1/31/2021 Markets were lower for the week on profit taking. The major Indices were on Highs last week and were very over-bought and were Way Above the Green Lines.

FEAR has quickly returned to the Markets as the CNN Fear & Greed Index is back down to 38, after being up at 92 late last year. We like to BUY on FEAR, and the Leaders are coming down to the Green Zones for some Short Term trades soon, The weakest major Index is the DOW 30, and it closed below the Red Line (50-day average) which is bearish. But the Strongest Index is currently the Small Cap Fund (IWM) and it is well above the Red Line and should have a Money Wave Buy Signal soon.

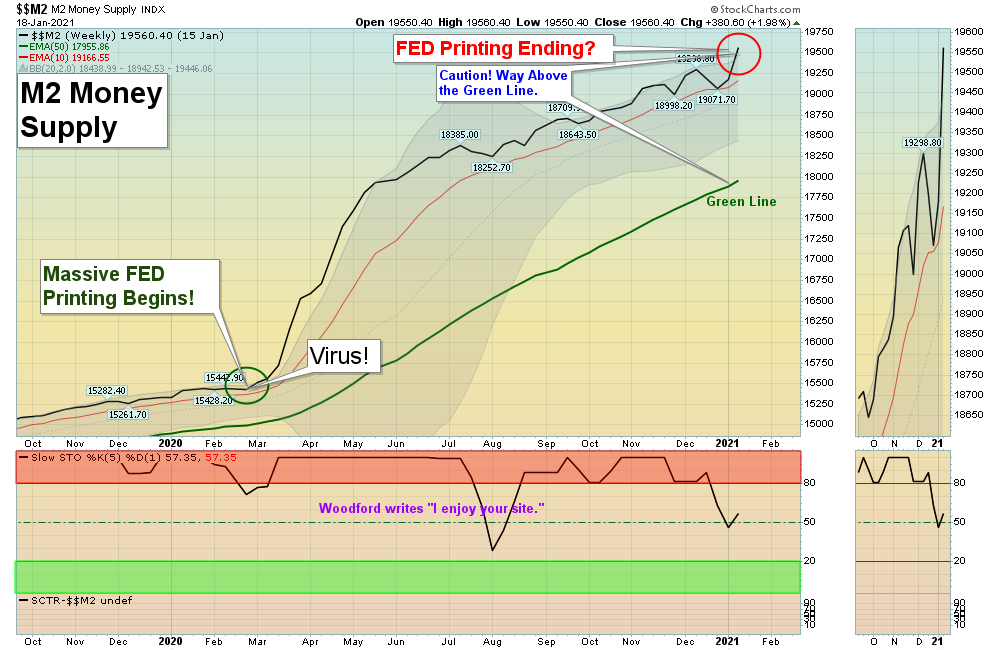

The FED is continuing to Print aggressively, so the Markets should be ok until the Indices can no longer make New Highs (Sell Signal). Bonds are also being propped up by the FED at $120 Billion of monthly Buying, so we will watch for any changes there. Higher Commodity Prices are worrying the Bond Markets, and could eventually force the FED to stop Printing when Inflation returns.

Completed Trades this week:

MARA MARATHON PATENT Jan 29 Target Hit at $24 for a 31.1 % Gain. This trade was not logged.

MVIS MICROVISION INC. Jan 25 Target was Hit at $7.50 for a 26.9 % Gain. This trade was not logged.

OSTK OVERSTOCK.COM Jan 26 Target Hit at $85 for a 40 % Gain. This trade was not logged.

For the week the Dow was down 3.27%, the S&P 500 was down 3.35%, and the Nasdaq 100 was down 3.34%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 0.78% for the week and is Above the Green Line, indicating Economic Expansion.

Bonds were up 0.08% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was up 0.33% for the week.

Crude Oil was down 0.13% for the week at $52.20 and GOLD was down 0.32% at $1850.30.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are currently in 3 logged Current Positions, for the Short & Medium Term. There are 7 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (Most of the Leaders are back up in the Weekly Red Zones.)

Buy the Leading Investments that are down near the Weekly Green Zones.

CBAY CYMABAY THERA. Buy if it Closes $6.73 on High Volume.

FDX FEDEX CORP. Buy if it Closes above the Daily Red Line on High Volume.

MJ MARIJUANA FUND Wait for the next Daily Money Wave Buy Signal.

PLG PLATINUM METALS GROUP Wait for the next Daily Money Wave Buy Signal.

ZM ZOOM VIDEO Buy when it Closes above $404.44 on High Volume.

______________________________________________________________________________________

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

New: My Trading Dashboard

Long Term Strategy for IRAs & 401k Plans

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

___________________________________________________________________________________________

4 Ways to Get your Daily Money Wave Alert:

- Emailed to your box between 3:40 3:50pm ESDT.

- Website menu Commentary/Buy/Sell Signals

- Twitter notifications are the fastest and most reliable: @AboveGreenLine

- Text messages: Email us your Cell number & phone carrier.

Thank you,

AGL