By ATGL

Updated August 27, 2024

As the market fluctuates, the eyes of both traders and investors gleam with possibility. Stock trading and investing often get painted with the same brush, but the fine lines between them are colored with intricate strategies and goals. Understanding these differences is crucial for anyone looking to navigate the financial markets.

Stock trading is the art of timing the market, where precision can be as crucial as strategy. It involves frequent buying and selling, with traders constantly seeking to capitalize on short-term market movements. Conversely, investing is akin to planting a seed and nurturing it over time, a commitment to long-term growth that often requires patience and vision.

In the forthcoming article, we dissect the unique advantages and challenges of both stock trading and investing. Delving into the nuanced world of financial strategies, we’ll explore time horizons, risk tolerance, and the stark contrasts that define the trader and the investor’s journey through the markets.

What is Stock Trading?

Stock trading involves the buying and selling of shares in public companies. This activity takes place on various exchanges around the world, with traders looking to make a profit by capitalizing on stock price fluctuations. Unlike investing, which is often associated with a buy-and-hold strategy for the long term, stock trading typically focuses on short-term profits. Traders employ various strategies to execute trades within a shorter period – from a few seconds in the case of day traders to several weeks or even months in swing trading scenarios.

The goal of a stock trader is to generate quick returns by buying low and selling high, or sometimes by selling high and then buying back at a lower price (short-selling). Each trade involves an initial investment with the hope of selling it for more than the purchase price. The risk tolerance of a trader must match the volatility and speed of the market’s fluctuations. Moreover, the tax rate on short-term gains can be higher than on long-term investments, which is an essential consideration for stock traders.

Understanding the Basics of Stock Trading

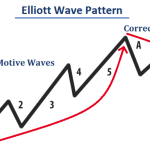

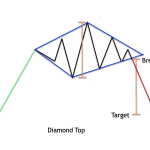

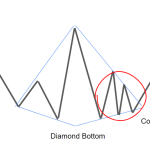

Stock trading begins with an understanding of the financial markets and the various types of securities that can be traded, such as individual stocks, mutual funds, and exchange-traded funds (ETFs). Market participants need to continuously monitor share prices and market information, often using both technical and fundamental analysis to inform their trading decisions.

Technical analysis involves examining statistical trends gathered from trading activity, such as price movement and volume, while fundamental analysis looks at economic factors, like a company’s financial performance and industry conditions, to predict price movements.

Financial advisors often suggest traders have a diversified portfolio to spread their risk across a variety of financial instruments. However, the need for diversification against risk must be balanced with the focus on making short-term gains in stock trading.

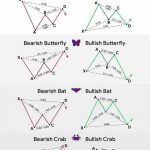

Different Types of Stock Trading Strategies

There are several well-known stock trading strategies traders use to navigate the financial markets:

- Day Trading: This strategy involves making multiple trades in a single day to capitalize on small price movements.

- Swing Trading: Swing traders hold positions for several days or weeks to capture gains in a stock’s momentum.

- Growth Investing: This approach focuses on stocks that exhibit signs of above-average growth, even if the share price appears expensive in terms of metrics like earnings or book value.

- Stage Chart Investing: Traders use visual representations of stock data to identify patterns or trends to make trading decisions.

Each of these strategies carries its own set of risks and requires a specific level of market expertise and risk tolerance. Traders often select strategies based on the amount of time they can dedicate to market analysis, their financial goals, and their personal preferences in terms of the trade-off between risk and potential rewards.

Incorporating these strategies into a trader’s approach can influence the overall annual return, with some traders preferring the quick profits of day trading and others opting for the slightly extended period of swing trading for potentially higher short-term gains.

What is Investing?

Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit over time. It involves purchasing assets that are not consumed today but are used to create wealth in the future. Investors often focus on generating returns over the long term by putting their capital into investment vehicles such as stocks, bonds, mutual funds, real estate, or other financial instruments.

