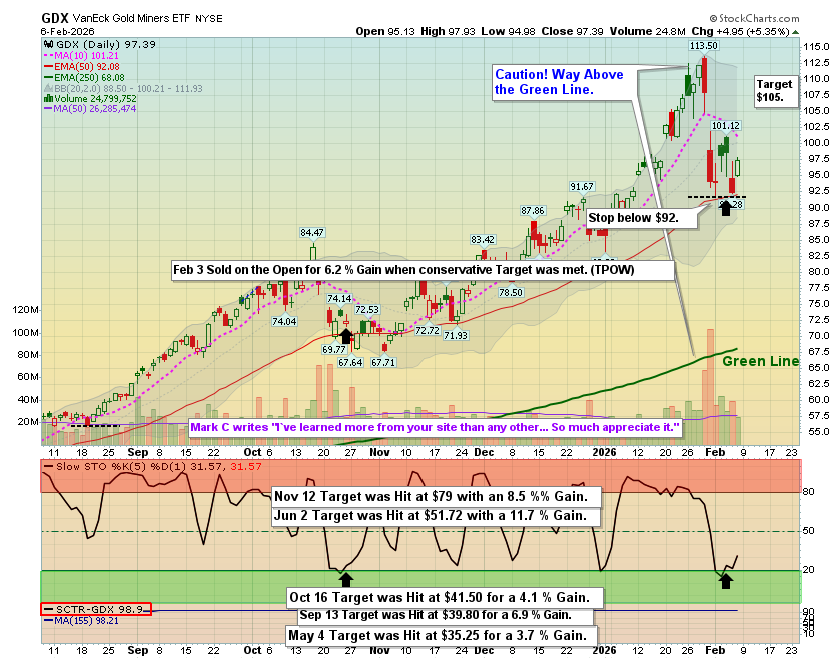

Last week’s Top Pick of the Week focused on GDX, the VanEck Gold Miners ETF, which was entered near $93.99 at the start of the week as price moved decisively above the Green Zone with confirming Money Wave momentum. The position was closed the following trading day near $99.79, producing a +6.17% gain. The exit occurred quickly by design — once the predefined objective was reached and short-term momentum began to level, the rules-based criteria signaled that the probability edge had been captured. Rather than remaining exposed to potential mid-week reversals, the strategy followed its discipline and stepped aside after strength materialized.

The technical structure behind the selection aligned cleanly with the ATGL methodology. Price cleared the trend threshold with expanding volume, Money Wave indicators supported continuation rather than exhaustion, and relative strength began to favor precious-metal equities. This convergence of signals created a high-probability swing window early in the week, which is precisely the type of setup the TPOW framework is designed to identify. The objective is not to predict how long a move will last, but to participate when structure aligns and exit when the rules indicate the initial momentum phase has run its course.

The broader market environment was characterized less by broad index movement and more by sector rotation and cross-asset volatility. Mid-week, cryptocurrency-linked equities experienced a sharp sell-off, which contributed to a temporary cooling of risk appetite and spilled into portions of the technology sector, particularly higher-beta growth names. While this did not produce a full market downturn, it did introduce caution and uneven performance across major indices. At the same time, capital rotated toward commodity-linked and defensive assets, which provided an additional tailwind for gold and gold-miner equities and reinforced the technical signals already present in GDX.

The S&P 500 (SPY) traded within a relatively narrow range throughout the week. After an early push higher, the index encountered resistance and moved into consolidation rather than establishing a decisive trend. This environment often underscores an important principle of the ATGL approach: strong index momentum is not required for individual opportunities to emerge. Even while SPY lacked clear directional conviction, internal market dynamics created selective strength in certain sectors, allowing technically aligned instruments such as GDX to outperform on a short-term basis.

Volatility increased modestly compared to the prior week, particularly as crypto-related weakness influenced sentiment. For swing-based strategies, this type of backdrop emphasizes the importance of predefined entry and exit rules. The rapid fulfillment of the trade objective early in the week helped avoid the later-week choppiness that affected many momentum-driven names. Last week’s outcome reinforced a core ATGL principle: we do not trade headlines — we trade structure. When Green Zone alignment, Money Wave confirmation, and sector rotation converge, disciplined participation — followed by equally disciplined exits — remains the foundation of consistent performance.