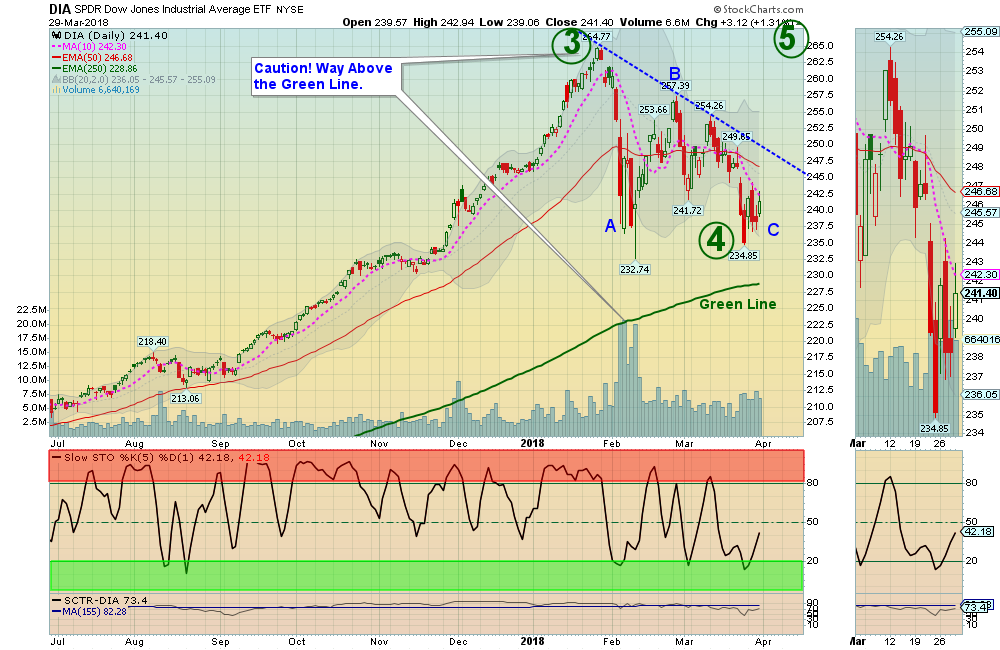

04/01/2018: Markets were up over 2% for the week, as the Indices are trying to bounce near the February Lows. If the Markets can hold and bounce soon, we could see a “W” Pattern for the Indices to Bounce near the Green Lines and possibly re-test the Jan Highs.

The NASDAQ 100 Index and Techs are still below their Red Lines (50-day avgs.), so the first bounces will probably not be that good (resistance near the Red Lines). Try to Buy Investments that are still Above the Red Lines. The Long Term Trend is UP.

The Strongest Leaders are Holding Above their Red Lines. The list of Large Caps that should bounce the best: MU INTC CSCO HPE NFLX M NTNX STX ADBE PGR GERN VIPS ADSK TPR NTAP EL RHT EW & AKAM. Many are so strong that they have not even returned to their Green Zones for Buy Signals.

Bonds are bearish (Below the Green Line and Low Relative Strength) but have rallied way back up to the Green Line (250-day avg.) on fear of Economic weakness.

The Inflation Index (CRB) is struggling to get back above the 196.36 Break Out level, which shows some weakness with Inflation. The US DOLLAR failed again the Red Line, and is re-testing the recent Lows.

Crude Oil was down 0.90% for the week at $65.00, and GOLD was down 1.70%.

___________________________________________________________________________________________

MONEY WAVE BUYS SOON: We are currently in 7 logged Open Positions, for the Short & Medium Term. There are 8 Investments on the Short Term Watch List. Be patient and WAIT for Green Zone Buys!

______________________________________________________________________________________________

LONG TERM TRADES

The Funds below are currently out of favor and and recent news has cause more weakness. Some are having trouble with nice uptrends. But historically these could possibly Double or more from these lower levels. We are looking for a good Entry Point for these, but need the entire Economy & Inflation to pick up speed:

DBC COMMODITY FUND Relative Strength is back Below 90.

KOL COAL FUND Relative Strength is back Below 90.

REMX RARE EARTH FUND Relative Strength is back Below 90.

TWTR TWITTER INC. Broke Out Above $25.85. Buy on next Daily Buy Signal.

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is LOW (Green Zone). The probability of successful Short Term Trades is higher, when the S&P 500 is down near the Green Line. The Strongest Investments could re-test their Highs from these Over-Sold levels.

Tell your Friends about the Green Line, and Help Animals.

QUESTION: Rocky writes “Curious as to why the SCTR rankings (StockCharts Technical Rank) on the ETFs are not used when they are with stocks.

Also, why are the ETF.com > 90 ETF rankings better than the SCTR > 90 ETF rankings?

Thank you in advance for your response!”

ANSWER: Hi Rocky. The SCTR from StockCharts is convenient on each Chart, but is weighted heavily to the last 90 days of trading (too volatile). We prefer the 1 year weightings on ETF Screen or IBD (Investors Business Daily), as the Relative Strength does not hop around as much.

Relative Strength Values comes from the SCTR Rank (StockCharts Technical Rank), www.etfscreen.com for ETFs , and Investor’s Business Daily (IBD) for stocks. We prefer the longer term weighting used by www.etfscreen.com and IBD.

Good trading, and tell your friends!