By ATGL

Updated December 23, 2024

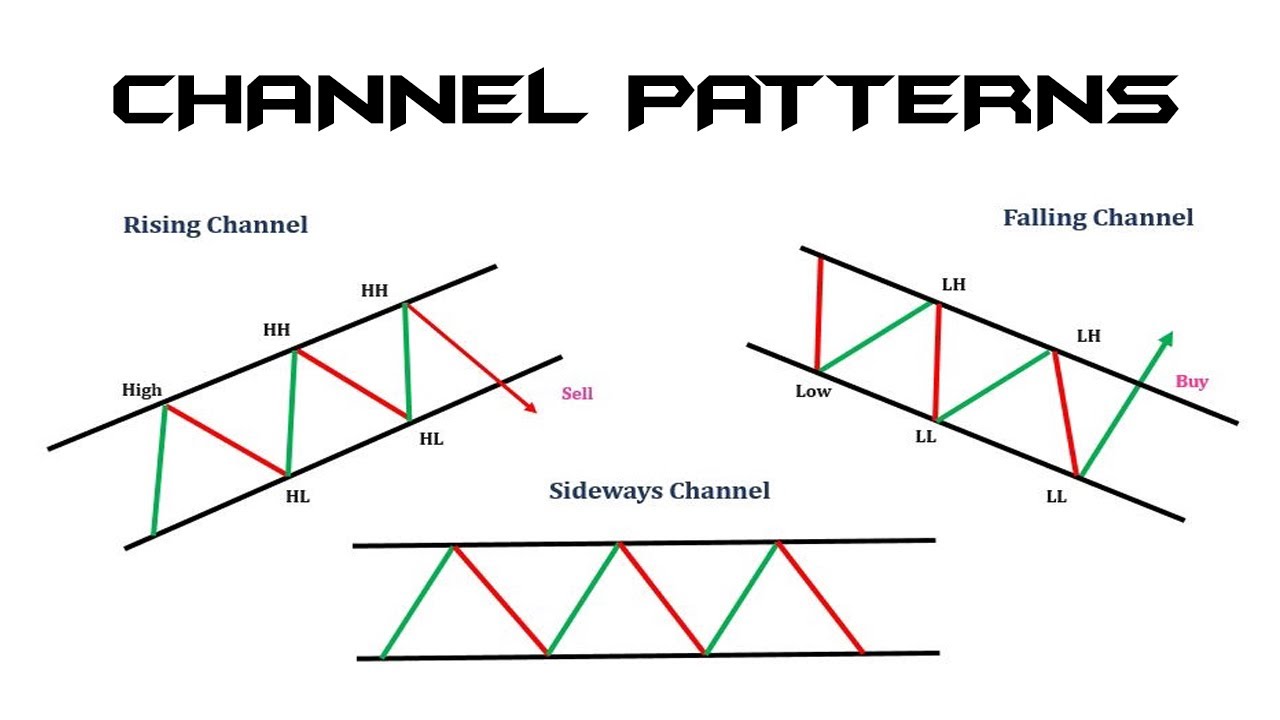

The rising wedge stock pattern represents a significant technical formation in financial markets, characterized by converging trendlines that slope upward as price action narrows. This pattern typically indicates exhaustion in an upward trend, making it valuable for traders seeking optimal exit points or potential shorting opportunities.

What Is a Rising Wedge Pattern and Why Does It Form?

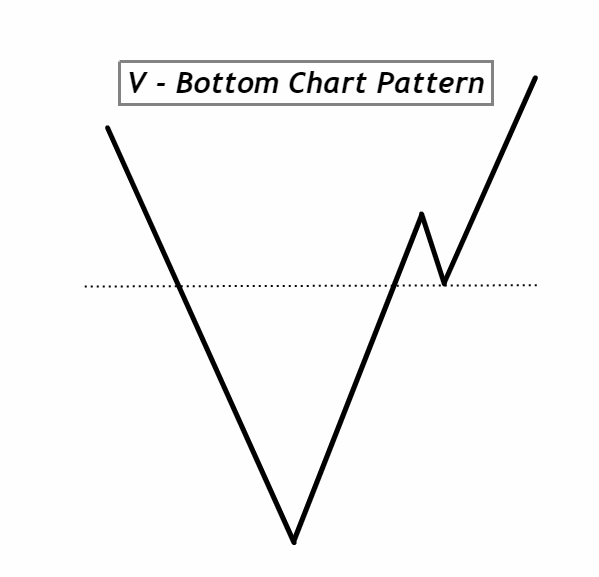

A rising wedge develops when price action creates higher highs and higher lows but with diminishing momentum as the pattern progresses. The upper trendline connects the higher highs, while the lower trendline connects the higher lows, both moving upward but at different angles that eventually converge.

