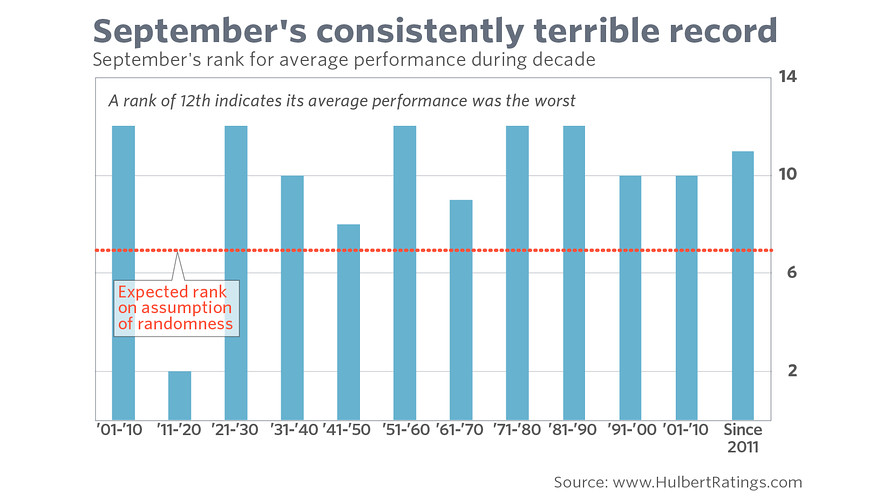

9/12/2021 Markets were lower for the week, as the Indices were up near the Highs and stretched Way Above the Green Lines. Profit taking came in as September is normally one of the worst months for the Stock Markets. But the S&P 500 Index is back down in the Green Zone, which is the first time since February. So we should see a bounce soon for the Markets to re-test the recent Highs.

Some of the strong Stocks below have corrected down near the Green Lines and should have nice bounces up (Long Term Scrolling Charts).

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets. No predicting here, just Following the Money.

We are having good success lately by using Triple Buy Signals on the Day Trading Scrolling Charts.

For the week the Dow was down 2.10%, the S&P 500 was down 1.65%, and the Nasdaq 100 was down 1.31 %. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 0.14% for the week and is Above the Green Line, indicating Economic Expansion.

Bonds were up 0.15% for the week, and are Above the Green Line, indicating Economic Contraction.

The US DOLLAR was up 0.61% for the week and is Above the Green Line.

Crude Oil was up 0.62% for the week at $69.72 and GOLD was down 2.27% at $1792.10.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are currently in only 3 logged Current Positions, for the Short & Medium Term. There are 7 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (Some Leaders have pulled back , but Markets are near Highs.)

Long Term Scrolling Charts (Real Time)

EYES SECOND SIGHT MEDICAL Buy if it Closes above the Green Line (250-day avg.) with High Volume.

F FORD MOTOR CO. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

KOPN KOPIN CORP. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

MGI MONEYGRAM INT’L. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

PRTY PARTY CITY INC. Buy if it Closes above the Red Line (50-day avg.) with High Volume.

VALE VALE STEEL SA Buy if it Closes above the Red Line (50-day avg.) with High Volume.

______________________________________________________________________________________

My Trading Dashboard

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List Sep 1, 2021

Dividend Growth Portfolio

ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

______________________________________________________________________________________

QUESTION: Jim S. writes “Why do you use the 250 vs 200 or any other moving average? And, in a bear market, are you concerned that your Money Wave (slow sto line) might get stuck in the Green Zone for an extended period or give false breakout buy signals?

ANSWER: Hi Jim. The 250-day average (Green Line) has been back tested and has fewer “false Sell Signals” than the 200-day. The question should be: Why do most investors use the inferior 200-day average?

In the next Bear Market, we should be in Inverse Funds (like SH) which we were in the 2008 Bear (with good success)… In a Bear Market, most investments will be Below the Green Lines. The Green Line Rules do not allow us to own weaker investments Below the G L.

But historically there will always be investments Above the Green Lines, and we should have them for you.

Good trading and tell your friends!

ATGL