When chaos looms in the financial markets, trading halts operate as a crucial pause button. These temporary stops in trading serve as safeguards to ensure fair and orderly market conditions when faced with unexpected events or extreme volatility. … [Read more...]

Understanding the VIX: How Volatility Index Affects Stocks

When stock market turbulence strikes, and investor emotions fluctuate like a roller coaster, market volatility becomes a pressing concern. Traders and analysts often turn to the VIX, a leading indicator, to gauge this volatility and guide their … [Read more...]

Understanding the Normal Yield Curve: What Is It and How It Works

A normal yield curve is a fundamental concept in fixed-income investing and economic analysis. It illustrates the relationship between bond yields and maturities, typically sloping upward. This upward trajectory indicates that long-term bonds offer … [Read more...]

Interest Rate Risk: Definition, Impact, and How To Mitigate It

Interest rate risk represents the potential for investment losses resulting from fluctuations in interest rates. This financial vulnerability affects various market participants, from individual investors to large financial institutions. … [Read more...]

What Is an Inverted Yield Curve and What Does It Tell Investors?

An inverted yield curve occurs when short-term interest rates exceed long-term rates, a rare phenomenon that has historically signaled economic downturns. Investors closely monitor yield curve inversions because they often precede recessions, … [Read more...]

What Does a Flat Yield Curve Mean? | Uses and Implications

The nuances of the yield curve can often reveal vital insights about economic trends. Understanding what a flat yield curve signifies is essential for investors and economists alike, as it reflects shifting perceptions of risk and return in the bond … [Read more...]

What Is a Yield Curve and How Do You Use It?

Investors and economists alike often rely on the yield curve as a vital indicator of economic health and future financial trends. Understanding this critical tool provides insight into market expectations and potential shifts in the economy. The … [Read more...]

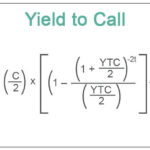

What Is Yield To Call? Formula + Calculations

When it comes to bond investing, understanding financial metrics can make a significant difference in your decisions. One essential concept is yield to call (YTC), a measure that helps investors evaluate the potential return on callable bonds if they … [Read more...]

Callable (or Redeemable) Bonds: Types and How They Work

Callable bonds, also known as redeemable bonds, represent fixed-income securities that grant issuers the right to repay the principal before the scheduled maturity date. These debt instruments play a significant role in corporate finance and … [Read more...]

Non-Callable Bond: Understanding What It Means and How It Work

Investors are always on the lookout for stable and predictable income sources, and non-callable bonds can provide just that. In a fluctuating financial market, understanding different investment options, especially bonds, is essential for making … [Read more...]