The S&P 500 Index just completed one of the best years (28.88%) in 25 years in 2019. It is hard to beat that… But if the Markets rotate from “Buy & Hold” to “Trading” in 2020, we could see a nice year for trading. The Green Line System of Swing Trading should do well if that happens.

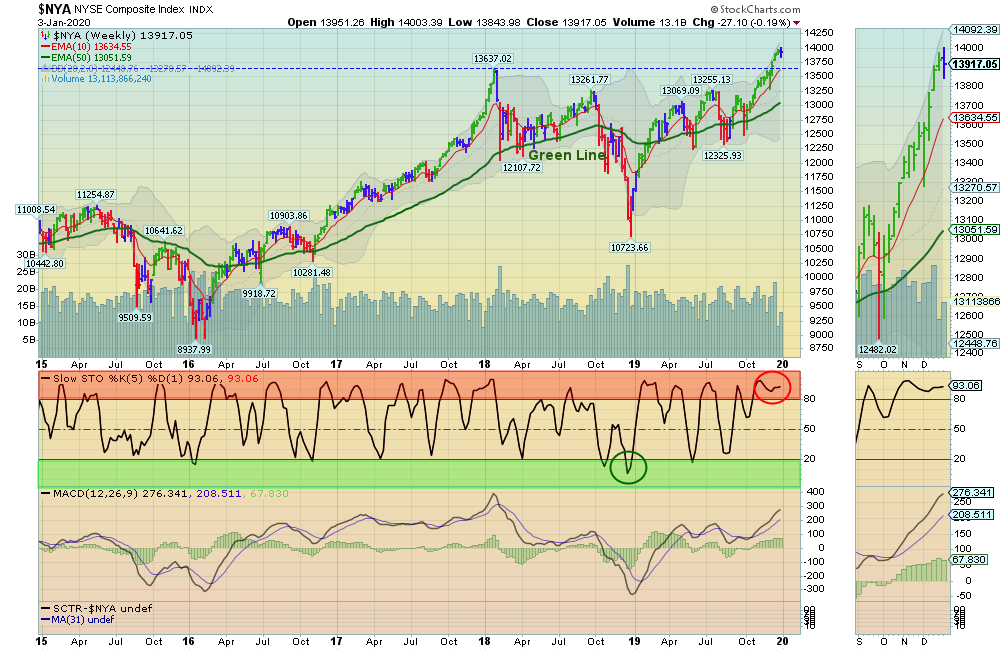

01/05/2020: Markets were mixed for the week on slow Holiday trading. Profit Taking should come in soon as the Indices are Way Above the Green Lines, and Investors’ Greed Level is high.

Oil, Gold, and the Inflation Index were up again on expectations of a stronger Economy. These tangible Investments should eventually compete with High Priced Stock & Bonds.

Shorter Term Traders should raise Cash and WAIT for the S&P 500 Index and the Leaders to return to their Green Zones for Money Wave Buy Signals.

For the week the Dow was down 0.04%, the SP 500 was down 0.14%, and the Nasdaq 100 was up 0.27%. The Long Term Trend on the Stock Markets is UP.

The Inflation Index (CRB) was down 0.15% and is Above the Green Line, indicating Economic Strength.

Bonds were up 1.31% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was unchanged for the week, and is nearing good Support.

Crude Oil was up 2.15% for the week at $63.05, and GOLD was up 2.26% at $1552.40.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 1 logged Open Positions, for the Short & Medium Term. There are 7 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS

Buy the Leading Investments that are down near the weekly Green Zones.

BLL BALL CORP. Buy if it Closes above $67.87 on High Volume.

GE GENERAL ELECTRIC CORP. Closed above $11.83, but the Volume was not High (2-3 X normal). Wait for next Daily Money Wave Buy Signal.

GNC GNC HOLDINGS Buy if it Closes above $2.96 on High Volume.

KMX CARMAX INC. Buy if it Closes above $89.68 on High Volume.

NWL NEWELL BRANDS Buy if it Closes above $20.84 on High Volume.

RAD RITE AID CORP. Wait for the next Daily Money Wave Buy Signal.

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Long Term Strategy for IRAs & 401k Plans: Currently invested in all 4 Funds.

Alert! Market Risk is HIGH (Red Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________

4 Ways to Get your Daily Money Wave Alert:

- Emailed to your box between 3:30 3:50 pm EST.

- Website menu Commentary/Buy/Sell Signals

- Twitter notifications are the Fastest and most reliable @AboveGreenLine

- Text messages: Email us your Cell number & phone carrier.