By ATGL

Updated April 23, 2025

In the exhilarating world of trading, finding the right tools to make informed decisions can feel like searching for a needle in a haystack. Among these tools, the Relative Strength Index (RSI) emerges as a beacon for traders aiming to decipher market trends and forecast potential reversals. Developed by J. Welles Wilder Jr., the RSI is a momentum oscillator that measures the speed and change of price movements, helping traders identify when markets might be overbought or oversold.

Understanding how to spot these critical points can significantly impact trading strategies and outcomes. By grasping how the RSI is calculated and interpreted, traders can enhance their ability to predict market movements and make more informed decisions. With topics ranging from RSI calculations to practical applications and enhancing its accuracy, this article aims to equip you with the insights needed to leverage RSI effectively in your trading endeavors.

What Is the Relative Strength Index?

The Relative Strength Index (RSI) is a popular momentum oscillator developed by J. Welles Wilder Jr. It was introduced in his 1978 book, New Concepts in Technical Trading Systems. The RSI measures the speed and size of price movements in a security. It helps determine whether a market is overbought or oversold, providing valuable insights into potential price reversals.

The RSI is plotted on a scale from 0 to 100. Values above 70 suggest overbought conditions, indicating a potential price correction. Conversely, values below 30 indicate oversold conditions, signaling a potential upward price movement. This technical indicator is a powerful tool for traders to analyze price trends and forecast potential reversals or continuations.

Traders use the RSI to identify overbought and oversold conditions in financial markets. This allows them to make informed trading decisions. Here is a quick reference list:

- Above 70: Overbought

- Below 30: Oversold

By analyzing these levels, traders can anticipate potential price adjustments and align their strategies with market trends. The RSI offers a straightforward way to assess market conditions and improve trading outcomes.

How to Calculate the Relative Strength Index (RSI)

To calculate the Relative Strength Index (RSI), you begin by selecting a timeframe, such as the common default of 14 periods. This timeframe can be adjusted for different trading strategies, with shorter periods making RSI more responsive, while longer periods reduce sensitivity. Next, calculate the average gain and average loss over the chosen period.

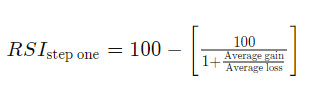

Divide the average gain by the average loss to find the Relative Strength (RS). With RS in hand, apply this to the RSI formula:

[ \text{RSI} = 100 – \frac{100}{1 + \text{RS}} ]

This formula converts the calculation into an oscillating index ranging from 0 to 100. Typically, an RSI value above 70 suggests the asset may be overbought, while a value below 30 indicates it could be oversold. Traders often use smoothing techniques like Wilder’s Moving Average to refine the average calculations and better spot potential reversal points.

By combining RSI with other indicators like the StockCharts Technical Rank (SCTR), traders can evaluate a stock’s momentum and strength, enhancing technical analysis through a comprehensive view of price movements.

How to Read the Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a valuable momentum oscillator that helps traders assess price momentum. It’s usually displayed below an asset’s price graph. Here’s how to read RSI effectively:

- Overbought Conditions: An RSI reading above 70 may indicate an overbought condition. This suggests a potential market decline.

- Oversold Conditions: A reading below 30 often signals oversold conditions. It can hint at a possible rebound.

- Trading Range Effectiveness: RSI shines in range-bound markets, assisting traders in finding optimal entry and exit points by evaluating market strength against an asset’s price history.

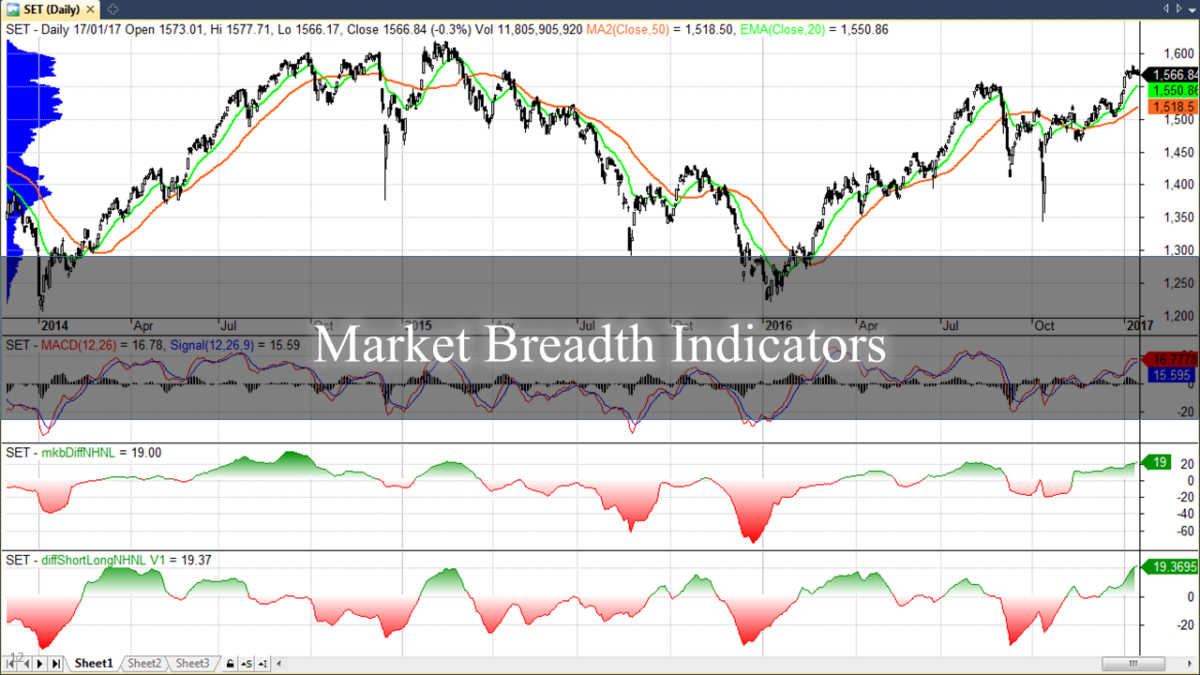

- Combine with Other Tools: Pair RSI with other technical indicators like MACD to refine trading decisions.

