By ATGL

Updated February 28, 2025

The triple top pattern is one of the most reliable bearish reversal patterns in technical analysis. When properly identified, this formation can give you valuable insight into potential market direction changes and profitable trading opportunities.

What Is a Triple Top Pattern?

A triple top pattern is a technical chart formation that indicates a potential reversal from an uptrend to a downtrend. It consists of three distinct peaks at approximately the same price level, with moderate pullbacks between them. This pattern signals that despite multiple attempts, buyers cannot push the price beyond a specific resistance level, suggesting weakening bullish momentum and increasing bearish pressure.

The triple top is considered complete when the price breaks below the “neckline” — the support level formed by the troughs between the peaks. This confirmation signals that sellers have gained control and a new downtrend may be underway.

Technical analysts view the triple top as a powerful signal that an asset’s upward momentum has exhausted, providing you with a strategic opportunity to enter short positions or exit existing long positions.

Key Components of the Triple Top Pattern

Understanding the essential elements of a triple top pattern helps you identify genuine reversal signals and avoid false patterns.

The Three Peaks

The most distinctive feature of the triple top pattern is the three consecutive peaks that reach approximately the same price level. These peaks represent repeated failed attempts by buyers to push the price higher, demonstrating a clear resistance level. While the peaks don’t need to be exactly equal in height, they should be relatively close, typically within 1-2% of each other.

The Resistance Level

The horizontal line connecting the three peaks forms a significant resistance level. This price zone represents the point where selling pressure consistently overcomes buying pressure. Each time the price approaches this level, more sellers enter the market, preventing further upward movement.

Volume Considerations

Volume trends provide important confirmation for triple top patterns. Ideally, volume should decrease during the formation of the second and third peaks, indicating waning buying interest. Conversely, volume should increase significantly during the breakdown below the neckline, confirming strong selling pressure and pattern validity.

How the Triple Top Chart Pattern Forms

The triple top pattern typically develops after a sustained uptrend and follows a predictable sequence:

- Initial Peak: After a prolonged uptrend, the price reaches a new high but meets resistance and pulls back.

- Second Peak: Buyers attempt to resume the uptrend, pushing the price back toward the previous high. However, once again, they fail to break through the resistance, causing another pullback.

- Third Peak: In a final effort, bulls push the price to the resistance level one more time. The failure to break through for a third time strongly suggests that the uptrend has been exhausted.

- Neckline Break: The pattern is confirmed when the price falls below the support level (neckline) formed by the troughs between the peaks. This breakdown, especially when accompanied by high volume, signals that sellers have taken control.

This pattern represents the transition from a market dominated by buyers to one controlled by sellers, making it an important formation for identifying trends in stock charts.

Identifying the Triple Top Pattern

Accurately identifying a genuine triple top pattern requires attention to specific market conditions and timing considerations.

Recognizing Market Conditions

Triple tops typically form after sustained uptrends when buying momentum begins to wane. The pattern is more reliable when it appears at key resistance levels, such as previous historical highs or major psychological price points. You should also consider the broader market context — triple tops tend to be more reliable during market transitions or when fundamentals suggest potential trend changes.

Timing Entry Points

The most conservative entry strategy is to wait for confirmation of the pattern — specifically, a decisive break below the neckline with increased volume. Some traders use additional confirmation signals, such as a failed retest of the neckline from below or bearish candlestick patterns forming at the third peak.

It’s essential to distinguish the triple top from consolidation patterns or temporary pauses in an uptrend. False signals can be reduced by waiting for clear neckline breaks and using multiple timeframes to confirm the pattern development.

Trading Strategies for the Triple Top Pattern

Once identified, the triple top pattern offers several strategic approaches for traders.

Profit Targeting Methods

A common approach to setting price targets uses the height of the pattern. Measure the vertical distance from the resistance level (tops) to the support level (neckline), then project this distance downward from the neckline breakpoint. This measurement provides a minimum price objective for the downward move.

Alternatively, you can use Fibonacci retracement levels to identify potential support zones where the price might pause or reverse during its decline.

Stop-Loss Placement Techniques

Risk management is important when trading the triple top pattern. Conservative traders typically place stop-loss orders slightly above the third peak to protect against false breakdowns. More aggressive traders might place stops just above the neckline after it has been broken, allowing for potential retests while minimizing risk.

Position sizing should be determined based on the distance to the stop-loss, ensuring that potential losses remain within acceptable risk parameters. Like other trading patterns, the triple top requires disciplined execution of both entry and exit strategies.

