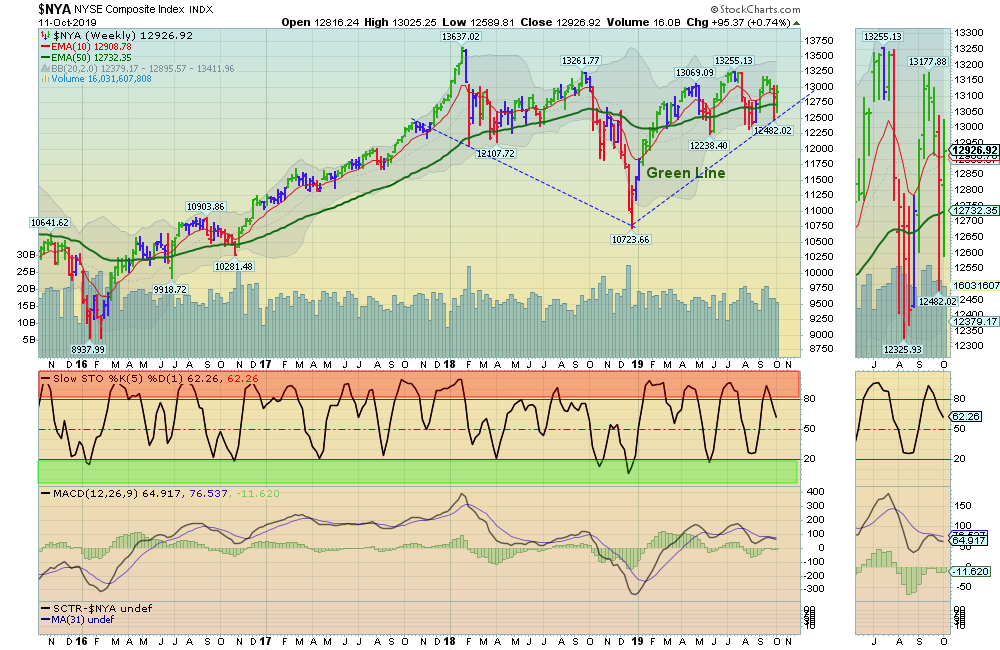

10/13/2019: Markets were up for the week after being down earlier. The S&P 500 was able to Close above the Red Line (50-day avgs.) which is Bullish.

The Markets are in a sideways move between the Highs and the Support of the Green Line. Sideways means “Indecision” and then normally a Big Move is coming (Up or Down). We must Wait for the Markets to “tell us”. Please WAIT for the Leaders to return to their Green Zones.

The number of new lows declined, dropping to 46 on the NYSE and 94 on the Nasdaq. The percentage of stocks above their 200-day moving average bounced back above the 50% level again, to 52%.

For the week the Dow was up 0.87%, the S&P 500 was up 0.62%, and the Nasdaq 100 was up 1.22%. The Long Term Trend on the Stock Markets is UP.

The Inflation Index (CRB) was up 1.46% and is Below the Green Line, indicating Economic Weakness.

Bonds were down 3.86% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was down 0.52%, after making a 3 year High last week.

Crude Oil was up 3.58% for the week at $54.70, and GOLD was down 1.60% at $1488.70.

_____________________________________________________________________________________________________________________________________________

COMPLETED LOGGED TRADES THIS WEEK

NET

2019-10-03 ACAD Acadia Pharma. $38.30 2019-10-11 $40.52 $2.22 +5.80%

2019-09-30 ATUS Altice USA $28.68 2019-10-10 $28.25 -$0.43 -1.50%

2019-10-03 ENPH EnPhase Energy $22.42 2019-10-09 $24.22 $1.80 +8.03%

2019-10-01 ROKU ROKU Inc. $102.40 2019-10-09 $117.79 $15.39 +15.03%

2019-09-16 SHOP Shopify Inc. $337.93 2019-10-11 $329.26 -$8.67 -2.57%

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 4 logged Open Positions, for the Short & Medium Term. There are 4 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS

Buy the Leading Investments that are down near the weekly Green Zones.

AMD ADVANCED MICRO Buy if it is going to Close above the Red Line of $29.99.

AYX ALTERYX INC. Buy if it is going to Close above the Red Line of $117.53.

CDNS CADENCE DESIGN Buy if it is going to Close above the Red Line of $67.23.

NVCR NOVOCURE LTD. Buy if it is going to Close above the Red Line of $77.96.

SBUX STARBUCKS CORP. Buy if it is going to Close above the Red Line of $89.71.

TLRA TELARIA INC. Buy if it is going to Close above the Red Line of $7.98.

TTD TRADE DESK INC. Buy if it is going to Close above $201.90.

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is MEDIUM (Yell0w Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________

QUESTION: Kurt S. writes “Is there a search field to look at any chart of stocks or ETFs that that I have in other portfolios, to see where the Green Zone and Money Wave are?

ANSWER: Hi Kurt, on the web site Main Menu under “Chart tab”, you will find:

Click Here to see your favorite Chart at StockCharts: (Input the Symbol and then Click on the Update button).

You should be able to enter your Investments and see if they are Above the Green Line, and Relative Strength (SCTR Rank on bottom left).

Good trading and tell your friends,