- Pairing RSI with trading divergence combined with MACD offers traders a more nuanced view of momentum shifts, particularly when RSI and MACD both show signs of reversal against price trends.

- Failure Swings: A failure swing occurs if RSI doesn’t maintain a previous high or low. This may suggest a potential reversal, alerting traders to prepare for market shifts.

Here’s a simple table for reference:

| RSI Reading | Market Condition |

|---|---|

| Above 70 | Overbought |

| Below 30 | Oversold |

Understanding these signals can help traders make informed decisions in financial markets.

How RSI Signals Market Reversals

The Relative Strength Index (RSI) is a crucial tool for spotting market reversals. RSI levels above 70 suggest overbought conditions. This can indicate a potential market reversal if the RSI then moves back below 70. Conversely, when RSI readings fall below 30, assets are considered potentially oversold. This suggests conditions for a market reversal if the RSI starts to rise.

Traders often wait for these movements as confirmation of a shift in momentum. They look for the RSI to drop back below 70 or rise above 30 before acting. These levels indicate a change, signaling traders to potential buying or selling opportunities.

RSI divergences occur when price and RSI move in opposite directions. This can be a warning of a potential market reversal. However, in strong trends, these signals might not immediately result in a turnaround.

The RSI works best in range-bound markets. Here, the oscillation between support and resistance effectively highlights potential reversal points. Understanding these signals can provide traders with valuable insights for making informed decisions.

Practical Applications of RSI

The Relative Strength Index (RSI) is a powerful tool in technical analysis. It measures the speed and change of price movements, allowing traders to spot potential overbought and oversold conditions. Here’s how to apply it:

- Identifying Overbought and Oversold Levels:

-

- Readings above 70 suggest overbought conditions. This may hint at a downward reversal.

-

- Readings below 30 indicate oversold conditions, signaling a possible upward reversal.

- Spotting Divergences:

-

- Bullish Divergence: Occurs when prices hit new lows, but RSI forms higher lows. This indicates a potential price increase.

-

- Bearish Divergence: Happens when prices reach new highs, but RSI shows lower highs. This signifies a potential price drop.

- Entry and Exit Strategies:

-

- Use RSI in conjunction with other indicators like CCI and stochastic to enhance accuracy.

-

- Spotting double tops or bottoms through RSI can provide entry or exit signals.

Properly interpreting RSI enables traders to align their strategies with market trends, ensuring informed trading decisions. Always consider combining RSI readings with other tools for the best results.

How to Enhance the Relative Strength Index Accuracy

To enhance the accuracy of the Relative Strength Index (RSI), it’s essential to combine it with other technical indicators like moving averages and the MACD. This approach minimizes false signals and confirms market trends. RSI becomes far more effective when used alongside complementary technical indicators for trading, allowing traders to confirm signals across different analytical perspectives and improve confidence in decision-making.

The standard overbought and oversold levels of 70 and 30 might not suit all instruments and timeframes. Adjust these levels according to the specific market conditions for more precise readings.

Avoid using RSI in isolation. Pair it with price action analysis and other confirming indicators. This strategy provides a more holistic view of market movements.

Recognizing divergence between RSI and price action is key. Divergences can indicate potential trend reversals, making your analysis more reliable.

Typically, RSI uses a 14-day period to average gains and losses. Adjusting this period can refine its assessment of price momentum to fit longer or shorter trading styles.

Combination of RSI with Other Indicators:

- Moving Averages

- MACD

- Price Action Analysis

Applying these strategies will make the RSI a more powerful tool in your technical analysis arsenal, providing valuable insights into potential trend reversals and strong trends.

Understand the RSI for Better Trading

The Relative Strength Index (RSI) is a powerful tool in technical analysis. It offers valuable insights into market conditions and potential trend reversals. Traders often use the RSI to identify overbought and oversold levels, which could signal buying and selling opportunities.

Understanding RSI levels is crucial. A crossover below 30 typically indicates oversold conditions. In contrast, a crossover above 70 suggests overbought conditions. These levels can highlight potential entry and exit points for trades.

Divergences play an important role in RSI analysis. When the RSI moves in the opposite direction of the price action, it may indicate a potential trend reversal. This divergence signals a possible change in market trends. RSI analysis is frequently used in stock charts investing strategies to visualize momentum signals and spot potential entry or exit points in a visual, data-driven format.

For effective use, RSI should be combined with other technical indicators. By adopting risk management strategies, traders can enhance their trading decisions. This approach helps avoid false signals and supports making more informed trades.

In summary, the RSI is a momentum oscillator that provides insights for various trading styles. By mastering how to read and calculate RSI, traders can better navigate financial markets and seize opportunities. Join Above the Green Line today and learn how to spot overbought and over sold conditions.