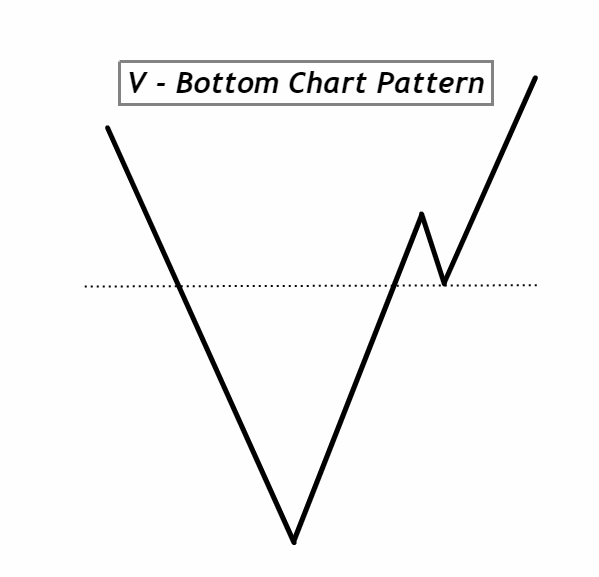

Comparing Triple Top and Triple Bottom Patterns

The triple top pattern has a bullish counterpart — the triple bottom pattern. While the triple top forms at market highs and signals potential downtrends, the triple bottom appears at market lows and indicates possible uptrends. Both patterns reflect the market’s struggle at key price levels and the eventual victory of either buyers or sellers.

The trading approach for triple bottoms mirrors that of triple tops, with the direction reversed. Triple bottoms are confirmed when the price breaks above the “neckline” resistance, with targets projected upward based on the pattern’s height.

Understanding both patterns enhances your ability to identify potential reversals in different market conditions. These formations share similarities with other patterns, like the Bear Pennant trading pattern, in terms of their significance for trend analysis.

Real-World Example of Triple Top Patterns

Traders have successfully used the triple top pattern to anticipate market reversals. For instance, in 2016, gold prices formed a triple top around Rs. 1350-Rs. 1375 but failed to break resistance. Once support at Rs. 1250 was breached, prices dropped significantly, allowing traders to profit from short positions.

The triple top pattern can provide valuable trading signals when properly identified and confirmed. By studying historical examples, you can improve their pattern recognition skills and better understand the behavioral dynamics that create these formations.

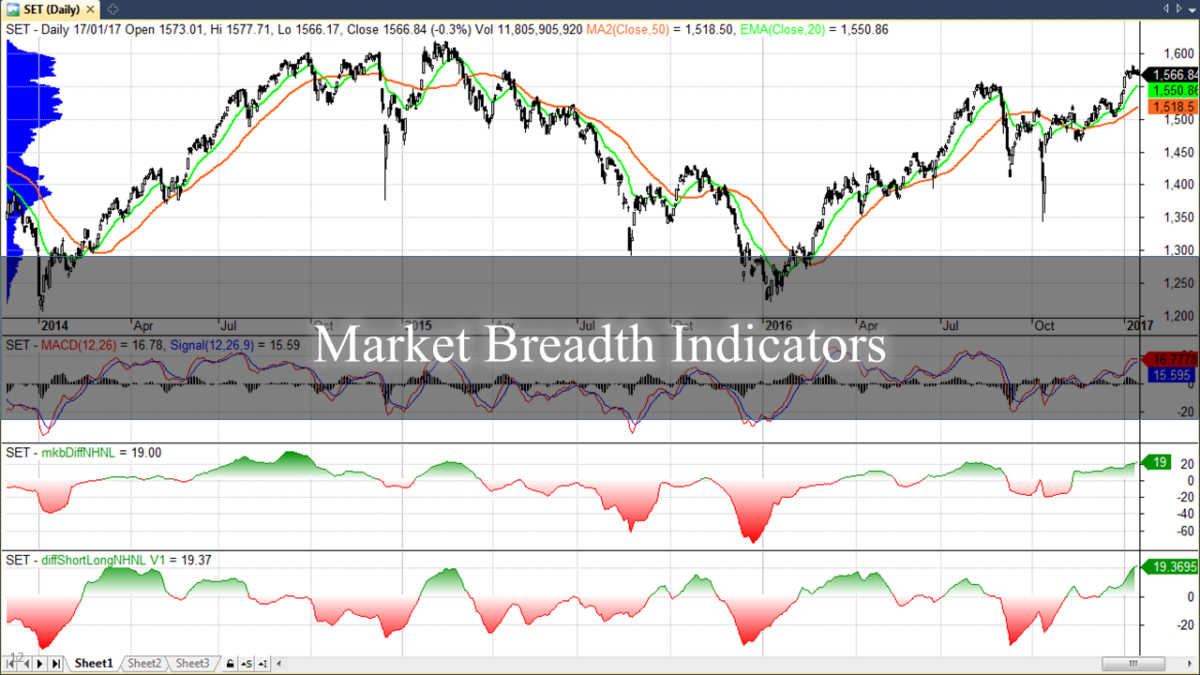

Utilizing the Triple Top in Market Analysis

The triple top pattern is most effective when used as part of a comprehensive trading strategy. Rather than relying solely on this pattern, experienced traders incorporate additional technical indicators such as RSI, MACD, or moving averages to confirm the reversal signal. This multi-faceted approach to drawing stock charts and analysis helps filter out false signals and improves trading outcomes.

Market context also matters significantly. Triple tops forming in securities with deteriorating fundamentals or in sectors experiencing broader weakness tend to be more reliable. Similarly, the pattern’s appearance at key resistance levels or during periods of increasing market volatility often enhances its predictive value.

Take your trading to the next level with our comprehensive trading courses and community support. Join Above The Green Line today and gain access to expert insights, real-time trading discussions, and advanced technical analysis training that will transform your approach to the markets. Become a member now and start your journey toward more consistent trading success.