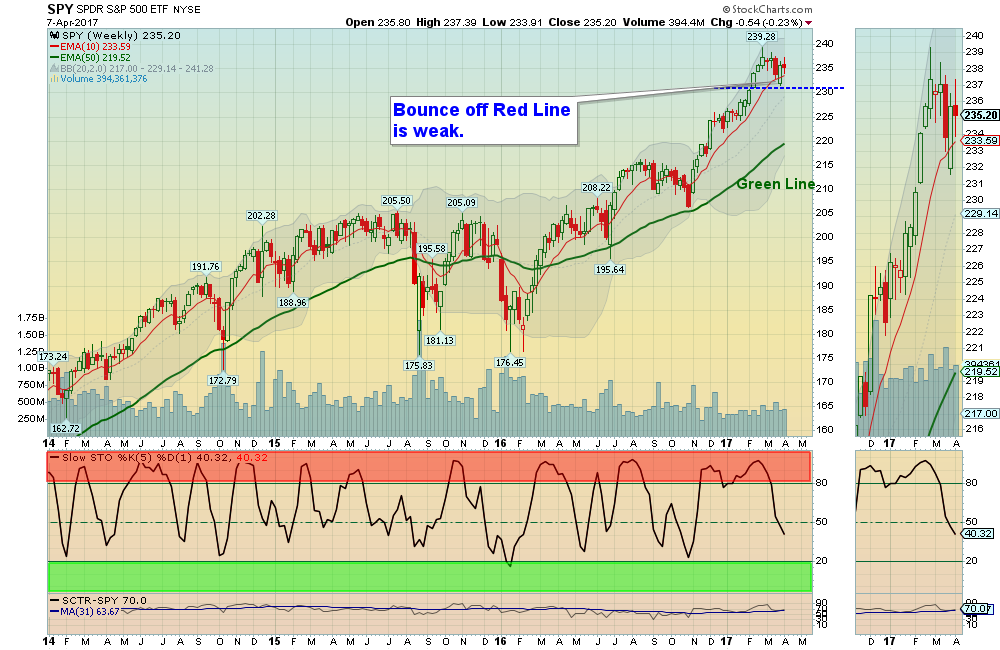

04/09/2017: Markets were down slightly for the week, as the weekly bounce of the major Indices off of the Red Lines was not impressive. Usually the bounce would quickly go back up to the Highs, or higher… Falling below the Red Line would indicate that the Correction has arrived.

Bonds are back up near Resistance Support, so probably not much movement anywhere until the Economy shows more speed, or slows down…

Crude OIL was up 2% for the week, but it needs to Close above $55.24 for a Bull to begin.

MONEY WAVE BUYS SOON: There are 2 Open Positions, and 10 Investments are on the Watch List.

ON DECK to Buy soon: Watch List.

Wait for GREEN ZONE BUYS. We will email or text when they are ready.

LONG TERM TRADES – We are looking for a good Entry Point for these, which could possibly Double:

DBC COMMODITY FUND Waiting for Break Out Above $16.08.

IPI INTREPID POTASH Waiting for Break Out Above $3.04.

JJC COPPER FUND Waiting on a Pull-back.

KOL COAL FUND Waiting for a Pull-back.

MDR MCDERMOTT INT’L. Waiting for Bounce Up & Above 90 Relative Strength.

UGA US GASOLINE FUND Waiting on Break Out Above $32.03.

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk (Yellow Zone). The probability of successful Short Term Trades is lower, when the S&P 500 is Way Above the Green Line. Even the Strongest Funds can get chopped up. Either take quick gains from Money Wave Pops, or STAY IN CASH & WAIT for a larger correction.

[s_static_display]

Tell your Friend about us, and HELP ANIMALS.

Question: Mike asks “When you say “you will not log the trade” what does that mean?

Thanks…”

ANSWER: Hi Mike, if the Reward / Risk is not 2:1 of better we will not log the trade (or count it in our Performance Record).

Some members want to see every mechanical Money Wave Buy Signal, but the Money Wave pops are usually only good for 3-5 % in the Short Term.

If a stock is already up >3%, we will normally not log the trade. Good trading, and tell your friends!