Markets were higher today as the Indices were able to go above Wednesday’s High. Even the DOW 30 Index was able to make a New High, but the Small Cap Index is struggling to get above the 50-day average. Volume was low and the weaker Buying is keeping most the Money Wave Pop trades small.

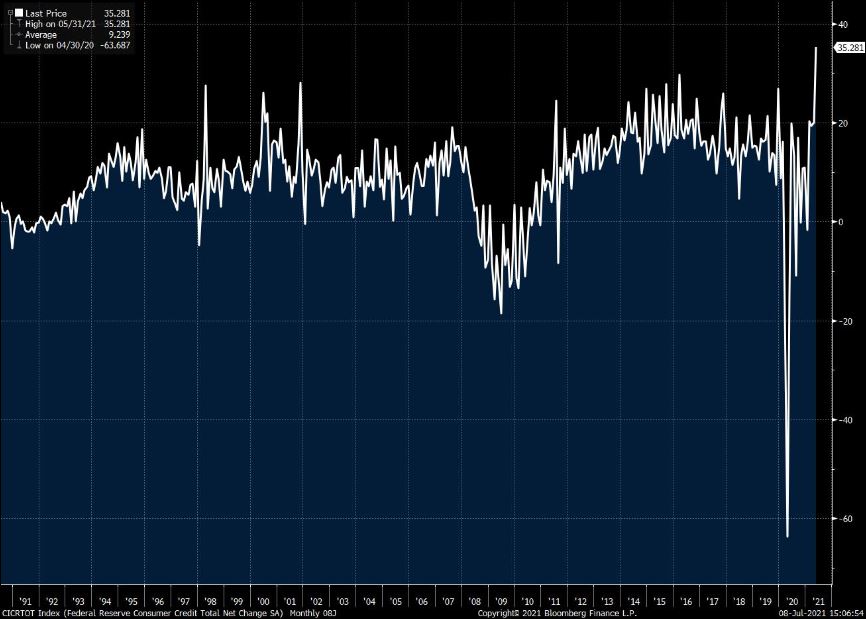

The Indices are stretched Way Above the Green Lines and very over-bought for the Short Term. The Indices are being held up with massive Buying of the very largest Companies. Looks like the Consumer is Buying and Borrowing on HUMAN EMOTION from the Virus winding down (see chart above). Then what?

NEW SUBSCRIBERS: Markets are Way Above the Green Lines and Buying has weakened for many stocks. That is when new investors LOSE Money. Please WAIT for the Volume to improve. The low Volume recently has WARNED us against Buying much at this time. The better trades happen when the S&P 500 Index is also in the Green Zone.

New adds today on DAY TRADING SETUPS

Bonds were lower today, but are back above the Green Line.

Crude Oil was up $1.70 today at $74.64.

BUYS TODAY 7/9/2021

F FORD MOTOR CO. Money Wave Buy today. Target is $16.25. EXIT if it is going to Close below Support of $13.73. Yes, the Volume is below average, so don’t Buy unless you really like it. (2nd Buy signal).

DSX DIANA SHIPPING INC. Money Wave Buy today but DCX will not be bought or logged as the Volume is below average of 1.5 MIL.

SESN SESEN BIO INC. Money Wave Buy today but SESN will not be bought or logged as the Volume is below average of 7 MIL.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

_______________________________________________________________________________________________________

JUMP START SCROLLING CHARTS: (Buy Signal should be very soon… Click on the Jump Start link for more info.)

ATOS ATOSSA GENETICS Buy above $6.08 with High Volume with a 5% Trailing Sell Stop Loss below it.

BB BLACKBERRY LTD. Buy above the Pink Line around $11.70 with High Volume with a 5% Trailing Sell Stop Loss below it.

MMAT META MATERIALS INC. Buy above the Pink Line around $7.01 with High Volume with a 5% Trailing Sell Stop Loss below it.

____________________________________________________________________________________________________________

WATCH LIST SCROLLING CHARTS (Real Time)

MVIS MICROVISION INC. Buy above the Pink Line around $16.53 with High Volume with a 5% Trailing Sell Stop Loss below it.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

Emotions are very high now, so please do not Buy unless you are VERY NIMBLE.

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

____________________________________________________________________________________________________________

SELLS TODAY

AVXL AVANEX LIFE SCIENCES Popped up 9.7 % this morning and then slipped below the Buy Price of $25.50 and was Stopped Out. (Don’t Take a Loss!) This trade was not logged.

Click for CURRENT POSITION CHARTS – Real Time (Please check and adjust your Sell Stops).

Click for CLOSED POSITIONS,

NEW: MY TRADING DASHBOARDDAY TRADING SETUPS

NEW: TRADE ALERTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

ETF SECTOR ROTATION SYSTEM

TOP 100 LIST Updated Jul 5, 2021

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

HAVE A NICE WEEKEND!