Buy and Hold Investing or Market Timing?

By Author

Updated February 8, 2024

There is often debate between investors as to which investment method is better: a traditional buy-and-hold approach or market timing. Here, we will discuss the merits and challenges that both strategies present to hopefully give a better understanding of which method works best for you.

Market Timing

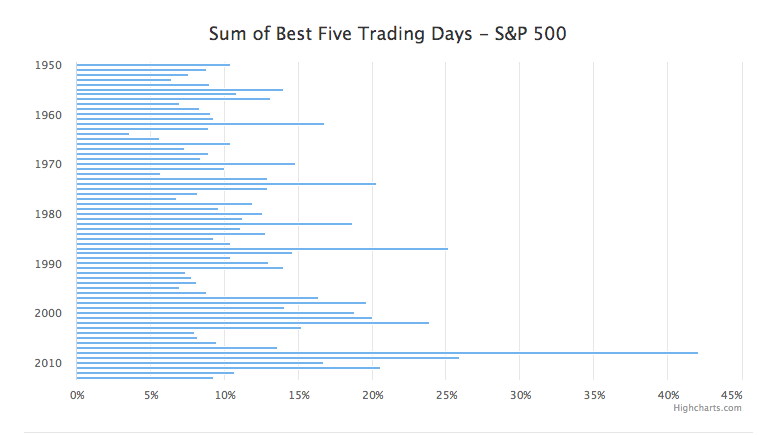

Market timing is a strategy that is highly debated as its methodology involves great risk and effort. In short, market timing is the ability to predict the market’s short term reversal points, meaning the right points in time to enter and exit the market. Since it is a short term approach, it requires a great deal of diligence as well as ample time to give to monitoring the market. Why participate in a high-risk scenario that requires a great deal of attention? Well, there is a potential for a high return. Over the past decade, the S&P 500’s annual average return is 9.10%. This is the average return that investors would experience using a more long term strategy. In contrast, those who use the methodology of market timing correctly can outperform this return greatly, thus gaining more profit in a shorter amount of time. For example, the chart below represents a sample taken over 63 years of the “best five trading days”; a strategy that outperforms the market’s annual return a total of forty-two times. However, this is an incredibly difficult game to play. Returns are often concentrated in a very short time span and the chances of receiving no returns or even worse, negative returns, are dangerously high considering no one can predict the future with complete accuracy. It is important to weigh the risks and benefits before engaging with market timing.

Buy and Hold Investing

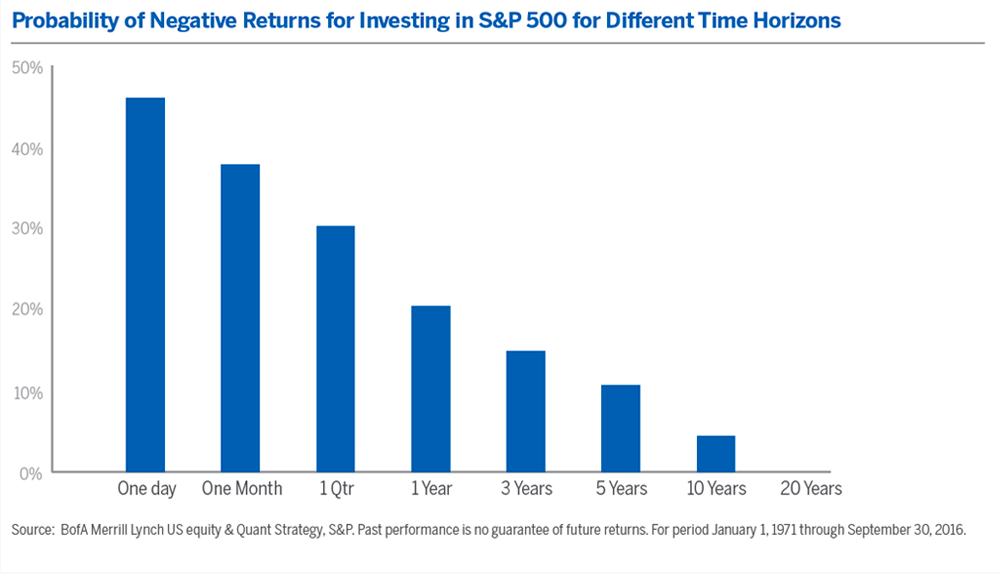

Buy-and-hold investing, also known as passive management, varies greatly from market timing. Instead of predicting the right points to enter and exit the market, an investor employing a buy-and-hold approach selects securities or funds and then holds onto them long term with no focus on short term price fluctuations. It is generally thought that when employing this method one’s assets should not be needed for three to five years. Many investors are advocates of this method simply because it works. Since the buy-and-hold strategy is based entirely on fundamental analysis, there is no room for subjectivity. Forecasting the degree of growth, however, is subjective. The chart below illustrates this concept well as the probability of negative returns decreases greatly as time goes on. The benefits of a buy-and-hold strategy sound enticing; it requires little effort and over time will guarantee somewhat of a return. Nonetheless, it is important to note that there are consequences for utilizing this strategy. As previously discussed, a buy-and-hold strategy requires a significant time investment and it is up to the investor’s discretion just how long they would like to hold on. It is essential to know that one cannot expect a degree of return that matches the time invested. For instance, if an investor were to hold on to a stock for ten years, that does not guarantee it will represent the magnitude of time they spent without that asset. Lastly, there is always the possibility of a market crash. During a crash, buy-and-hold investors can lose most if not all of their gains. It is necessary to consider the pros and cons of a buy-and-hold strategy before participating in it.

Key Takeaways

In short, an investor utilizing a buy-and-hold strategy would buy and hold onto securities for the long term. The interpretation of the magnitude of ‘the long term’ varies between investors. Employing market timing involves buying and selling over a short term period in hopes of profiting from price swings. A buy-and-hold strategy tends to be a more secure path, while market timing is generally a more difficult approach. At the end of the day, both methods have their pros and cons; it all depends on the investor themselves and what best suits their needs.