02/04/2018: Markets were down 3.5 - 4% for the week, as most of the Earnings are out, and profit Taking came in on the "Good News". Most of the Indices are back down in the Green Zone, so the Markets should re-test the Highs soon if they … [Read more...]

Archives for February 2018

Money Wave Alert! Feb 2, 2018

Markets dumped down today after the Long Term Bond made 8 month Lows. Lower Bond prices causes Interest Rates to rise. Most of the Indices are slowly returning to their Red Lines for a probable bounce. The S&P 500 is back down in the … [Read more...]

Money Wave Alert! Feb 1, 2018

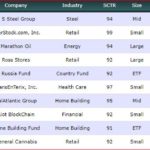

Markets were mixed today after "Gapping Down" on the opening. The S&P 500 is almost back down in the Green Zone, as pull-backs have been small. The Watch List above is growing as more Investments are correcting back down to their … [Read more...]