Markets were sharply lower today as Commodities dumped from over tightening by the FED. It is obvious to most investors that the Economic Slow Down could get worse, and the Markets are dumping down to force the FED walk back their “hawkish” tightening rhetoric.

Crude Oil, Steel, Copper Gold, Silver. Rare Earth, Agriculture are all now Below the Green Lines, indicating Inflation has peaked. Soon the FED will probably admit their error of tightening too much (like they did in 2018) and make an announcement about revising their strategy.

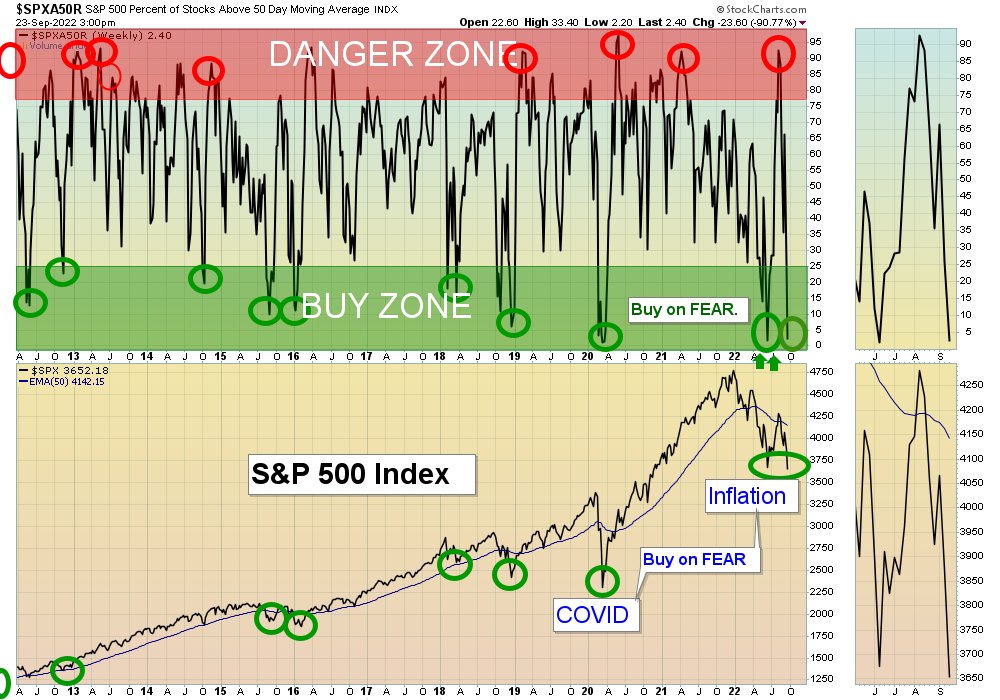

The Indices are back down to the June lows (Support), where they bounced up 19 % from being over-sold on FEAR. We are lowering the Sell Stops and not Selling anything down here in the long term Green Zone (see chart above). Smart Money sold up in the Red Zone in August, and should be Buying soon near Support and in the Green Zone.

Please be patient and wait for Buy Signals for Securities that are still Above the Green Lines. BUYS SOON – CHARTS The best moves are when the S&P 500 Index is also coming up out of the Green Zone (very soon).

_________________________________________________________________________________________________________________

BUYS TODAY 9/23/02022 NONE TODAY

BUYS TOMORROW

CPRX CATALYST PHARMA. Wait for Money Wave Close > 20 with High Volume.

ENVX ENOVIX CORP. Wait for Money Wave Close > 20 with High Volume.

Shop for a better price earlier in the day with Triple Buy Signal, on the same day that a Daily Money Wave Buy Signal will occur.

BUYS SOON

GERN GERON CORP. Wait for Money Wave Close > 20 with High Volume.

SIGA SIGA TECH. Wait for Money Wave Close > 20 with High Volume.

UNG US NAT’L. GAS FUND Wait for Money Wave Close > 20 with High Volume.

XOM EXXON MOBILE CORP. Wait for Money Wave Close > 20 with High Volume.

Please be patient and Wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

SELLS TODAY

ARRY ARRAY TECH Lower Sell Stop Loss below the Green Line of $16.00 until it bottoms.

CAH CARDINAL HEALTH LOWER the Sell Stop Loss below $64.00 until it bottoms.

OXY OCCIDENTAL PETE LOWER the Sell Stop Loss below $58.00 until it bottoms.

PBR PETROBRAS ENERGY LOWER the Sell Stop Loss below $12.25 until it bottoms.

XLU UTILITIES FUND LOWER the Sell Stop Loss below $70.85 until it bottoms.

XME METALS & MINING FUND LOWER the Sell Stop Loss below $40.00 until it bottoms.

__________________________________________________________________________________________________________

DAY TRADING SETUPS. A few Triple Buy Pops today: LABD (+10%) (TZA (+9%) & SOXL (+9%). ( Try out the New Side by Side layout.

DAY TRADING FOR INDICES & LARGE CAPS CHARTS.

Bonds were down today and are Way Below the Green Line.

Crude Oil was down $4.52 today at $78.97.

MY TRADING DASHBOARD

SWING TRADING CURRENT POSITIONS

DAY TRADING SETUPS

TRADE ALERTS

GREEN LINE CHARTS AT STOCKCHARTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

GREEN LINE RULES

ETF SECTOR ROTATION SYSTEM

New TOP 100 LIST Updated Sep 1, 2022

Many like to Buy the Swing Trades just before the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and up out of the Green Zone). Don’t Buy if the Security has already popped up too much. Money Wave Buy Signals are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

HAVE A NICE WEEKEND!

Related Post

– CPRX