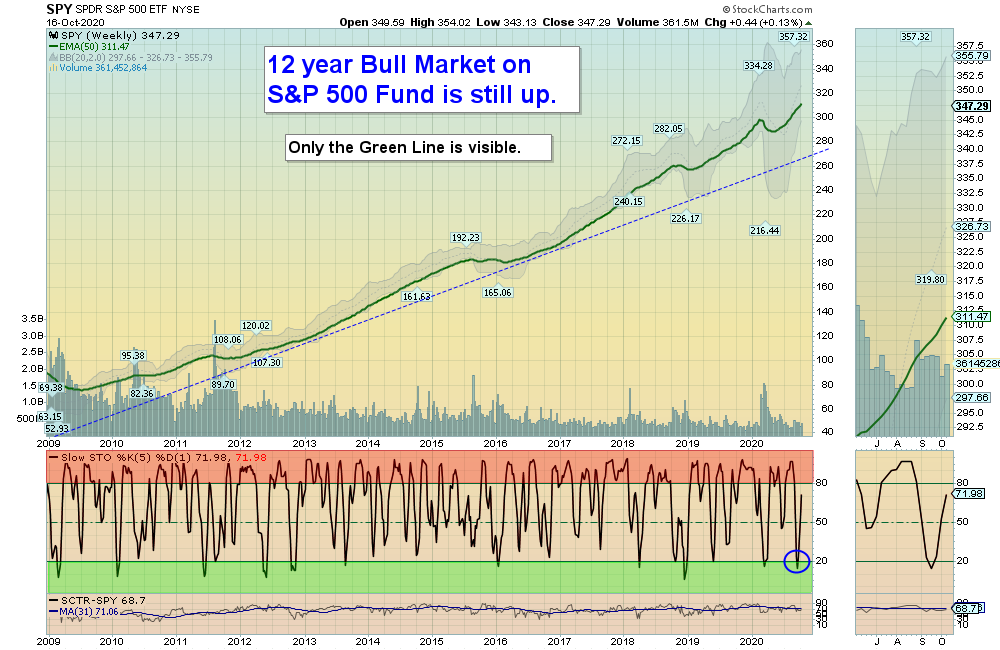

10/18/2020 Markets were mixed for the week after the Indices went back up near the September Highs. The FAANMG stocks woke up and most had big pops up, but no New Highs. Investors seem to be comfortable owning stocks as long as Interest Rates are so low.

You can see on the Chart above that there has been 2 Weekly Green Zone Buys on the S&P 500 this year. We have been able to have some nice Gains when Buying near the Green Zones and capturing Gains near the Red Zones. “Buy & Hold” Investors could be in for a Big Surprise when Interest Rates go back up.

We harvested more Gains this week:

MIK MICHAELS CO. +11.1%

NVDA NVIDIA CORP. +14.42%

ZS ZSCALER +18.18%

COUP COUPA SOFTWARE (Long Term) +25.5%

PENNY STOCK WATCH LIST has many Green Zones Buy Signals soon that are 50-80% off the recent Highs.

For the week the Dow was up 0.05%, the S&P 500 was up 0.13%, and the Nasdaq 100 was up 0.98%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was down 0.17% and is above the Green Line, indicating Economic Strength.

Bonds were up 0.81% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was up 0.60% for the week and is Below the Green Line.

Crude Oil was up 1.28% for the week at $41.12 and GOLD was down 1.03% at $1906.40.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are currently in 6 logged Current Positions, for the Short & Medium Term. There are 7 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (Most of the Leaders are back up in the Weekly Red Zones.)

Buy the Leading Investments that are down near the Weekly Green Zones.

ADT ADT INC. Buy above the Red Line around $9.05.

ALT ALTIMMUNE INC. Buy above $15.63 on High Volume.

FCEL FUELCELL ENERGY INC. Buy if it Closes above $3.42 on High Volume. All time High is $682.00.

VBIV VBI VACCINES INC. Buy when it Closes above the Red Line.

WATR WAITR HOLDINGS INC. Buy when it Closes above the Red Line.

______________________________________________________________________________________

Click for Current Positions

Click for Watch List

Click for Closed Positions

Dividend Growth Portfolio (we are now posting a Dividend Calendar for the entire portfolio to assist with planning purposes).

ETF Sector Rotation System – The System closed all 5 positions on Sep 30 and Bought SPY QQQ SLV EEM & EFA on Oct 1, 2020 (20% into each).

Long Term Strategy for IRAs & 401k Plans

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________

QUESTION: Stan writes ” Do you ever Sell Investments Short?”

ANSWER: Hi Stan, as long at the major Indices are in up-trends we will not Short, as most Followers don’t understand Selling Short. We will use Inverse Funds when they meet the Green Line Rules.