Correlation Coefficient

The Correlation Coefficient is a statistical measure of the strength of the relationship between the relative movement of two variables. The correlation statistics is used in both Finance and Investing. There are several types of correlation coefficients with the Pearson correlation (r) being the most common.

KEY TAKEAWAYS

- Correlation coefficients are used to measure the strength of the relationship between two variables.

- Pearson correlation is the one most commonly used in statistics. This measures the strength and direction of a linear relationship between two variables.

- Values always range between -1 (strong negative relationship) and +1 (strong positive relationship). Values at or close to zero imply weak or no linear relationship.

- Correlation coefficient values less than +0.8 or greater than -0.8 are not considered significant.

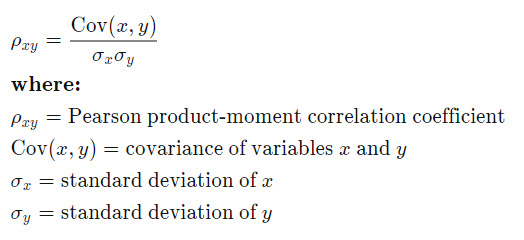

The calculation of the Pearson Correlation is given by the expression below.