What Is a Stock Purchase Agreement?

In the world of corporate finance, stock purchase agreements are legally binding contracts between shareholders and companies. They outline the terms and conditions of the sale of a company’s shares, such as the price, quantity, representations, warranties, and indemnifications.

Whether you’re an investor or a business owner, understanding the intricacies of these contracts will help you protect your interests. In this article, we examine stock purchase agreements, including their contents and legal terms, the difference between asset purchase vs stock purchase, and more.

Stock Purchase Agreements Explained

A stock purchase agreement, or SPA, is a legally binding contract that outlines the terms and conditions of the sale of outstanding stocks, including the stock’s purchase price. Most stock transactions take place on the open market through brokers or online platforms and don’t require an SPA. The open market is typically used by investors trying to make a profit, such as when moving their investments between sectors to realize the greatest financial gain.

An SPA, on the other hand, is typically used to conduct a private transaction between two parties. In a stock purchase agreement, the buyer becomes owner of the company’s shares. They inherit the company’s assets as well as its liabilities, which can include potential legal claims or risks. Depending on the type and amount of shares purchased, the buyer may gain voting rights and the ability to influence key business decisions.

SPAs are crucial in the event that either the buyer or seller disputes the transfer of ownership in the future. They also serve as proof that the buyer now owns the shares, similar to stock certificates.

What Is the Difference Between SPA and APA?

SPAs allow the buyer to acquire ownership in a business by purchasing shares of stock. Under an SPA, the buyer assumes all company assets and liabilities. An asset purchase agreement, or APA, differs in that the seller retains full ownership of the company while selling only specific assets and liabilities.

What Are the Parties Involved in the Agreement?

Stock sale agreements typically involve:

- A seller: The company, entity, or individual that currently owns the stocks.

- A buyer: The individual or business entity acquiring ownership of the target company through the purchase of stocks.

- Legal counsel: The buyer’s and seller’s lawyers, who are usually responsible for drafting the SPA and making sure it conforms to current stock purchase agreement securities laws.

- Target company: The business whose stocks are being traded that must verify the sale complies with its laws and policies.

What Are the Contents and Legal Terms of the Agreement?

All SPAs differ based on the specific circumstances of the sale. However, most common stock purchase agreements include:

The parties involved in the transaction.

- A description and the price of the shares being sold.

- The conditions that all parties must meet for the transaction to proceed, as well as any additional terms.

- Warranties of the target company’s financial health, including financial reports and other relevant documents.

- Representations of the target company’s potential future growth, including market research reports and the business model and strategy.

- An indemnification clause, which protects both parties by identifying how each is responsible for compensating the other for losses and harms that could arise, such as infringement of intellectual property rights.

- A stock purchase agreement mutual release, which is an agreement between the buyer and seller to release each other from certain liabilities, claims, and obligations.

Due Diligence Period and Fair Market Value Determination

Performing due diligence before entering into a stock purchase agreement helps both parties to protect their interests. Because buyers assume the legal and financial risks of a business when purchasing stock, they should perform a thorough investigation into the target company by reviewing company documents such as financial records and tax returns, and interviewing company leaders and stakeholders.

Obtaining comprehensive insights into the company can help avoid legal and financial problems in the future. Sellers may also perform due diligence on buyers to ensure they have the financial ability to close the deal.

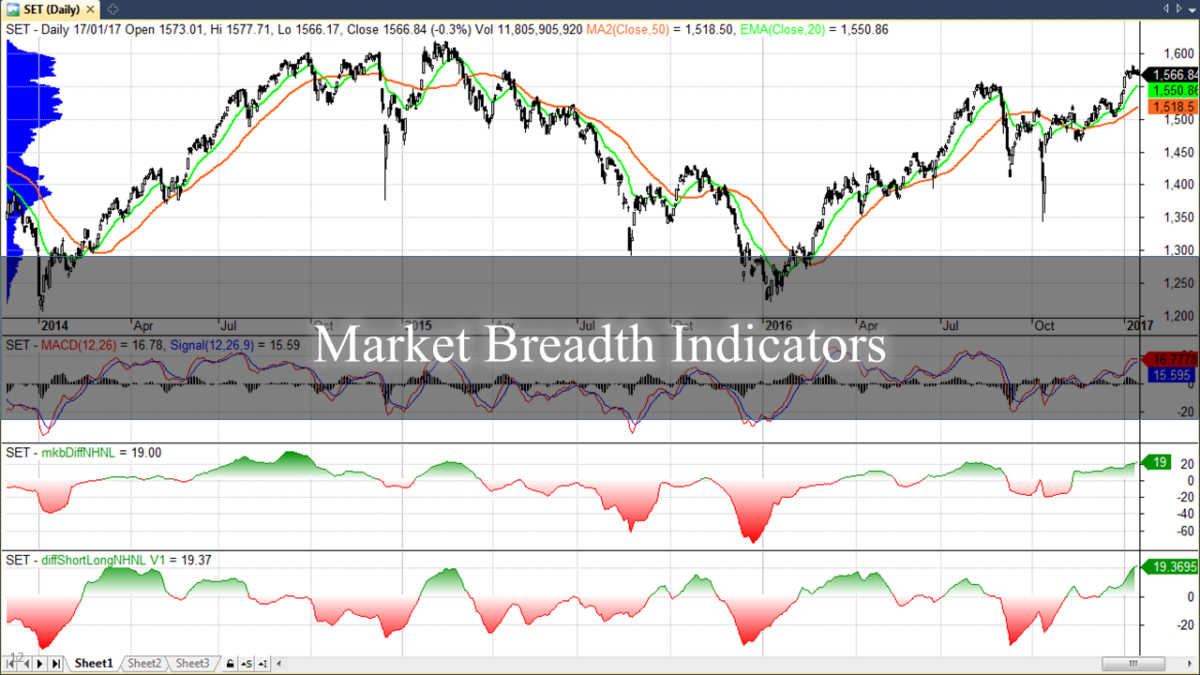

Master Financial Market Investments With Above the Green Line

Mastering financial market investments requires a deep understanding of investment strategies and financial complexities. How do you draft a stock purchase and sale agreement form? Should you buy and hold your investments or use a market timing strategy? Above the Green Line will help you understand all this and more. It’ll let you take charge of your financial market investments with buy-and-sell notifications, swing trading alerts, real-time charts, member forums, resource recommendations, and more. Subscribe to Above the Green Line today to master your investment strategy.