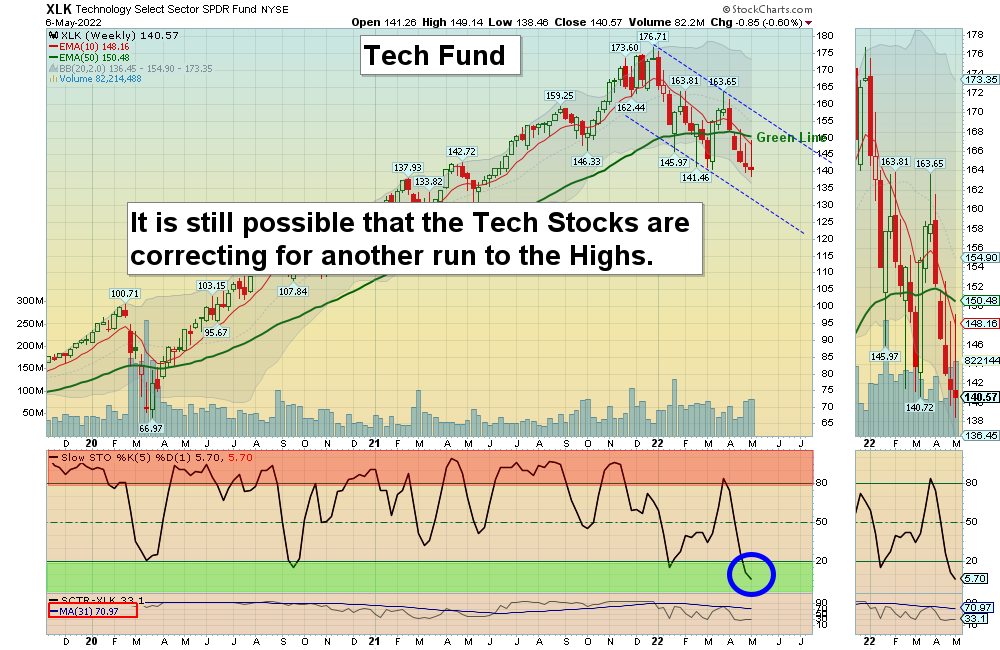

It is still possible that the Tech Stocks are correcting for another run up to the Highs.

HAPPY MOTHER’S DAY!

5/8/2022 Markets were slightly lower for the week as Interest Rates rose and T-Bonds tanked another 5 %. The FED did “walk back” their aggressive Interest Rate tightening talk at Wednesday’s meeting, to prop up the Stock Markets from breaking Support and entering a Bear.

But Long Term Bonds want the opposite (a Slow Down and no Inflation) so Tammy has been dumping Bonds, even after a 34 % drop from the COVID highs. Eventually the higher long term Interest Rates and Commodity prices will cause the Economy to slow down. The Tech Stocks need lower long term Interest Rates for a rally.

Commodity Investments recently corrected back down to the 50-day averages for another bounce back up… Then if they don’t make New Highs we could see the dreaded “Double Top” and then a sizable correction.

The major Stock Indices’ weekly charts went from over-bought (Red Zone) to over-sold (Green Zone) in the last month. The Stock Indices need to hold at the March lows (Support) to remain Bullish.

Currently the tangible Commodities are Way Above the Green Lines, and Bonds are Way Below the Green Lines. Both will eventually return to the Green Lines, so maybe we will see a Stock Market rally when Interest Rates and Inflation fall. (Big surprise for Tammy.)

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets.

More action this week on the Day Trading Scrolling Charts.

DAY TRADING CHARTS FOR INDICES & LARGE CAPS.

We have not had many intra-day Trade Alert signals lately as the Volume has been too Low with the Buy Signals. These low Volume Buy Signals tend to pop up and quickly fade back down. We like to see High Volume on rallies.

For the week the Dow was down 0.19%, the S&P 500 was down 0.16%, and the NASDAQ 100 was down 1.28%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 0.99% for the week and is Above the Green Line, indicating Economic Expansion.

Bonds were down 4.68% for the week, and are Way Below the Green Line, indicating Economic Expansion.

The US DOLLAR was up 0.71% for the week and is Way Above the Green Line.

Crude Oil was up 4.85% for the week at $109.77 and GOLD was down 1.51% at $1882.80.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are in now in 7 logged Current Positions for the Short & Medium Term. There are 4 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

_________________________________________________________________________________________

LONG TERM INVESTMENTS (Hard to find many Long Term now because most normal Investments no longer have 80 Relative Strength required.)

Long Term Scrolling Charts (Real Time)

AA ALCOA CORP. Wait for Weekly Money Wave Close > 20 with High Volume.

ACI ALBERTSONS CO. Wait for Weekly Money Wave Close > 20 with High Volume.

BLDR BUILDERS FIRSTSOURCE Buy when it Closes above $66.83 with High Volume with a 5% Trailing Sell Stop Loss below it.

COST COSTCO WHOLESALE Wait for Weekly Money Wave Close > 20 with High Volume.

F FORD MOTOR CO. Buy if it Closes above $16.46 with High Volume.

RRPIX RISING INTEREST RATES FUND Blew out to New Highs this week. Currently the Weekly Chart is in the Red Zone. Wait for the next Daily Money Wave Buy Signal.

_______________________________________________________________________________

My Trading Dashboard

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List May 1, 2022

Dividend Growth Portfolio

Updated ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is LOW (GREEN). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

________________________________________________________________________________

QUESTION: Kinch writes “I am only receiving a notification about the market about 10 minutes before the market closes. I never get a text message about any trades. Is this the way it works?”

ANSWER: Hi Kinch. Most subscribers do best with the End of Day Swing Trading (email arrives just before the Market Close).

We do send out Day Trade Alerts by Twitter, if you want to set up a free Twitter account. These Alerts are also on the Main Menu: Stock Alerts

For Twitter, please install the app on your cell, and set up mobile notifications:

Please Follow Us @AboveGreenLine on Twitter and click on the bell icon to set up mobile notifications.

Thanks for writing,

ATGL