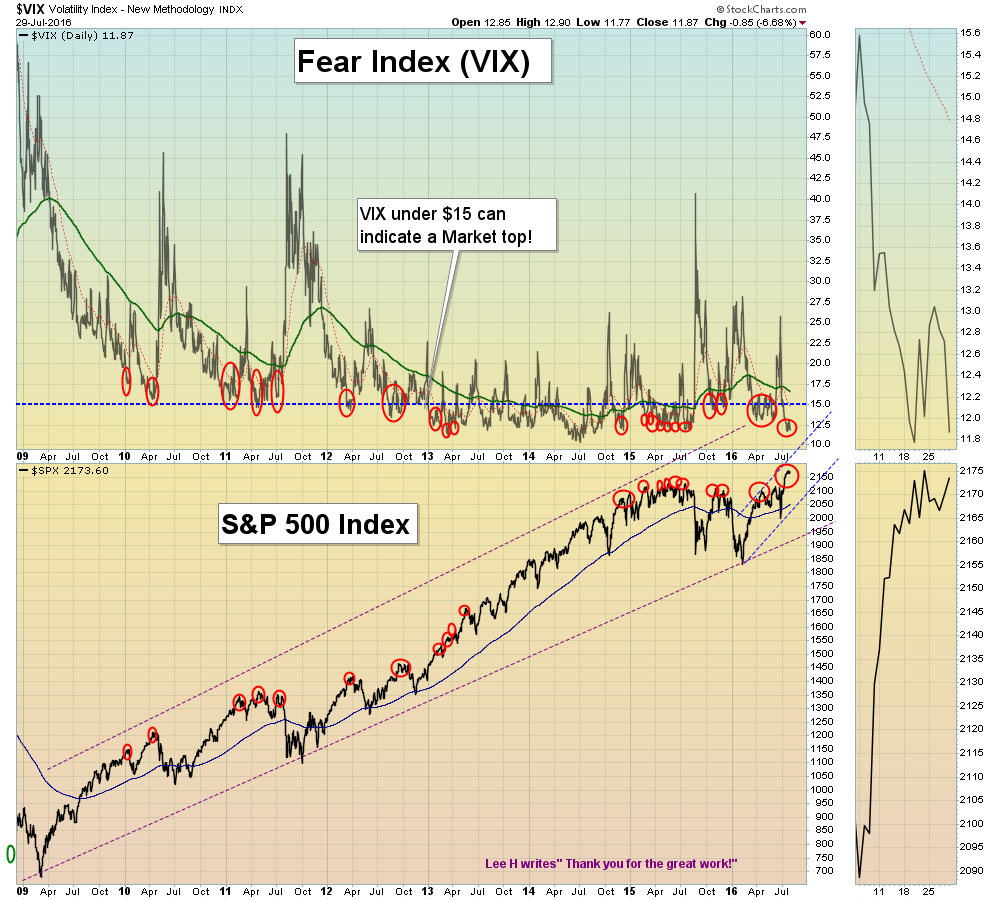

07/30/2016 Weekly Commentary: Markets were mixed for the week, but the S&P 500 is trying to hold above the Pink Line (10-day avg.). The Volatility Index is Below $13, which is NOT a good time to expect a Market rally.

The S&P 500 should drop down soon to test Support around 2130. Then it should have another bounce back up to re-test the current Highs. Bonds must make Higher Highs soon, or they will correct.

Gold & Gold Miners bounced off their Red Lines, and MUST make new highs soon to avoid a correction.

Crude Oil is going down to re-test the February Lows… Oil Stocks are not dropping much, telling us Oil could be bottoming soon.

Current Open Positions We sold NGD on Friday for an 18% gain in 3 days. Many Open Positions are in the Red Zones, so we have set tight Sell Stops. Please check here.

Money Wave Buys on Friday for NTDOY & OKE.

Many Funds are having trouble staying Above 90 Relative Strength.

When Markets are tired like they are now, either take quick gains from Money Wave Pops, or STAY IN CASH & WAIT for a larger correction.