5/1/2022 Markets were lower again this week as most are worried about high Interest Rates and Inflation. The Stock Indices need to hold at the March lows (Support) to remain Bullish.

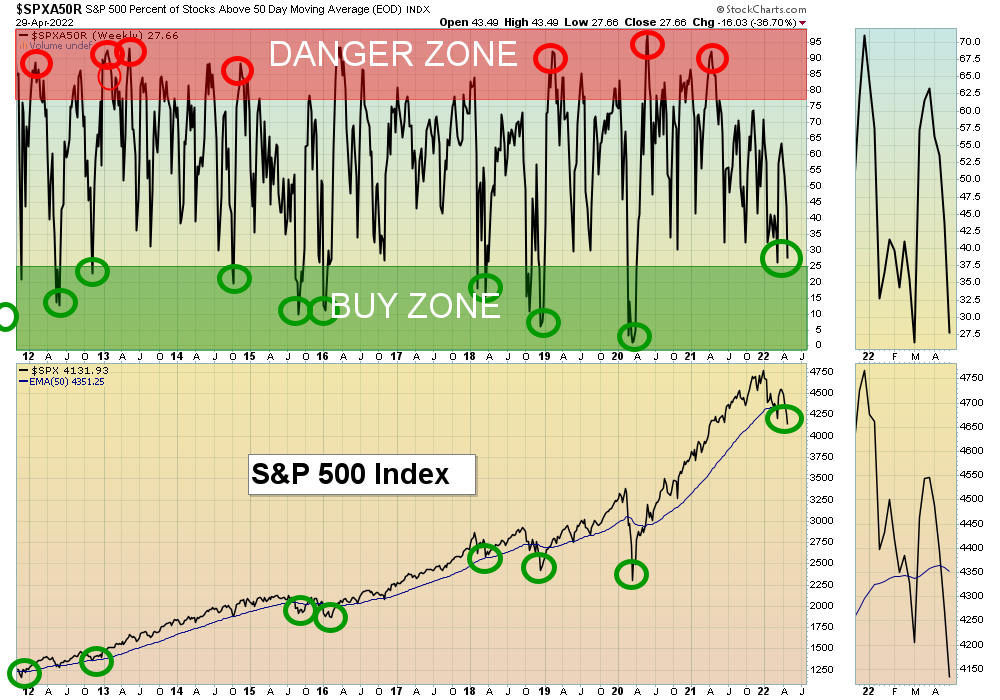

Unless the FED wants to guarantee a slow down, they will probably “walk back” their aggressive Interest Rate tightening talk on Wednesday. Tammy is dumping stocks on slow down FEARS, but the FEAR technical indicators like the VIX, Stocks below 50-day (Chart above) and high Put / Call ratio say that it is normally too late to Sell.

The major Indices’ weekly charts went from over-bought (Red Zone) to over-sold (Green Zone) in the last month, and most of the strongest Leaders are coming up out of the Green Zones for Money Wave Buy Signals.

Commodity Investments just corrected back down to the 50-day averages for maybe one more bounce up… Then if they don’t make New Highs we could see the dreaded “Double Top” and then a sizable correction. Most of the Tech Stocks are weaker and no longer meet the Green Line Rules.

Currently the tangible Commodities are Way Above the Green Lines, and Bonds are Way Below the Green Lines. Both will eventually return to the Green Lines, so maybe we will see a Stock Market rally when Interest Rates and Inflation fall. (Big surprise for Tammy.)

The Stock Indices need to hold at the March lows (Support) to remain Bullish. We will use Inverse Funds in the next Bear Market, but only SARK and EUM Inverse Funds currently meet the Green Line Rules (and they are now in the Red Zones).

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets.

More action this week on the Day Trading Scrolling Charts.

DAY TRADING CHARTS FOR INDICES & LARGE CAPS.

We have not had many intra-day Trade Alert signals lately as the Volume has been too Low with the Buy Signals. These low Volume Buy Signals tend to pop up and quickly fade back down. We like to see High Volume on rallies.

For the week the Dow was down 2.54%, the S&P 500 was down 3.30%, and the NASDAQ 100 was down 3.73%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 1.33% for the week and is Above the Green Line, indicating Economic Expansion.

Bonds were down 0.45% for the week, and are Way Below the Green Line, indicating Economic Expansion.

The US DOLLAR was up 1.75% for the week and is Way Above the Green Line.

Crude Oil was up 2.57% for the week at $104.69 and GOLD was down 1.17% at $1911.70.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are in now in 8 logged Current Positions for the Short & Medium Term. There are 5 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

_________________________________________________________________________________________

LONG TERM INVESTMENTS (Hard to find many Long Term now because most normal Investments no longer have 80 Relative Strength required.)

Long Term Scrolling Charts (Real Time)

ACI ALBERTSONS CO. Wait for Weekly Money Wave Close > 20 with High Volume.

BLDR BUILDERS FIRSTSOURCE Buy above $66.83 with High Volume with a 5% Trailing Sell Stop Loss below it.

F FORD MOTOR CO. Buy if it Closes above $16.46 with High Volume.

RRPIX RISING INTEREST RATES FUND Currently in the Weekly Chart Red Zone. Wait for the next Daily Money Wave Buy Signal.

________________________________________________________________________________

My Trading Dashboard

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List May 1, 2022

Dividend Growth Portfolio

Updated ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is MEDIUM (Yellow). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

________________________________________________________________________________

4 Ways to Get your Daily Money Wave Email Alert:

-

- Emailed to your box between 3:45 3:50 pm EST.

- Website menu Commentary/Buy/Sell Signals

- Twitter notifications are the fastest @AboveGreenLine

- Text messages: Email us your Cell number & phone carrier.

Thank you,

ATGL