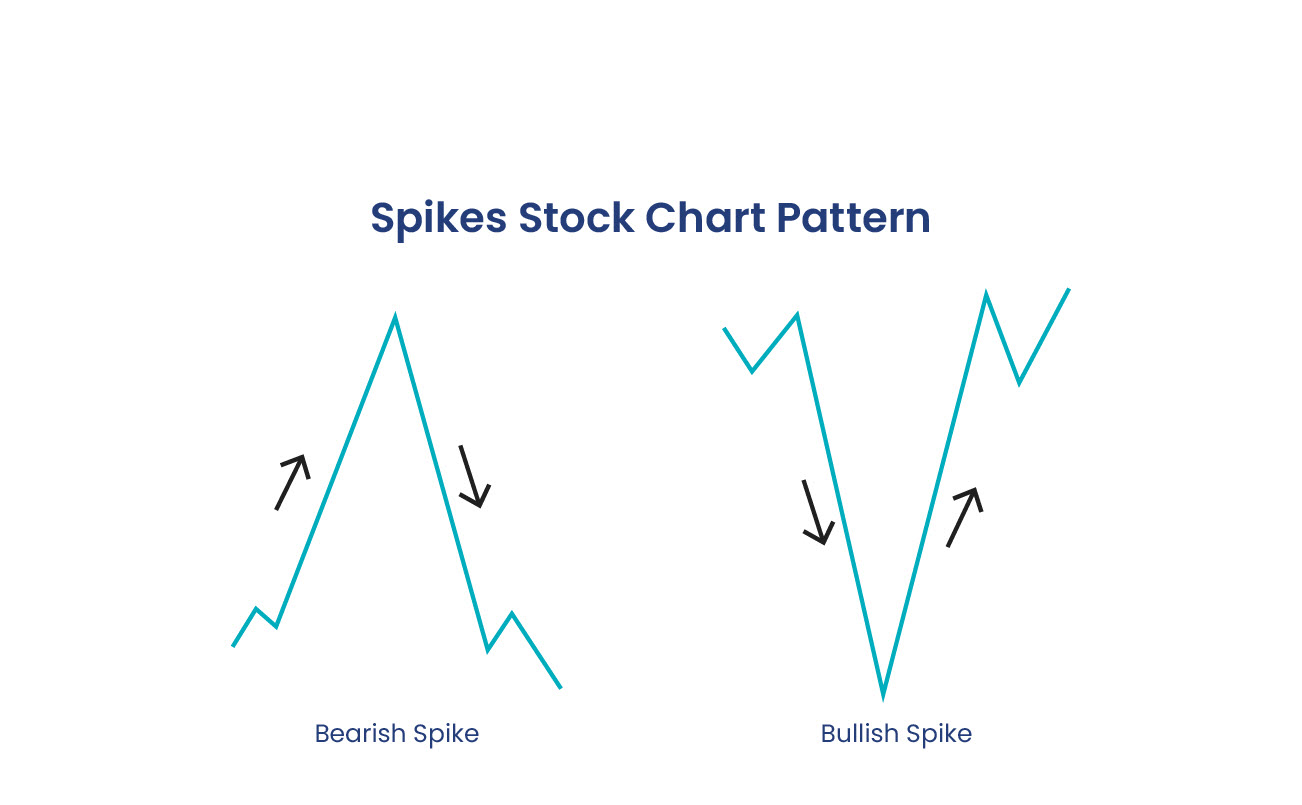

This formation often materializes during the later stages of an uptrend, signaling waning buying pressure. Unlike its counterpart — the falling wedge pattern, which forms during downtrends and suggests potential bullish reversals — the rising wedge typically precedes bearish price movements.