The primary aim of investing is to build wealth gradually through the compounding of earnings and the appreciation of asset values. Investment strategies can vary widely according to an individual’s financial goals, risk tolerance, and time horizon. Unlike trading, which seeks profitable outcomes from short-term market movements, investing typically means embracing a longer horizon — ranging from years to decades. A key element of investing is the potential for the assets to produce an income, such as dividends from stocks or interest from bonds.

Tax considerations are also different for investors compared to traders; long-term investments often enjoy more favorable tax treatment on capital gains, providing an additional incentive for those with a patient and disciplined approach to growing their wealth.

Exploring the Concept of Investing

While investing can mean different things to different people, at its core, investing is about making your money work for you. It’s a means to secure your financial future, as well as to accumulate the funds necessary for various life goals, such as retirement, education, and homeownership. The process typically requires thorough research, patience, and a clear understanding of one’s financial objectives.

Investors must not only choose where to invest their funds but also how to manage their portfolio over time. Long-term investors often employ fundamental analysis to evaluate an asset’s intrinsic value and growth potential by studying factors like a company’s earnings, economic forecasts, interest rates, and overall market trends. This contrasts with the technical analysis more frequently used in shorter-term trading strategies.

The idea is to invest in assets that will increase in value or provide a steady income. So, while market volatility can affect the performance of investments, the extended period involved in investing allows individuals to ride out the ups and downs of financial markets with less immediate concern than day-to-day traders.

Different Types of Investment Strategies

Different investment strategies cater to individual goals and risk tolerances. Here are a few common approaches to long-term investing:

- Buy and Hold: Investors purchase securities with the intention to hold them for many years, regardless of fluctuations in the market.

- Indexing: This strategy involves constructing a portfolio to match or track the components of a market index, such as the S&P 500.

- Dividend Investing: Focused on acquiring stocks of companies that pay regular dividends, offering both potential appreciation and income.

- Value Investing: Searching for undervalued stocks that have the potential to increase in share price once the market corrects the undervaluation.

- Growth Investing: Similar to the trading strategy but with a long-term perspective, growth investing concentrates on companies with strong potential for future earnings growth.

- Dollar-Cost Averaging: Investing a fixed amount into the same investment at regular intervals, regardless of the share price, to mitigate the effects of market volatility.

Each of these strategies offers a distinct way of constructing a diversified portfolio that aligns with an investor’s specific financial timeline and risk profile. Some may focus on capital preservation, while others may seek aggressive growth, and others yet may desire consistent income streams.

Investors needn’t select just one of these strategies; a combined approach is often ideal. Financial advisors might recommend a mix to create a well-rounded, resilient portfolio designed to withstand market changes and align with personal financial plans. Additionally, investors might incorporate other vehicles like real estate, commodities, or hedge funds to further diversify and balance their investment decision-making process.

Pros and Cons of Stock Trading

Engaging in stock trading can be an attractive endeavor for those seeking more active involvement in the financial markets. It involves a different set of strategies, knowledge, and commitment compared to traditional long-term investing. Below, we examine the potential benefits and drawbacks that come with this more dynamic approach to navigating market conditions.

Pros of Stock Trading

- Potential for Short-Term Profits

- Flexibility and Control

- Ability to Take Advantage of Market Swings

- Opportunity to Generate Income through Active Trading

Potential for Short-Term Profits

Stock trading allows for the potential to secure quick profits due to the short-term nature of the transactions. Day traders and swing traders operate on the premise that making successful trades based on market trends and fluctuations can lead to sizable gains in a relatively shorter period.

Flexibility and Control

Traders have the flexibility to react to market changes swiftly and make decisions that can immediately affect their holdings. This level of control enables them to manage their positions based on real-time information or quick shifts in market dynamics.

Ability to Take Advantage of Market Swings

Traders can capitalize on market volatility. Using various trading strategies, they can profit from both rising and falling markets by going long (buying) or short (selling) on stocks. This ability to navigate and potentially benefit from market movements is a significant draw for stock trading.

