Markets were up slightly again today as the S&P 500 Index was able to Close above Resistance of the Pink Line (10-day avg.) of 2780.

The high yielding, big Dividend Investments are slow, but are chugging up to new Highs.

The Leaders are popping up out of the Green Zones for Money Wave Buy Signals. The best trades usually happen now when the S&P 500 Index is also coming up out of the Green Zone.

Please be patient and WAIT for Money Wave Buy Signals.

Crude Oil was up $0.15 today at $56.95.

__________________________________________________________________________________________________

The Following Investments will probably have a Money Wave Buy Signal soon.

(Slow Stochastic Closing > 20) on today’s Close.

BUYS TODAY

CIEN CIENA CORP. Money Wave Buy today. Target is $44.00. EXIT if it is going to Close below Support of $37.69.

Money Wave Buys Signals Soon: (Best to Buy when the S&P 500 is also in the Green Zone.)

AVP AVON PRODUCTS

CGC CANOPY GROWTH Money Wave must Close in the Green Zone.

CYH COMMUNITY HEALTH

LLY ELI LILLY & CO. Money Wave must Close in the Green Zone.

SBUX STARBUCKS CORP.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Click on Watch List.

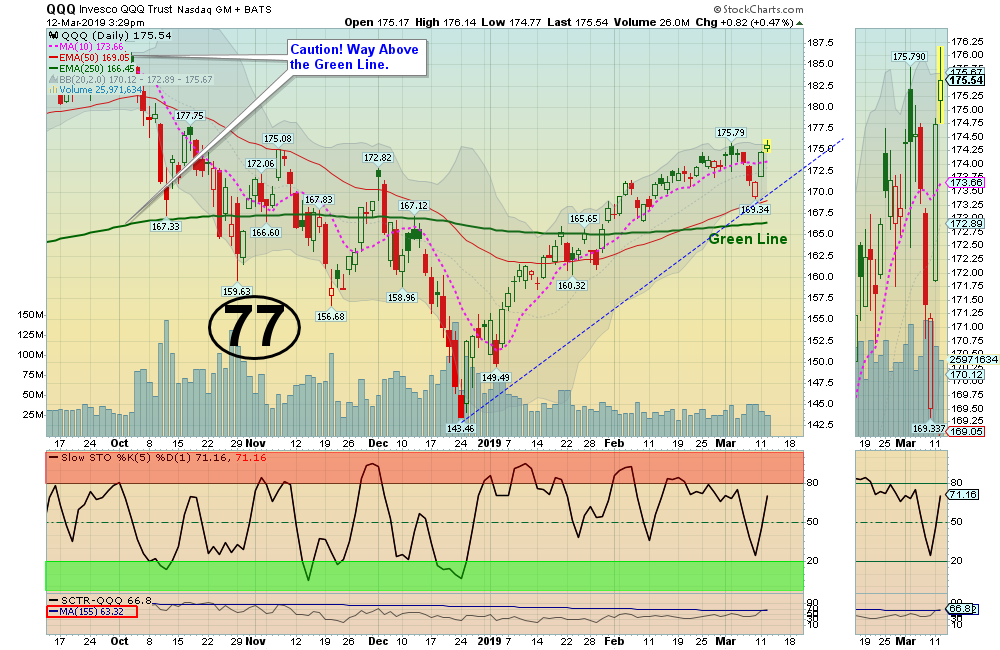

Emotions are very high now, so please do not Buy unless you are VERY NIMBLE. The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

______________________________________________________________________________________

SELLS TODAY

EXIT VHC VIRNET X HOLDING if it is going to Close below the Pink Line around $6.09 on the Close. This trade was not logged.

Please Check PORTFOLIO (Open Positions) and adjust your Sell Stops.

Click for CLOSED POSITIONS.

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1.