The pattern forms due to several market dynamics:

- Declining trading volume despite rising prices

- Reduced momentum in price advances

- Growing selling pressure meeting diminishing buying interest

- Technical resistance levels affecting price action

How To Identify a Rising Wedge Pattern

Chart Patterns To Look For

Recognizing a valid rising wedge requires attention to specific characteristics.

The price channel must display two converging trendlines sloping upward, with the lower trendline rising more steeply than the upper trendline. This compression reflects declining buying momentum and suggests potential selling pressure building within the trading pattern.

Trading volume typically decreases as the pattern develops, indicating reduced buyer conviction. This declining volume often precedes a breakdown, particularly when accompanied by bearish divergence in momentum indicators.

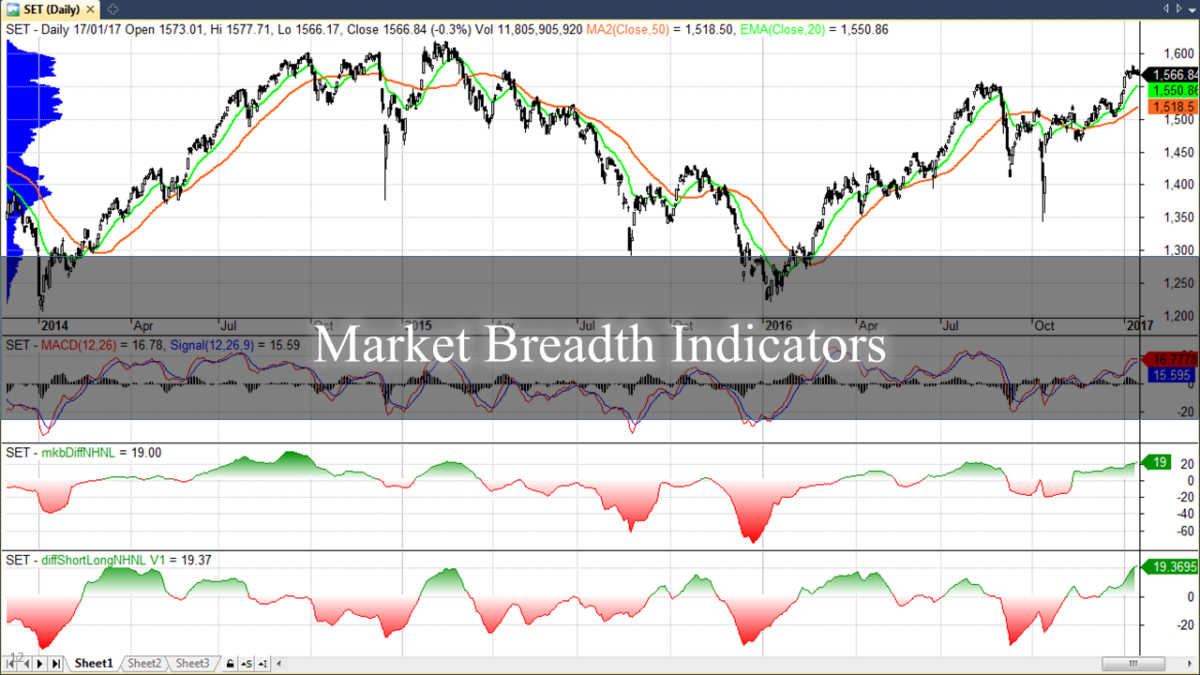

Indicators To Confirm the Pattern

Successful traders complement pattern recognition with technical indicators to validate potential trade setups, which include:

- Relative Strength Index (RSI): Watch for bearish divergence where price makes higher highs while RSI shows lower highs, suggesting weakening momentum.

- Moving Average Convergence Divergence (MACD): Declining MACD histogram bars or bearish crossovers can confirm weakening upward momentum.

- Volume Analysis: Decreasing volume during pattern formation, followed by increased volume during breakdowns, helps confirm pattern validity.

Trading Strategies Using Rising Wedge Patterns

Entry and Exit Points

Strategic trade execution requires precise entry and exit planning. Conservative traders often wait for a confirmed breakdown below the lower trendline before entering short positions. This approach may sacrifice some potential profit but provides higher probability setups.

