Watchlist and Charts to Buy Soon.

| Daily Swing Watch List | Daily Swing Charts to Buy |

| Current Swing Positions | Current Swing Charts |

| Closed Results | Trading Dashboard |

Current Pick and Chart

| Top Pick of the Week | TPOW Stock Chart |

This week’s TPOW is Hims & Hers Hearth HIMS again this week, since we held from last week. It’s slightly up today.

March 31, 2025,The Nasdaq market showed mixed movement today, with overall weakness but signs of potential recovery. SPY gapped down, forming a double bottom, and started retracing back up. Meanwhile, VIX spiked 16%, signaling heightened fear in the market. Despite this, VIX made a lower low, suggesting fear might soon stabilize, bringing strength back. While the market wasn’t strong today, we see this as an opportunity to capitalize. Soon, we expect a bullish move as stability returns.

We will hold our Positions until this Fear Flush is over (W pattern).

Wait for more Buy Signals coming up out of the Green Zones. CHARTS The best moves happen when the S&P 500 Index is also coming up out of the Green Zone. ______________________________________________________________________________

ETF SECTOR ROTATION SYSTEM The 1st Quarter will end today and we will Sell all 5 ETF Positions on the Close. The 5 new ETFs to Buy on Tuesday Apr 1 will be SPY – S&P 500 Fund, QQQ – NASDAQ 100 Fund, XLF – Financial Fund, SLV – Silver Fund, and GDX – Gold Miners Fund. Or you can replace XLU with XLU on Tuesday’s Close and allocate 20% into each Fund for the quarterly rotation.

______________________________________________________________________________

BUYS TODAY 3/31/2025

TUYA TUYA INC. Swing Trade Buy on the Close today, but the Volume is not high (2 Star trade).

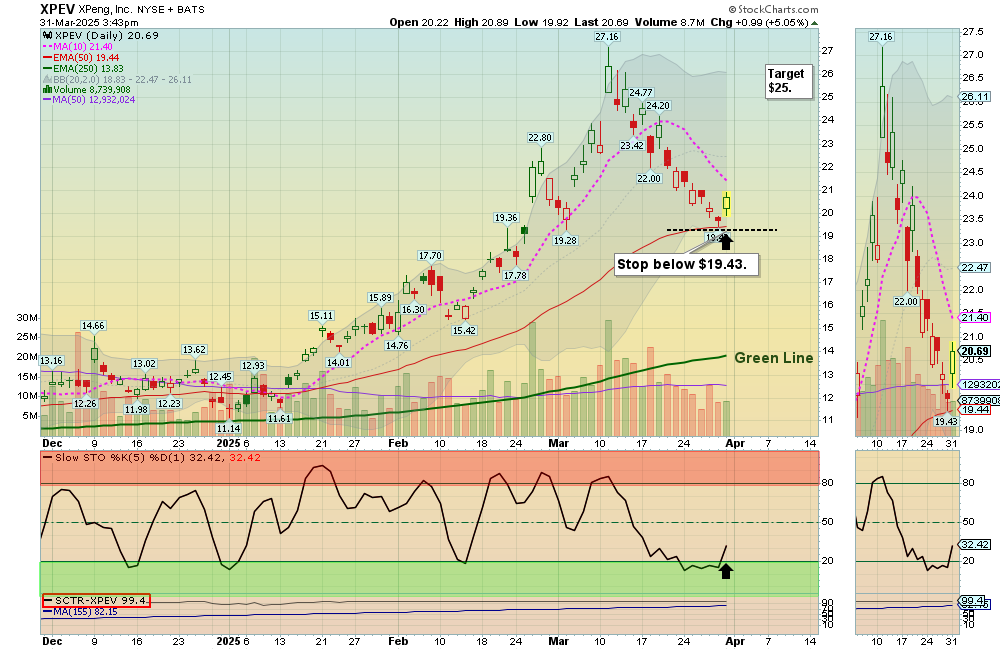

XPEV Xpeng Inc-ADR. Swing Trade Buy on the Close today, but its already up 5% (2 Star trade).

BUYS SOON

ERJ Embraer SA. Wait for next Daily Money Wave Close > 20 with High Volume.

EWG GERMANY FUND Wait for next Daily Money Wave Close > 20 with High Volume.

QBTS D-WAVE QUANTUM Wait for next Daily Money Wave Close > 20 with High Volume.

PLTR Palantir Technologies Inc. Money Wave must Close in the Green Zone.

Shop for a better price earlier in the day with Green Candle Buy Signal, on the same day that a Daily Money Wave Buy Signal will occur.

Many like to Buy the Swing Trades just before the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and up out of the Green Zone). Don’t Buy if the Security has already popped up too much. Money Wave Buy Signals are usually good for a 3-6 % move in a few days.

SELLS TODAY

GILD GILEAD SCIENCES Slipped down to the Buy Price and was Stopped Out even.

_____________________________________________________________________________

DAY TRADING SETUPS. Today we had 10 tiny scalp trades for nice Gains at our Trading Room. In this Emotional Market now, Day Trading Alerts are not being sent out on our Discord Site with Live Chatting. Please install Discord app on your PC or cell for mobile notifications. Check out our Live Stream.

Or look for Green Candle Buy Pops (Red Candle turns Green). Big Movers today: SQQQ + 7% GRRR +15% SOXS +6%

Bonds were up today and are Above the Green Line.

Crude Oil was up $2.12 today at $71.47.

MY TRADING DASHBOARD

SWING TRADING CURRENT POSITIONS

DAY TRADING SETUPS

TRADE ALERTS

STAGE CHART INVESTING

GREEN LINE CHARTS AT STOCKCHARTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

GREEN LINE RULES

ETF SECTOR ROTATION SYSTEM

Updated TOP 100 LIST Updated Mar 1, 2024

Important Links

Top 100 Stage Chart Investing CNN Fear & Greed Index

Dividend Growth Portfolio ETF Sector Portfolio Dogs of the Dow

Long Term Strategy Stage Chart Investing Articles

* Safer Trades that meet ALL three criteria will be classified as 3 STAR, while trades that only meet two of the three criteria will be flagged as 2 STAR (more risk).

Related Post

– ERJ