For busy investors that don’t have time to Swing Trade, we now have a simple Strategy: Top Pick of the Week. You Buy the “Pick” on Monday morning, and then Sell on Friday’s Close. This week: OWL BLUE OWL CAPITAL to retest the recent high again.

This “Pick” will be emailed to you on Sunday, and we will track the performance weekly. If the stock exceeds the 15% target before Friday, it will be sold immediately to lock in profits. Otherwise, the stock is sold at Friday’s market close, regardless of the outcome (more details here).

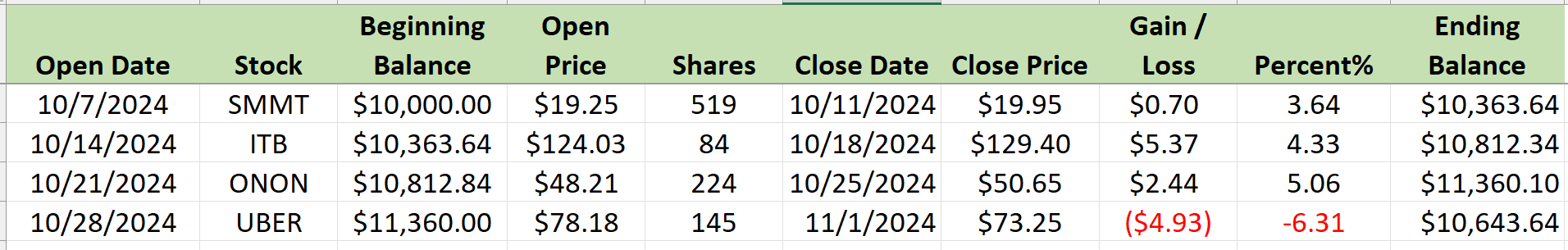

Below are the results for the Weekly Top Pick Performance.

During the week you can see the current Weekly Stock Pick Chart and Stock Pick.

______________________________________________________________________________

DAILY SWING TRADING (SHORT TERM)Watchlist and Charts to Buy Soon.

| Daily Swing Watch List | Daily Swing Charts to Buy |

| Current Swing Positions | Current Swing Charts |

| Closed Results | Trading Dashboard |

Current Pick and Chart

| Top Pick of the Week | TPOW Stock Chart |

11/3/2024 Markets were lower for the week and Bonds continued down from FED Printing (Inflation Fears). Bonds are now very over-sold, and would normally bounce soon. That should be Bullish for Stocks (lower long term Interest Rates). The DOW 30 & broad NYSE Indices are back down in the Green Zones for a probable bounce soon. Gold and Solver made new highs on FED Printing (Inflation Fears).

Longer term the S&P 500 & DOW 30 have corrected slightly off the highs, but are still stretched Way above the Green Lines (and will meet again with the Green Lines). Markets can go higher, but Smart Money requires at least a 2:1 Reward / Risk ratio when Buying. Historically Buying in the weekly Red Zone above does not offer a 2:1 Reward /Risk (So have tight Sell Stops on your positions if you want to have Cash to Buy on the next FEAR Flush).

We Buy the strongest Leaders that make new highs, on pull-backs. So follow the Green Line System and you should continue to win more than you lose. SEE WATCH LIST

With the Green Line System, your Money should flow into the Strongest areas and your Account value should be able to grow in both Bull and Bear Markets. Follow the MONEY, not the MEDIA.

______________________________________________________________________________

COMPLETED SWING TRADES THIS WEEK.

ADMA ADMA BIOLOGICS Stopped Out at $19.75 for a 25.9 % Gain.

BFLY BUTTERFLY NETWORK Target was Hit for an 18.3 % Gain.

CIFR CIPHER MINING Stopped Out with a 2.86 % Gain.

GOOGL ALPHABET INC. Stopped Out with a 3.97 % Loss.

IREN IRIS ENERGY Stopped Out with a 23.94 % Loss.

LUMN LUMEN TECH. Stopped Out at break even.

NGD NEW GOLD CORP. Stopped Out at break even.

Completed Swing Trades since Oct. 2024: 241 Trades, + 958% Total. Avg. Trade = 3.98 % Gain (before taxes and commissions).

______________________________________________________________________________

For the week the Dow was down 0.17%, the S&P 500 was down 1.38% and the NASDAQ 100 was down 1.59%. Many of the major Indices still have a Relative Strength below 80, so you should currently own the stronger Funds here.

The Inflation Index (CRB) was down 1.84% for the week and is Below the Green Line, indicating Economic Contraction.

Bonds were down 1.08% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was up 0.07% for the week and is Above the Green Line.

Crude Oil was down 3.19% for the week at $69.49 and GOLD was down 0.20% at $2749.20 a new high.

_______________________________________________________________________

DAY TRADERS: We are doing many profitable Day Trades on our Discord Trading Hub (free). Please join Discord or X (Twitter) with your cell phone app for the fastest Trade Alerts and Daily email notifications during the day. Other methods of notification have been too slow. Also, please check our our Live Trading Room on YouTube during Market hours.

_______________________________________________________________________

SWING TRADE BUYS SOON:

We are now in 5 Three Star logged Swing Trading Positions for the Short & Medium Term. There are 4 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________

LONG TERM WATCH LIST

ATGL Long Term Weekly Watchlist- Click here for scrolling charts.

Completed Long Term Trades in Oct. 2024: 41 Trades, +249.37% Total, or 6.08% / Trade.

______________________________________________________________________________

Important Links| Top 100 | Stage Chart Investing | CNN Fear & Greed Index |

| Dividend Growth Portfolio | ETF Sector Portfolio | Dogs of the Dow |

| Long Term Strategy | Stage Chart Investing | Articles |

Alert! Market Risk is Medium (YELLOW). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

______________________________________________________________________________

5 Ways to Get your Daily Money Wave Email & Trade Alerts:

-

- Emailed to your box between 3:45 – 3:50 pm EST.

- Website menu Commentary/Buy/Sell Signals

- Discord Chat. and X (Twitter) @AboveGreenLine are the fastest for Alerts (please set up “mobile notifications”)

- Text messages: Email us your Cell number & phone carrier (slower results).

Thank you,

ATGL