Entry strategies include:

- Placing orders slightly below the lower trendline

- Using the previous day’s low as a trigger point

- Monitoring volume spikes for confirmation

Setting Profit Targets

Calculate profit targets using these methods:

- Measure the widest part of the wedge and project downward from the breakdown point

- Use previous support levels as target areas

- Apply Fibonacci retracement levels to determine potential reversal points

Utilizing Indicators Like MACD and Bollinger Bands

Combine multiple indicators to strengthen trading decisions:

Price Target = Breakdown Point – Pattern Height

This formula provides an initial target, but you should consider market context and support levels when planning exits.

Advantages and Disadvantages of Trading Rising Wedges

Understanding the strengths and limitations of trading rising wedge stock patterns proves essential for developing an effective trading approach.

Advantages

- Clear Visual Pattern Recognition: The rising wedge’s distinctive shape, with its converging upward trendlines, makes it visually identifiable on price charts. This visual clarity helps you spot potential setups more readily and reduces the likelihood of pattern misidentification.

- Defined Risk Parameters: The structure of rising wedges provides natural points for stop-loss placement, typically just above the upper trendline. This built-in risk management feature allows traders to establish precise exit points and calculate position sizes based on their risk tolerance.

- Multiple Confirmation Methods: Rising wedges offer various ways to validate trading signals through volume analysis, momentum indicators, and price action. This multi-faceted confirmation approach helps you build confidence in your trading decisions and reduce false signal risks.

- Versatility Across Time Frames: The pattern works effectively across different time frames, from intraday charts to weekly analyses. This flexibility makes it valuable for both short-term traders and longer-term position holders who can adapt their strategies when swing trading or position trading.

Disadvantages

- False Breakout Vulnerability: Rising wedges can experience fake-outs, where price temporarily breaks below the lower trendline before reversing upward. These false signals can trigger premature entries and lead to unnecessary losses if proper confirmation isn’t obtained.

- Time-Intensive Pattern Development: The formation of a complete rising wedge typically requires significant time to develop, often weeks or months. This extended development period can test your patience and tie up capital while waiting for pattern completion.

- Complex Volume Analysis Requirements: Proper interpretation demands careful attention to volume patterns throughout the formation. You monitor volume trends alongside price action, which adds complexity to the analysis process and requiring additional technical expertise.

- Market Context Dependency: Rising wedges don’t exist in isolation — their reliability depends heavily on broader market conditions, support/resistance levels, and overall trend context. This interdependence means you must develop a broader market understanding beyond simple pattern recognition.

- Timing Precision Challenges: Determining the exact moment of pattern breakdown can prove difficult, as the pattern often exhibits slow deterioration rather than sharp reversals. This gradual nature can complicate entry timing and potentially impact trade profitability.

Approach rising wedge patterns with realistic expectations and appropriate risk management strategies. Success in trading these patterns often comes from leveraging their strengths while implementing measures to mitigate their inherent weaknesses.

FAQs About Rising Wedge Chart Patterns

Is a Rising Wedge Pattern Bullish?

No, the rising wedge pattern typically indicates bearish reversal potential. While prices move higher during pattern formation, the converging trendlines suggest weakening buying pressure and an increased probability of downward movement.

What Happens After a Rising Wedge Pattern?

Following a rising wedge breakdown, prices often decline significantly. The typical measured move equals the height of the pattern projected downward from the breakdown point. However, market conditions and support levels influence the extent of the decline.

What Is the Difference Between a Rising Wedge and a Bull Flag?

Rising wedges show converging trendlines and declining momentum, while bull flags display parallel trendlines and maintain consistent price ranges. Bull flags represent continuation patterns, whereas rising wedges suggest potential reversals.

What Invalidates a Rising Wedge Pattern?

A rising wedge becomes invalid when:

- Price breaks decisively above the upper trendline

- Volume increases substantially during upward moves

- Momentum indicators show strong bullish signals

- Pattern structure loses its characteristic convergence

Trading Smarter: Lessons from the Rising Wedge Pattern

Mastering the rising wedge pattern requires understanding both its technical aspects and practical applications. Success stems from combining pattern recognition with proper risk management and confirmation signals.

Take your trading to the next level with Above the Green Line’s comprehensive trading education and analysis tools. Our membership programs provide advanced pattern recognition training, real-time market analysis, and professional guidance to help you identify and trade these patterns effectively.

Learn more about our membership benefits and start improving your trading results today.