An option chain is a structured display of options data that reveals how traders are positioning around a specific security. By analyzing strike prices, open interest, volume, and implied volatility, investors gain insight into market sentiment and … [Read more...]

Trading Systems 101: Building and Optimizing Your Own Strategy

In a world of constant market noise and emotional impulses, the most successful traders often share a common secret: they don't rely on gut feelings. Instead, they operate with a disciplined, methodical approach guided by a well-defined trading … [Read more...]

What Is HFT? A Guide to High Frequency Trading for Retail Traders

In today’s stock market, prices can flicker and change in the blink of an eye. For retail investors, this rapid pace can seem chaotic, driven by invisible forces moving faster than human thought. That invisible force is often High-Frequency Trading … [Read more...]

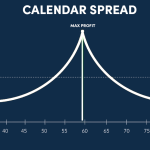

Calendar Spreads for Options Traders: Setup, Risks, and Rewards

Options allow you to express a view on direction, volatility, and time. Spreads refine that view by balancing cost and risk. A calendar spread uses the same strike and underlying, but different expirations. It is designed to take advantage of time … [Read more...]

A Modern Guide to Capital Growth Management for Traders and Investors

Capital growth management is the disciplined process of expanding principal over time while keeping risk aligned to your objectives. You set a clear mandate, choose an allocation that supports appreciation, and apply repeatable rules for selection, … [Read more...]

Portfolio Beta: What It Is and How to Calculate It to Manage Risk

Successful investing requires sophisticated risk management techniques that help you navigate unpredictable market conditions. Understanding how your portfolio responds to market volatility forms the foundation of effective investment planning. … [Read more...]

Position Sizing: How to Determine the Right Size for Your Trades

In the high-stakes world of trading, managing risk effectively can mean the difference between success and failure. Traders—both seasoned and new—continually seek methods to safeguard their investments while maximizing returns. One pivotal tool in … [Read more...]

Wash Sale Rule Explained: What Traders Need to Know About Tax-Efficient Trading

Navigating the intricate world of trading taxes can feel like walking a tightrope, but understanding key regulations can help ensure a smooth crossing. Among these, the wash sale rule plays a pivotal role in preventing traders from claiming a tax … [Read more...]

Conditional Value at Risk (CVaR): A Deeper Look at Tail Risk Management

Imagine navigating through the complexities of financial risk without a clear lens to spot potential pitfalls; this is where Conditional Value at Risk (CVaR) steps into the spotlight. CVaR extends beyond traditional Value at Risk (VaR) by delving … [Read more...]

Algorithmic Trading: How Automated Strategies Are Changing the Markets

Algorithmic trading transforms financial markets through computer-driven precision. This advanced trading method executes orders via automated, pre-programmed instructions based on variables such as price, timing, and volume. For professional traders … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 9

- Next Page »