The Markets popped back up to the Highs this morning on higher Oil, but are now weakening. The NAZ and Small Caps are down. The S&P 500 is holding above the August High of 2194 . More Money Wave Buy Signals soon.

Money Wave Buys soon!

The Following Investments will probably have a Money Wave Buy Signal

(Slow Stochastic Closing > 20) on today’s Close.

None Today

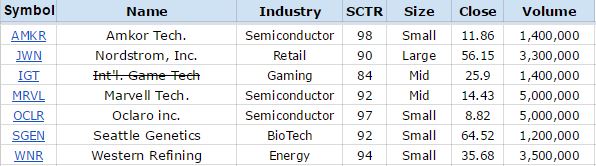

ON DECK: AMKR MRVL OCLR SGEN WNR

WAIT for Money Waves Buys soon coming out of the Green Zones. We will email you when they are ready.

Click for WATCH LIST

Click for STOCKCHARTS LIST

Click for OPEN POSITIONS

Many like to buy the day before, if the Investment has not popped up too much.

Money Wave Buys are usually good for a 3-6 % move in a few days.

About 1/3 of the time, the Money Wave Buys will result small losses, so please use a Sell Stop Loss after all Buy orders.