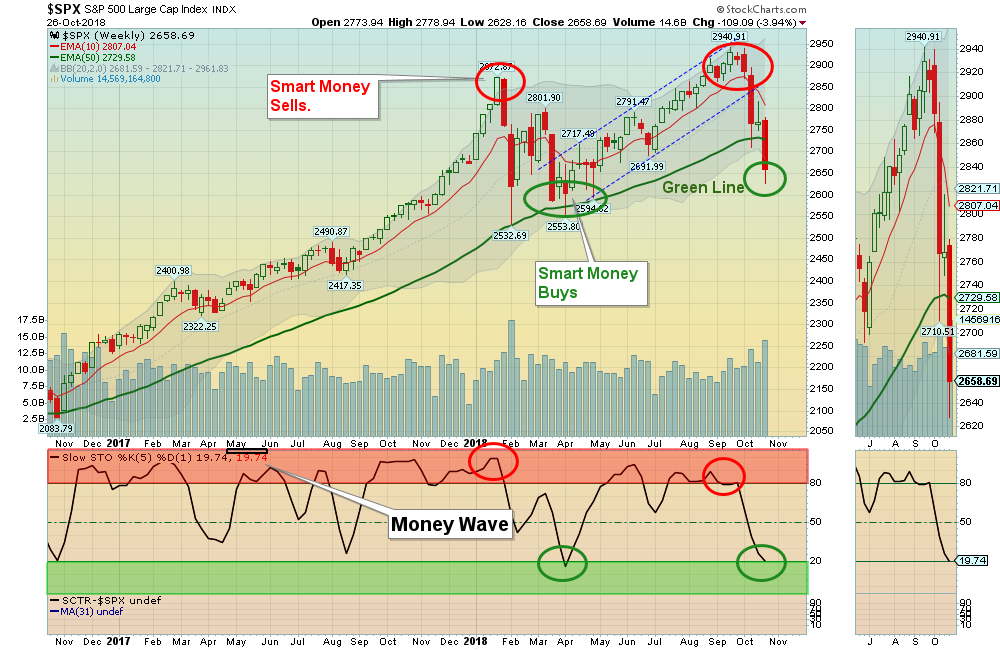

10/28/2018: Markets dumped for the week, as the S&P 500 sliced below the Green Line. Closing well below the Green Line is “Bearish”, but the Markets should have an oversold bounce soon.

Soon the Strongest Leaders that are holding Above the Green Line + Above 90 Relative Strength should go back up to re-test the September Highs. Investments that are currently Below the Green Line should probably be Sold on the next rally.

Weaker Investments might not bounce that well, so only Buy the Strongest Investments with > 90 Relative Strength.

For the week the Dow was down 2.97%, the S&P 500 was down 3.95%, and the Nasdaq 100 was down 3.59%. The Long Term Trend on the Stock Markets is UP.

There are 2 Inverse Funds that have begun Bull Markets (currently they are in the Red Zones so we will have to wait.) They are Inverse World Emerging Market Fund (EUM) and Inverse Small Cap Fund (RWM). These could go much higher over the Long Term.

The Inflation Index (CRB) was down 0.85% but is Above the Green Line, indicating Economic Strength.

Bonds were up 1.13% for the week and are Below the Green Line, indicating Economic Strength.

The US DOLLAR was up 0.71% for the week, and made a New High for the year.

Crude Oil was down 2.44% for the week at $67.59, and GOLD was up at $1236.

___________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 10 logged Open Positions, for the Short & Medium Term. There are 14 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM TRADES

The Long Term List has become large, and if the Investments below can Bounce up off the Green Line with Above 80 Relative Strength, some could re-test their Highs.

AEO AMER. EAGLE OUTFITTERS Wait for weekly Close Above the Red Line of $23.26 (50-day avg.)

ARWR ARROWHEAD PHARMA. Wait for weekly Close Above the Red Line of $14.88 (50-day avg.)

CVNA CARVANA CO. Wait for weekly Close Above the Red Line of $49.37 (50-day avg.)

FDN INTERNET FUND Wait for weekly Close Above the Red Line of $133.37 (50-day avg.)

FOSL FOSSIL GROUP Wait for weekly Close Above the Red Line of $22.10 (50-day avg.)

HEAR TURTLE BEACH CORP. Wait for weekly Close Above the Red Line of $20.73 (50-day avg.)

HRTX HERON THERA. Wait for weekly Close Above the Red Line of $31.77 (50-day avg.)

KSS KOHLS CORP. Wait for weekly Close Above the Red Line of $74.11 (50-day avg.)

M MACY’S INC. Wait for weekly Close Above the Red Line of $34.16 (50-day avg.)

URBN URBAN OUTFITTERS Wait for weekly Close Above the Red Line of $40.54 (50-day avg.)

WTW WEIGHT WATCHERS Wait for weekly Close Above the Red Line of $70.60 (50-day avg.)

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is LOW (Green Zone). The probability of successful Short Term Trades is better, when the S&P 500 is down near the Green Line.

Tell your Friends about the Green Line, and Help Animals.

QUESTION: Frederick writes “It appears to me that you never go short?

Please explain. Thanks.”

ANSWER: Most Followers do not understand Shorting, so we follow the Green Line Rules and normally Buy Long.

Inverse Funds (a form of Shorting) will eventually bottom and Begin a Bull like in 2008, and we should be in them again for nice gains.

2 Inverse Funds are now meeting the Green Line Rules: Inverse Emerging Markets EUM and Inverse Small Cap Fund RWM (we are waiting on Buy Signals).

If you want to Short, Reverse the Green Line Rules and Short the very weakest (Below Green Line + Below 10 Relative Strength + Below 80 on Money Wave).

Good trading and tell your Friends!