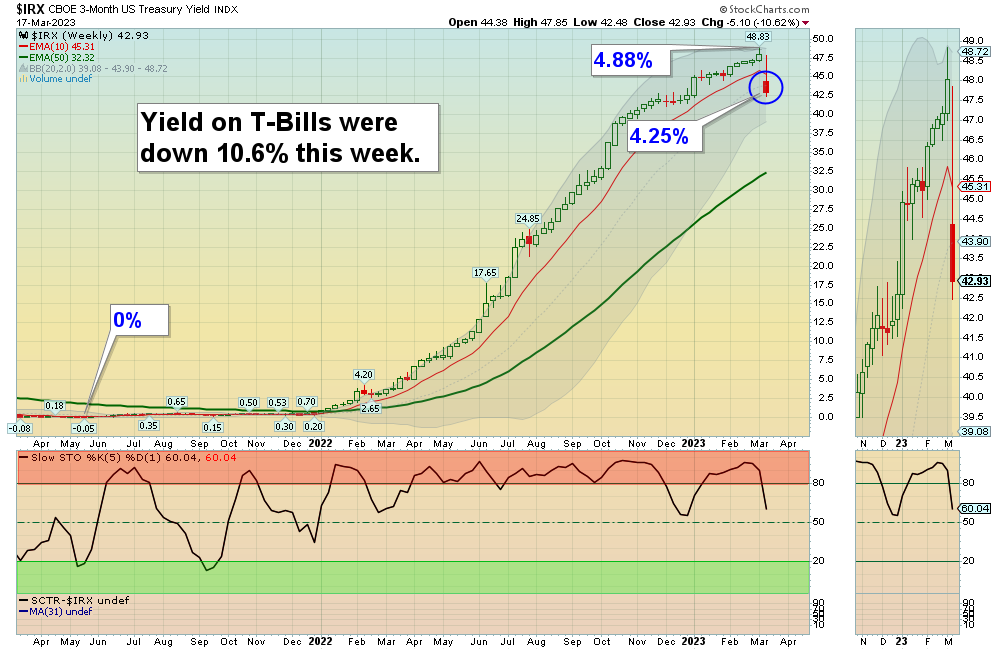

3/19/2023 Markets were mixed to higher for the week after 2 Bank failures created hope that the FED will only Tighten 1/4 point or less on short term Interest Rates on Wednesday. The Big Techs loved the falling short Term Rates and the NASDAQ 100 was up 5 % for the week.

Crude Oil dumped 12% and Commodities were down as the Economy has weakened. The FEAR was High now, and that is when we like to Buy. Investments that are still above the 50-day average after this week should pop up nicely after the FEAR Flushed is over by the Media. See Watch Lists.

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets. Follow the MONEY, not the MEDIA..

______________________________________________________________________________________________

For the week the Dow was down 0.12%, the S&P 500 was up 1.44% and the NASDAQ 100 was up 5.83%. Most of the major Indices have a Relative Strength above 80, so you should currently own the stronger Securities here.

The Inflation Index (CRB) was down 3.90% for the week and is Below the Green Line, indicating Economic Contraction.

Bonds were up 1.19% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was down 0.76% for the week and is Below the Green Line.

Crude Oil was down 12.72% for the week at $66.93 and GOLD was up 5.69% at $1973.50.

More action this week on the Day Trading Scrolling Charts. and Live Streaming.

DAY TRADING CHARTS FOR INDICES & LARGE CAPS.

We have not had many intra-day Trade Alert signals lately as the Volume has been too Low with the Buy Signals (FED is still tightening). These low Volume Buy Signals tend to pop up and quickly fade back down. We like to see High Volume on rallies. Please check our our Live Streaming during Market hours.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are in now in 8 logged Swing Trading Positions for the Short & Medium Term. There are 4 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

LONG TERM INVESTMENTS: (It is still hard to find many Long Term now because most normal Investments no longer have 80 Relative Strength required.)

Long Term Scrolling Charts (Real Time)

CHWY CHEWY INC. Buy above $52.88 with High Volume with a 3% Trailing Sell Stop Loss below it.

FLEX FLEX LTD. Wait for Weekly Money Wave Close > 20 with High Volume.

GERN GERON CORP. Bought on Mar 17 Weekly Buy Signal. Target $3.45. EXIT on Close below the Green Line.

GILD GILEON SCIENCES INC. Wait for Weekly Money Wave Close > 20 with High Volume.

SH INVERSE S&P 500 FUND Buy above $17.71 with High Volume with a 3% Trailing Sell Stop Loss below it.

TAL TAL EDUCATION GROUP Buy above $10.45 with High Volume with a 5% Trailing Sell Stop Loss below it.

TJX TJX COS. Wait for Weekly Money Wave Close > 20 with High Volume.

______________________________________________________________________________________________________

My Trading Dashboard

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List Mar 1, 2023

Dividend Growth Portfolio

Updated ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is Low (GREEN). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

________________________________________________________________________________

Related Post

– CHWY

[…] post Green Line Weekly Mar 19, 2023 appeared first on Above The Green […]