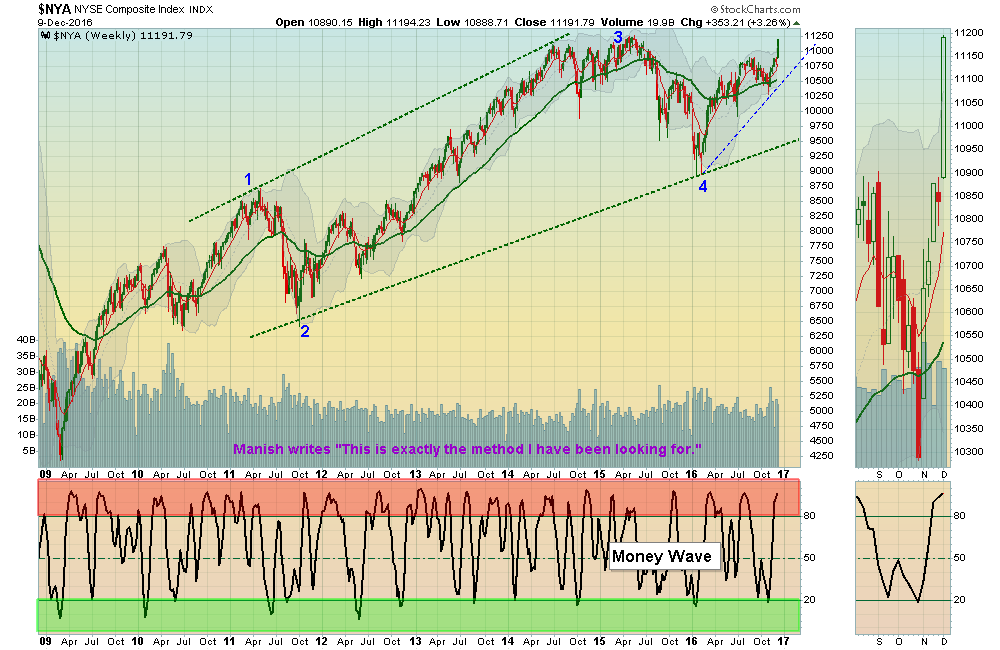

12/11/2016: Markets squirted up 3% this week, right before the FED is probably going to RAISE Fed Funds Rate… Why is nobody talking about the FED? Most are Excited about the Trump Rally, and are hopeful many problems will be fixed. What we KNOW is that the S&P 500 and US Dollar are Way Above the Green Line.

Bonds and Gold Miners are Way Below the Green Line. HOW DOES IT END? All will RETURN to the Green Lines… We just don’t know how far Investments will STRETCH from the Green Lines, before they snap back… The Stretching is temporary Human Emotion, which always fades over time. But Emotion give us Opportunities to Make Money.

The US Dollar is back up to the Highs, and might form a “Double Top” soon… If so, the Gold Miners might start up soon. There is FEAR in the Miners, as they have been correcting down 36% from the August highs. That is a lot, but remember, GDXJ had a run from $17 to $52 this year (205%), so a normal Wave 2 Correction is 38%. If the Elliott Wave count is correct, and GDXJ is going down on Wave 2, Wave 3 UP could go up to $91 from this low! Wait for strength and Buy Signal.

Please view the Leader List Charts for pending Money Wave Buys & Open Positions.

Money Wave Buys Soon: NONE.

Now is the time to RAISE CASH and WAIT for Money Waves Buys when they enter the Green Zones. We will email you when they are ready.

Click for Watch List

Click for Open Positions

Click for Closed Positions

Alert! Market Risk HIGH (Red Zone). The probability of successful Short Term Trades is lower, when the S&P 500 is Way Above the Green Line. Even the Strongest Funds can get chopped up. Either take quick gains from Money Wave Pops, or STAY IN CASH & WAIT for a larger correction.

Tell your Friend about us, and HELP ANIMALS.