Opportunity to Generate Income through Active Trading

For those who have mastered their trading strategies and risk management, trading stocks can become a consistent source of income. Though this requires a deep understanding of market mechanics and a crafted skill set, it can be a substantial advantage over traditional investing.

Cons of Stock Trading

- Requires Active Monitoring and Time Commitment

- Higher Risk and Volatility

- Potential for Emotional Decision Making

- Transaction Costs and Fees

Requires Active Monitoring and Time Commitment

The very nature of stock trading necessitates continual market monitoring and a substantial time investment. Traders need to keep abreast of market news, price charts, and economic events that could influence their trading decisions.

Higher Risk and Volatility

Trading, especially on a short-term basis, involves higher risk due to increased exposure to market volatility. A trader’s capital can rapidly diminish with swift changes in the market, making risk management an essential part of their trading strategy.

Potential for Emotional Decision Making

The fast-paced environment of stock trading can lead to emotional decision-making. Rapid gains and losses can provoke fear, greed, and other emotions that may impair judgment and lead to less-than-ideal trading decisions.

Transaction Costs and Fees

Frequent trading often results in higher transaction costs and fees. Each trade may come with a commission or spread, which can eat into profits—especially when making a large number of trades. Additionally, short-term gains are typically taxed at a higher rate compared to long-term investments.

Considering these pros and cons is paramount for anyone contemplating stock trading. It’s important to evaluate personal risk tolerance, financial goals, and lifestyle before delving into the stock market’s fast-paced realm. Those considering trading should be prepared both financially and mentally for the challenges and advantages it presents.

Pros and Cons of Investing

Investing in the stock market is a strategy often regarded as essential for building wealth over an extended period. Unlike active trading, investing typically focuses on accumulating assets for long-term appreciation and income generation. While it comes with its own set of potential rewards and risks, understanding these can help make informed financial decisions. Below are the key pros and cons associated with investing.

Pros of Investing

- Potential for Long-Term Growth

- Lower Transaction Costs and Fees

- Diversification and Risk Management

- Potential for Passive Income through Dividends

Potential for Long-Term Growth

Long-term investing is historically associated with achieving growth through a compounding annual return over time. Investors typically select a portfolio of stocks, mutual funds, or exchange-traded funds (ETFs) with the expectation that their initial investment will increase in value. Growth investing, in particular, involves selecting companies that have the potential to outperform the market over time, contributing to a more robust financial future.

Lower Transaction Costs and Fees

Investors engaging in long-term strategies usually incur fewer transaction costs since they are not continuously buying and selling. Compared to the frequent commissions and fees generated by trading, the buy-and-hold approach significantly reduces expenses, allowing more of the investment to grow.

Diversification and Risk Management

By investing in a diversified portfolio, individuals can spread risk across various assets, industries, and geographies. Diversification is an effective risk management tool that can lead to more stable long-term returns by mitigating the impact of non-systematic risk (or the risk inherent to a specific company or industry).

Potential for Passive Income through Dividends

Investing in dividend-paying companies provides the additional advantage of generating passive income. Income from dividends can be reinvested to purchase more shares or simply used as a regular income stream. Over time, this can significantly enhance the investor’s overall return on investment.

Cons of Investing

- Longer Time Horizon for Gains

- Lower Liquidity

- Lack of Control over Individual Stock Performance

- Vulnerability to Market Downturns

Longer Time Horizon for Gains

Long-term investments typically require patience and a commitment to an extended period before the realization of substantial gains. This longer time horizon may not align with the financial goals or life plans of individuals needing or wanting quicker access to funds.

Lower Liquidity

Investments designed for long-term growth usually offer lower liquidity compared to daily tradable assets. The implication of reduced liquidity is that converting investments to cash quickly can be challenging without potentially incurring losses, especially when the sale aligns with a market downturn.

