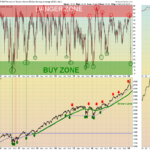

Above the Green Line © is a Newsletter System of rotating into Investments that generally have more Buyers than Sellers (Above the Green Line, which is Above the 250 day exponential moving average), and the highest Relative Strength (> 90 Relative Strength).

This System is designed to Buy High, and Sell Higher, where we BUY on the DIPS. But Momentum Investing does require discipline.

We email, text and tweet commentary on a daily and weekly basis. Below are commentaries previously posted.

***** THESE ARE SAMPLE PAGES & ARE NOT CURRENT ****