Swing Trade Buy on the Close for Germany Fund $EWG, but the Volume is not high. … [Read more...]

Swing Trade Buy on the Close for Applied Digital $APLD, but the Volume is not high.

Swing Trade Buy on the Close for Applied Digital $APLD, but the Volume is not high. … [Read more...]

Money Wave Alert! Jun 23, 2025

The Top Pick of the Week: World Large Cap Fund $EFA was bought on the Open today, and will be Sold on the Close Friday. June 23, 2025 The Markets were higher today after dipping slightly in the morning. The S&P 500 Index popped up out of … [Read more...]

Money Wave Alert! Jun 18, 2025

June 18, 2025 Today the NASDAQ opened with a sideways to bearish tone, showing weak sentiment across the board. SPY continued its slow retracement toward the Banana Line, indicating potential mean reversion. SH, the inverse of SPY, formed a W … [Read more...]

Swing Trade Buy on the Close for D-Wave Quantum $QBTS, but the Volume is not high.

Swing Trade Buy on the Close for D-Wave Quantum $QBTS, but the Volume is not high. … [Read more...]

Buy Stop on $PL at $5.23 for scalp.

Related Post - Buy Stop on … [Read more...]

Buy Stop on

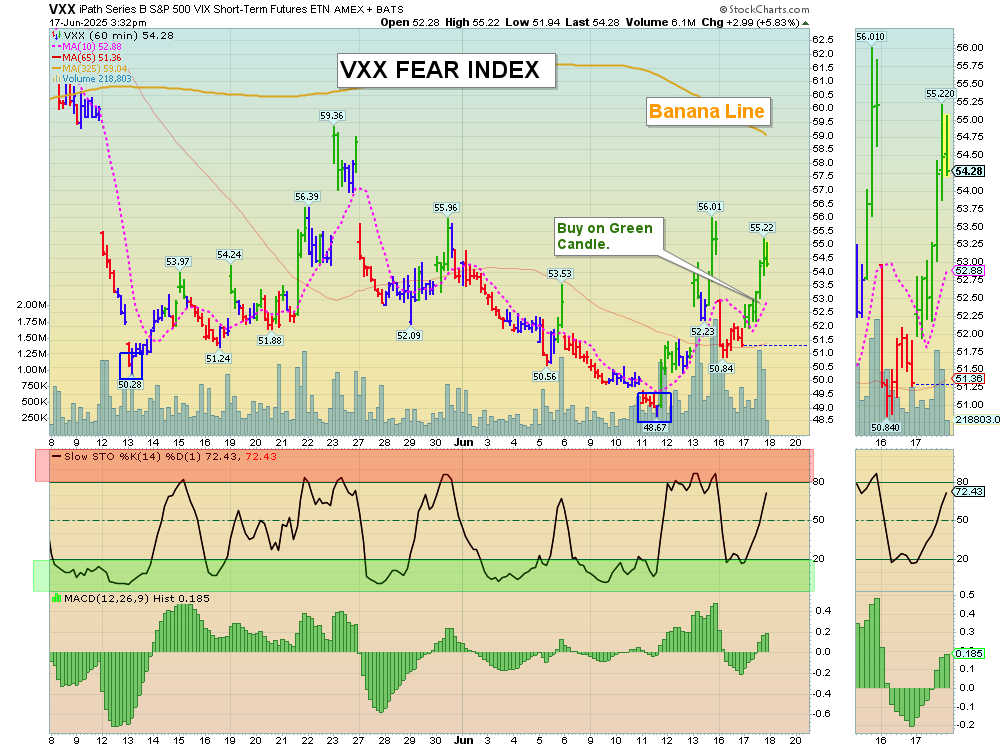

Related Post - Buy Stop on $VXX at $52.51 for a scalp. … [Read more...]

Target was Hit for Tapestry Inc. $TPR at $85 for a 23.4 % Gain (Long Term Portfolio).

Target was Hit for Tapestry Inc. $TPR at $85 for a 23.4 % Gain (Long Term Portfolio). … [Read more...]

Money Wave Alert! Jun 17, 2025

June 17, 2025 Today the NASDAQ opened bearish with clear downside pressure, showing weakness across major indices as SPY looked exhausted and formed a potential M pattern for mean reversion. Bitcoin also dipped, while war tensions and manipulative … [Read more...]

Money Wave Alert! Jun 16, 2025

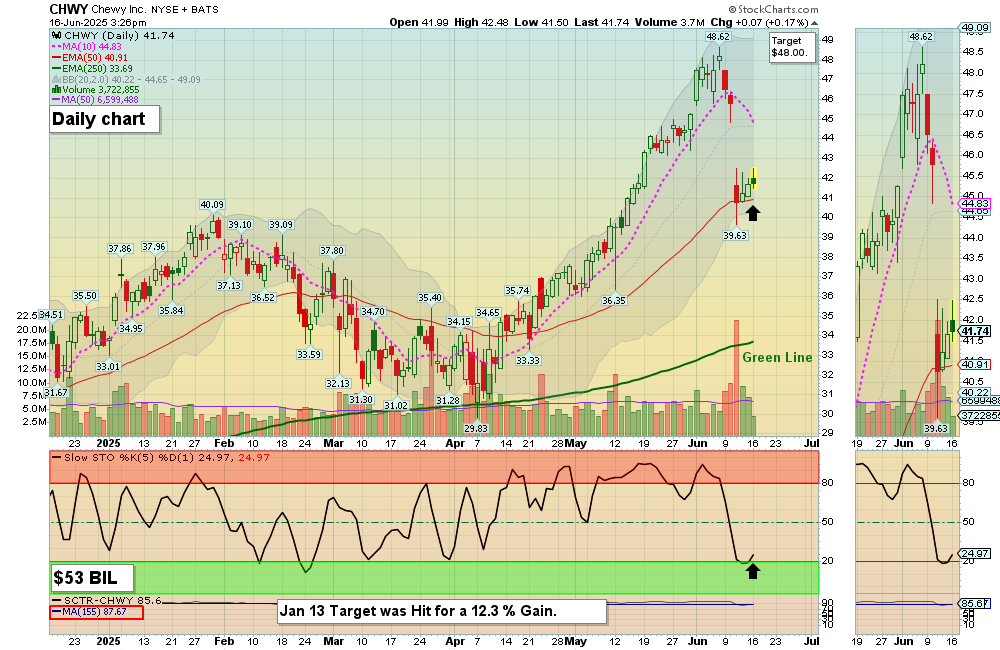

TOP PICK of the WEEK: Chewy Inc. $CHWY was Bought on the open today and will be sold on the Close Friday. June 16, 2025 Today, the NASDAQ opened with a bullish gap up, showing strong upside momentum as last Friday's fear eased off. Market … [Read more...]

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 363

- Next Page »