Lack of Control over Individual Stock Performance

Investors are largely at the mercy of the performance of the companies and funds within their portfolio. Market forces, management decisions, and global events can all affect share prices, and as a passive investor, there is little control over these outcomes.

Vulnerability to Market Downturns

While diversified investments help manage risk, they are still subject to market fluctuations. During market downturns, the value of investments can decline, and if an investor needs to liquidate assets during such times, they may suffer losses. Long-term investors must weather these downturns with the belief that markets will eventually recover.

In conclusion, the decision between stock trading and investing hinges on one’s financial goals, risk tolerance, and personal preference toward involvement in market activities. Whether aiming for quick profits through trading or a diligent accumulation of wealth through investing, understanding the risks and benefits related to each approach is crucial for making sound financial decisions.

Key Differences between Stock Trading and Investing

Understanding the distinctions between stock trading and investing is essential when making financial decisions. While both activities take place in the financial markets and involve buying and selling stocks, they are guided by different strategies, objectives, and mindsets.

Stock trading is characterized by the pursuit of short-term gains. Traders typically focus on share price movements over a shorter period—ranging from minutes to several weeks—capitalizing on market volatility. They employ a variety of trading strategies such as day trading, swing trading, and stage chart trading to achieve quick profits. The essence of trading lies in timing the market accurately, which requires sharp skills and a deep understanding of market trends.

Investing, on the other hand, is the process of building wealth gradually through buying and holding a portfolio of stocks, mutual funds, or other investment instruments. It is based on the expectation that the value of these assets will increase over an extended period, generally years or even decades. Investors rely on fundamental analysis to select their investments, aiming for gradual appreciation and dividends.

Time Horizon

The time horizon of financial activities plays a pivotal role in distinguishing between stock trading and investing. Stock traders operate on a markedly shorter timeframe. Day traders, as the name implies, make multiple trades within a single day, while swing traders may hold positions for a few days to several weeks. Their goal is to make short-term profits from price fluctuations in the stock market.

Investing, in contrast, has a much longer time horizon. Long-term investors typically hold onto their investments for years or decades. Their focus is on the potential for steady growth, compounding interest, dividends, and the benefits of long-term capital gains. This approach often requires a more patient and disciplined mindset, as the results are realized over a longer period of time.

Risk Tolerance

Risk tolerance is another factor that differentiates stock trading from investing. Due to the short-term nature of stock trading, it often carries a higher level of risk. Traders must remain vigilant about market movements, global events, and company-specific news that can lead to rapid price changes. It’s an environment where high stress and the potential for substantial losses are countered by the opportunity for quick, significant gains.

On the flip side, investing is considered to be a lower-risk approach. Long-term investors are typically more insulated from daily market volatility, though they are still exposed to systemic risks affecting the overall market. However, a well-diversified portfolio, which spreads risk across various asset classes, helps buffer against these challenges. Furthermore, the longer timeframe allows investors to recover from market downturns, whereas traders may suffer immediate losses.

In conclusion, while stock trading aims for higher short-term gains with increased risk and activity levels, investing focuses on steady, long-term growth with a corresponding lower risk profile. Both approaches have their merits, but individuals must align their financial strategies with personal objectives, risk tolerance, and the specific time horizon they are comfortable with.

Learn about both Stock Trading and Investing with Above the Green Line

Above the Green Line offers a holistic learning experience for individual investors by providing a suite of comprehensive tools and resources designed to enhance their understanding of stock trading and investing. Through access to technical charts, trade alerts, and real-time streaming, members can gain valuable insights into market trends, price movements, and potential trading opportunities. Additionally, the platform’s educational articles cover a wide range of topics, from basic trading concepts to advanced strategies, empowering users to expand their knowledge base at their own pace. By integrating these resources with interactive forums for chatting and tutoring, Above the Green Line fosters a collaborative learning environment where investors can engage with experts and peers, exchange ideas, and seek guidance on navigating the complexities of the financial markets. Become a Green Liner and join Above the Green Line today.