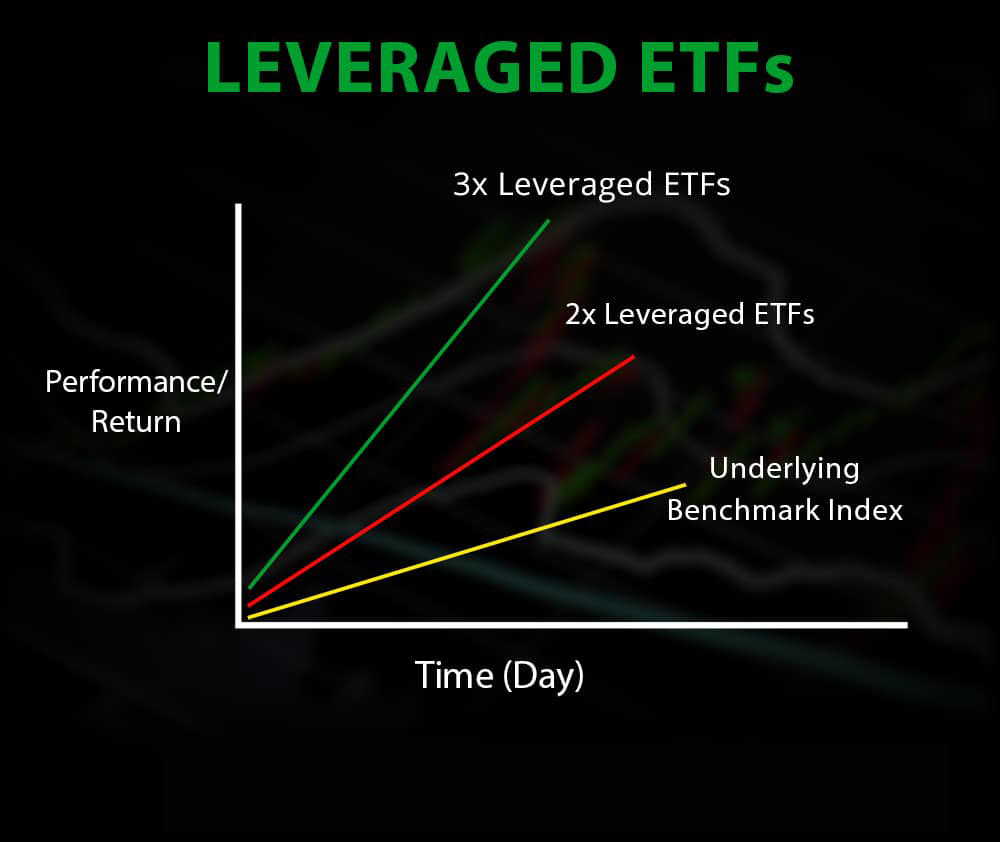

Leveraged ETFs (Exchange-Traded Funds) are financial instruments designed to amplify the returns of an underlying index or asset class using derivatives and debt. These ETFs aim to provide multiple times the daily or monthly return of the benchmark they track, typically ranging from 2x to 3x leverage. For day and swing traders, leveraged ETFs offer unique opportunities to capitalize on short-term market movements and potentially enhance returns within relatively brief time frames.

Day traders, who engage in rapid buying and selling of securities within a single trading day, find leveraged ETFs particularly attractive due to their amplified exposure to intraday price fluctuations. Leveraged ETFs allow day traders to magnify their potential gains or losses, enabling them to capitalize on short-term trends or patterns in the market. By leveraging the inherent volatility of leveraged ETFs, day traders can execute quick trades to exploit price movements, whether bullish or bearish, and generate profits over the course of a single trading session.

Similarly, swing traders, who hold positions for several days to weeks, can leverage the enhanced returns provided by leveraged ETFs to capture larger price movements during their relatively short holding periods. Leveraged ETFs offer swing traders the opportunity to amplify their gains while maintaining a shorter investment horizon compared to traditional investment vehicles. By strategically timing their entries and exits based on technical analysis or market trends, swing traders can seek to profit from both upward and downward price movements in leveraged ETFs, thereby enhancing their overall portfolio returns.

However, it’s essential for both day and swing traders to recognize that leveraged ETFs come with higher risk compared to traditional ETFs or individual stocks. The amplified exposure of leveraged ETFs magnifies both potential gains and losses, making them unsuitable for inexperienced traders or those with a low risk tolerance. Moreover, leveraged ETFs are subject to compounding effects, which can lead to tracking errors and performance deviations from the underlying index over longer holding periods. Traders must exercise caution and implement robust risk management strategies to mitigate the inherent risks associated with leveraged ETF trading.

In conclusion, leveraged ETFs present compelling investment opportunities for experienced day and swing traders seeking to capitalize on short-term market movements and enhance their portfolio returns. By leveraging the inherent volatility of leveraged ETFs, traders can execute timely trades to exploit price fluctuations and generate profits within relatively brief time frames. However, it’s crucial for traders to understand the risks involved and adopt disciplined trading strategies to navigate the complexities of leveraged ETF investing effectively. With careful planning and prudent risk management, leveraged ETFs can be valuable tools for traders looking to achieve their investment objectives in today’s dynamic financial markets.

Below are some of the most common leveraged funds for day trading that Above the Green Line follow:

SOXL – Direxion Daily Semiconductor Bull 3X Shares

SOXS – Direxion Daily Semiconductor Bear 3X Shares

SVIX – VS TR – 1X Short VIX Futures ETF

TQQQ – ProShares UltraPro QQQ

SQQQ – ProShares UltraPro Short QQQ

SPXL – Direxion Daily S&P 500 Bull 3X Shares

SPXS – Direxion Daily S&P 500 Bear 3X Shares

LABU – Direxion Daily S&P BioTech Bull 3X Shares

LABD – Direxion Daily S&P BioTech Bear 3X Shares

BOIL – Proshares Ultra Bloomberg Natual Gas

KOLD – Proshares Ultrashort Bloomberg Natual Gas

TNA – Direxion Daily Small Cap Bull 3X Shares

TZA – Direxion Daily Small Cap Bear 3X Shares

Find More information about specific families of Leveraged funds – Direxion here and Proshares.