4/2/2023 Markets were sharply higher for the week as long term Interest Rates have been dropping. The massive FED Tightening has caused Inflation and the Economy to slow down. The Big Techs love the falling Interest Rates and the NASDAQ 100 was up another 3.2 % for the week, but is now over bought (see chart).,

Many are hoping that the FED has finished Tightening, and later the Economy will pick up speed. But historically the FED over Tightens and causes a slow down.

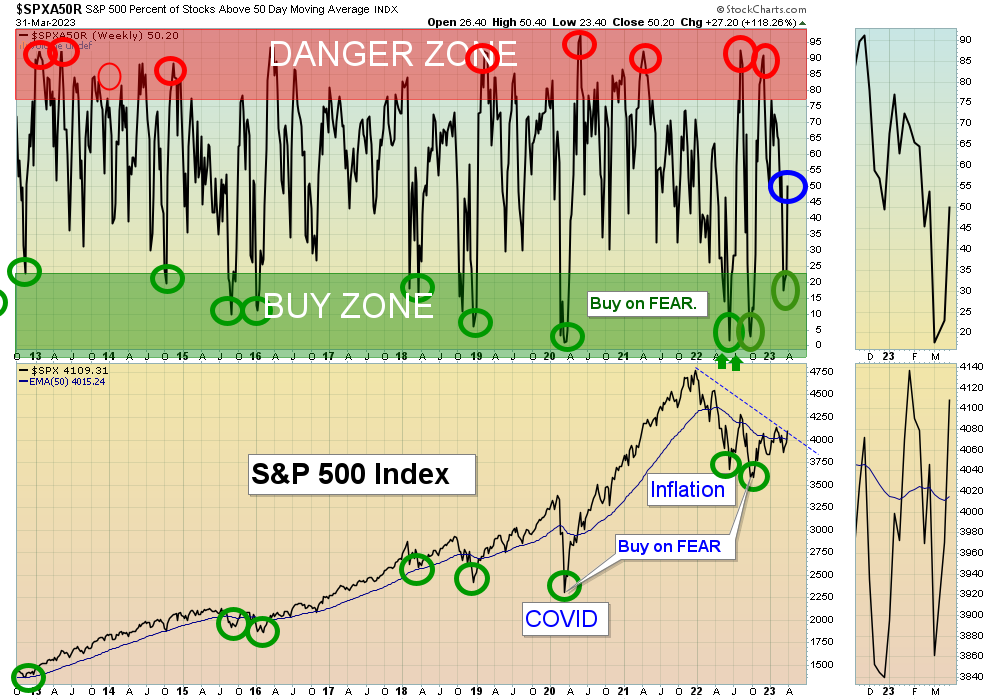

The Media created FEAR and Selling by the HERD over the bank failures, but quickly the HERD has forgotten that. Now the HERD thinks all is fixed, as the Media has stopped scaring investors. GREED and FOMO were back this week with almost panic Buying. Now the Markets are over bought again, so the Media should start scaring the HERD about Economic weakness soon.

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets. Follow the MONEY, not the MEDIA..

______________________________________________________________________________________________

For the week the Dow was up 3.20%, the S&P 500 was up 3.45% and the NASDAQ 100 was up 3.23%. Most of the major Indices have a Relative Strength below 80, so you should currently own the stronger Securities here.

The Inflation Index (CRB) was up 3.57% for the week and is Below the Green Line, indicating Economic Contraction.

Bonds were down 0.45% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was down 0.56% for the week and is Below the Green Line.

Crude Oil was up 9.25% for the week at $75.67 and GOLD was up 0.12% at $1986.20.

More action this week on the Day Trading Scrolling Charts. and Live Streaming.

DAY TRADING CHARTS FOR INDICES & LARGE CAPS.

We have now doing micro trades on our new Discord site (free).Please join for mobile notifications during the day. Other methods of notification have been too Slow. Also, please check our our Live Streaming during Market hours.

_____________________________________________________________________________________________

MONEY BUYS SOON:

We are in now in 7 logged Swing Trading Positions for the Short & Medium Term. There is 1 investment on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

LONG TERM INVESTMENTS:

Long Term Scrolling Charts (Real Time)

CAH CARDINAL HEALTH Moved up 8% this week on Money Wave Buy Signal, but Volume was not high.

CHWY CHEWY INC. Buy above $52.88 with High Volume with a 3% Trailing Sell Stop Loss below it.

FLEX FLEX LTD. Moved up 10% this week on Money Wave Buy Signal, but Volume was not high.

GILD GILEON SCIENCES INC. Moved up 3.7% this week on Money Wave Buy Signal, but Volume was not high.

SH INVERSE S&P 500 FUND Buy above $17.71 with High Volume with a 3% Trailing Sell Stop Loss below it.

TAL TAL EDUCATION GROUP Buy above $10.45 with High Volume with a 3% Trailing Sell Stop Loss below it.

TJX TJX COS. Moved up 4.7% this week on Money Wave Buy Signal, but Volume was not high.

XOM EXXON MOBIL CORP. Moved up 6% this week on Money Wave Buy Signal, but Volume was not high.

YPF YPF SOCIEDAD (ENERGY) Moved up 14% this week on Money Wave Buy Signal, with High Volume.

__________________________________________________________________________________________

My Trading Dashboard

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List Apr 1, 2023

Dividend Growth Portfolio

Updated ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is Medium (YELLOW). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

________________________________________________________________________________

4 Ways to Get your Daily Money Wave Email Alert:

-

- Emailed to your box between 3:45 – 3:50 pm EST.

- Website menu Commentary/Buy/Sell Signals

- Twitter mobile notifications are the fastest @AboveGreenLine (please set up “mobile notifications”)

- Text messages: Email us your Cell number & phone carrier.

Thank you,

ATGL

Related Post

– CAH

[…] post Green Line Weekly Apr 2, 2023 appeared first on Above The Green […]